Stocks closed modestly lower last week with the S&P 500 shedding 0.3%. The index is now up 7.4% year to date, up 15.2% from its October 12 closing low of 3,577.03, and down 14% from its January 3, 2022 record closing high of 4,796.56.

In the wake of the failure of Silicon Valley Bank in March, turmoil in the banking sector persists. And because bank lending is so critical to economic activity, all eyes have been on lending data.

Early data released in April was less than great.

Another month later, the data is arguably not as disastrous as it was fear to be.

Before we get to the new data, let’s remember that the Federal Reserve has been actively working to cool the economy with tighter financial conditions. That means lending activity has already been tightening and further tightening was to be expected.

To an extent, challenges in the banking system help the Fed achieve its goals if it means consumers and businesses have a more difficult time getting financing from banks. Same destination, but a more treacherous path.

The emerging concern was that bank turmoil would cause an extraordinary drop in lending as banks substantially tightened their purse strings beyond what the Fed was aiming for. Fortunately, the data doesn’t yet support this more worrisome outcome.

It Doesn’t Look Like A Bank Crisis

As expected, banks reined in lending a bit during the first three months of the year amid the Fed’s crusade against inflation.

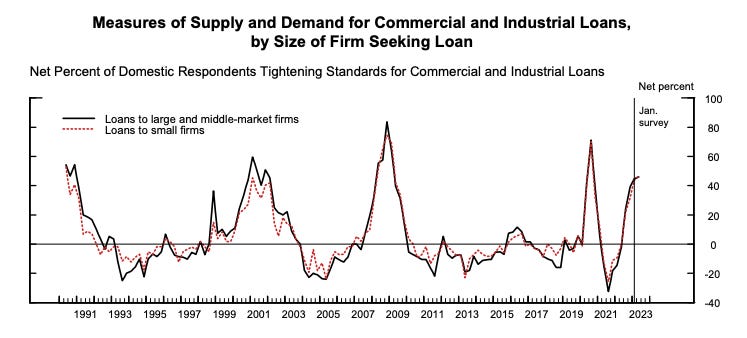

According to the Federal Reserve’s April Senior Loan Officer Opinion Survey (via Notes), lenders tightened standards for commercial and industrial loans…

(Source: Federal Reserve)

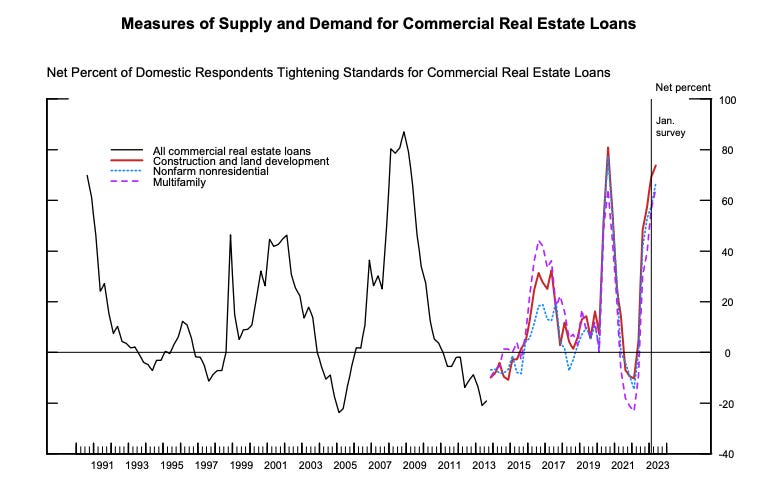

…commercial real estate loans…

(Source: Federal Reserve)

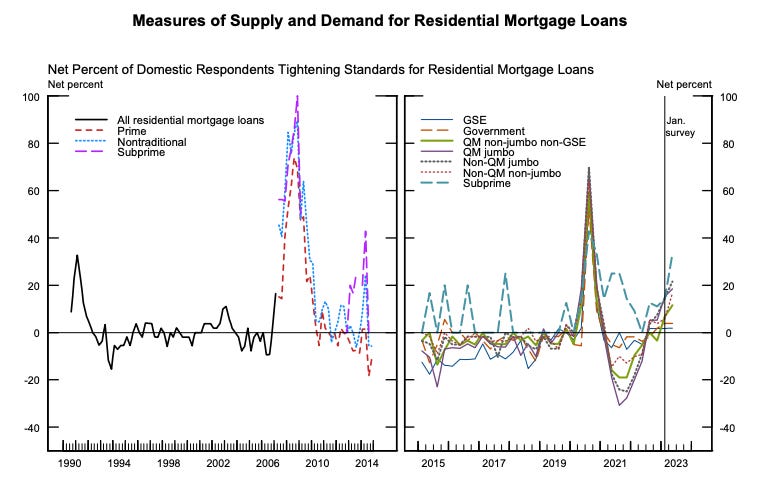

…residential mortgage loans…

(Source: Federal Reserve)

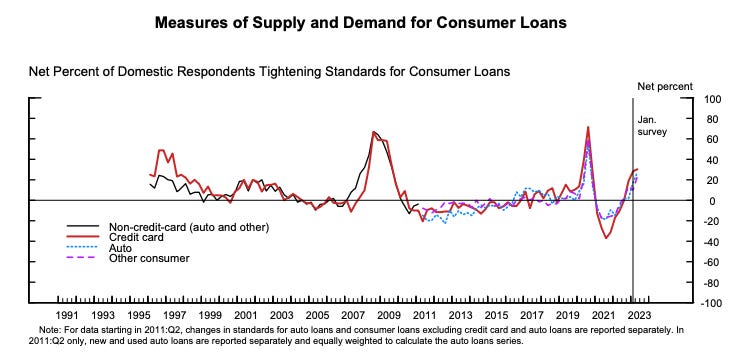

…and consumer loans.

(Source: Federal Reserve)

Sure, banks continued to tighten since the previous SLOOS report. But the magnitude of the change does not appear to reflect the kind of deterioration you might expect from a banking crisis.

“The April Senior Loan Officer Opinion Survey (SLOOS), in our view, does not suggest bank behavior changed markedly after the emergence of regional bank stress earlier this year,” Bank of America economists wrote on Monday.

It won’t be until August that we get the SLOOS report covering the second quarter.

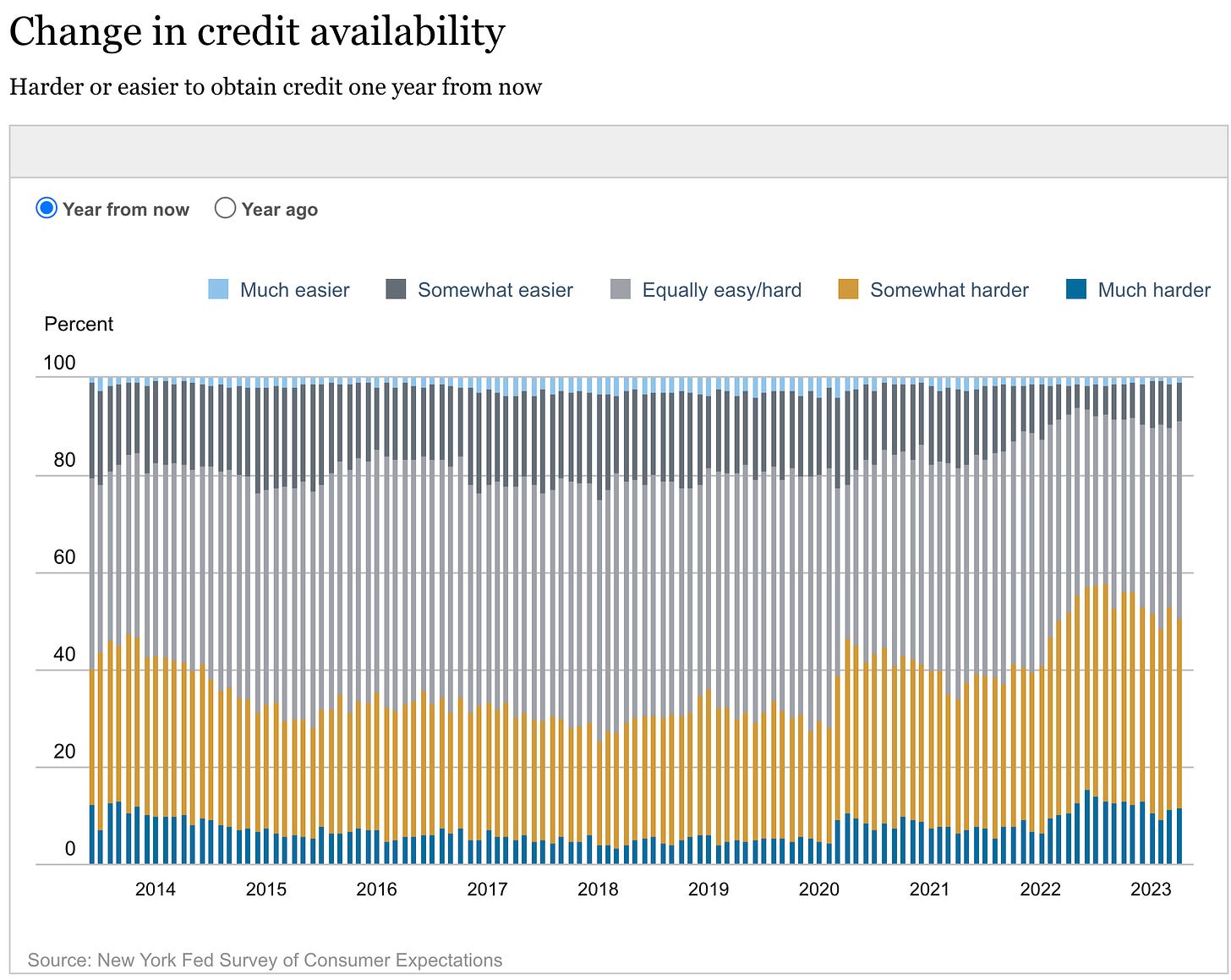

But the New York Fed’s April Survey of Consumer Expectations (via Notes) suggests lending hasn’t yet become a crisis for borrowers. From the report released Monday: “Perceptions of credit access compared to a year ago were mixed in April. Both the share of households reporting it is easier and the share reporting it is harder to obtain credit now than one year ago declined. Similarly, respondents’ views about future credit availability were mixed. Both the share of respondents expecting harder and the share expecting easier credit conditions a year from now declined.“

(Source: NY Fed)

Sure, the New York Fed characterized the results as “mixed.” But the bottom line, again, is that it does not look like a banking crisis.

This sentiment was also confirmed in the NFIB’s Small Business Optimism Index (via Notes).

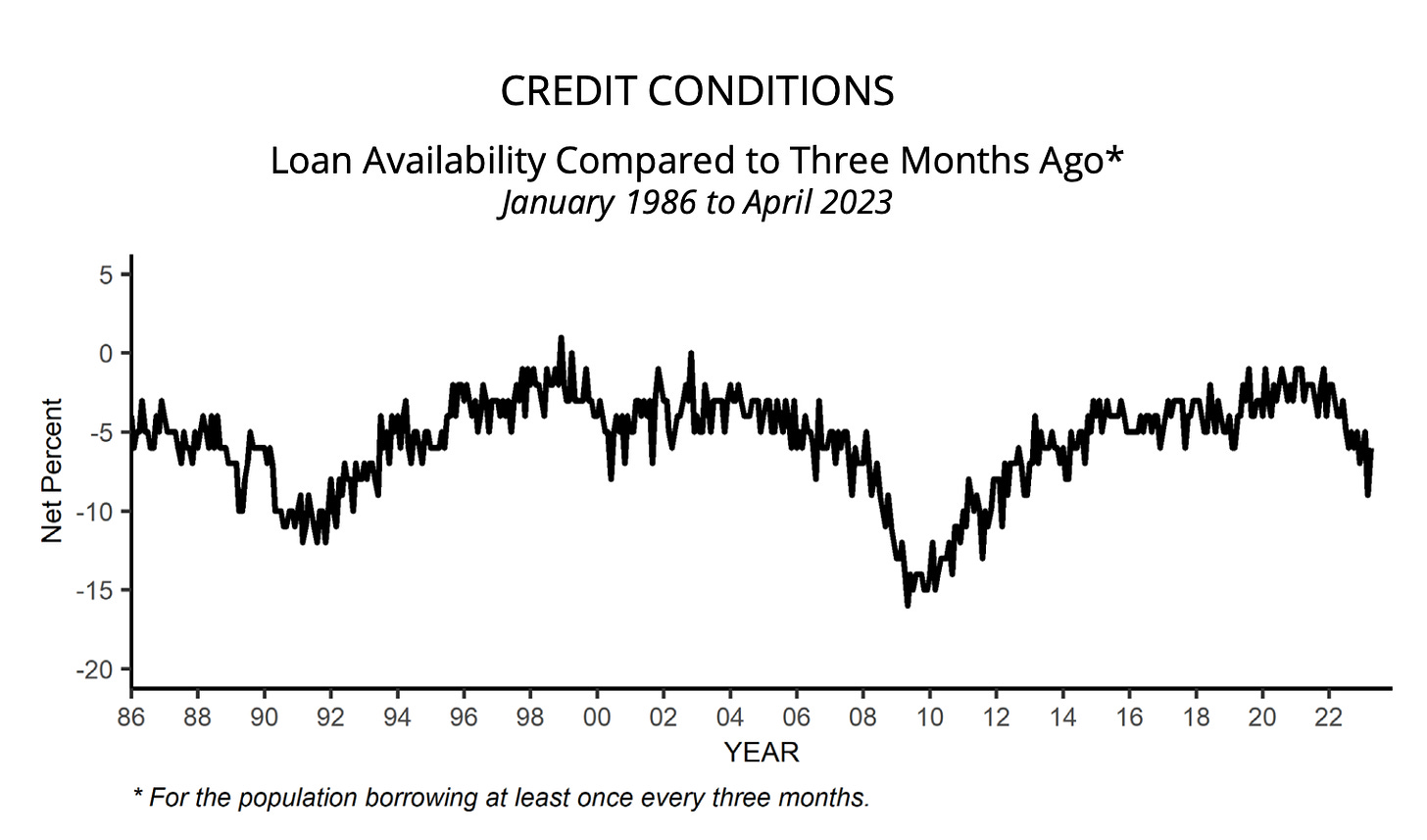

As you can see in the chart below, the net percent of small business owners saying they expect easier credit conditions has been trending unfavorably for a few months, which you’d expect from tighter monetary policy.

But if you look very closely, you’ll see that responses to this question actually improved modestly, ticking up to -9% in April from -8% in March.

NFIB

To be clear, the sentiment towards credit conditions continues to be pretty sour. BUT again, they do not appear to reflect systemic banking problems.

“While owners are becoming more pessimistic, April's report should help allay concerns that credit is becoming completely unaccessible for small businesses,“ Wells Fargo economists said on Tuesday.

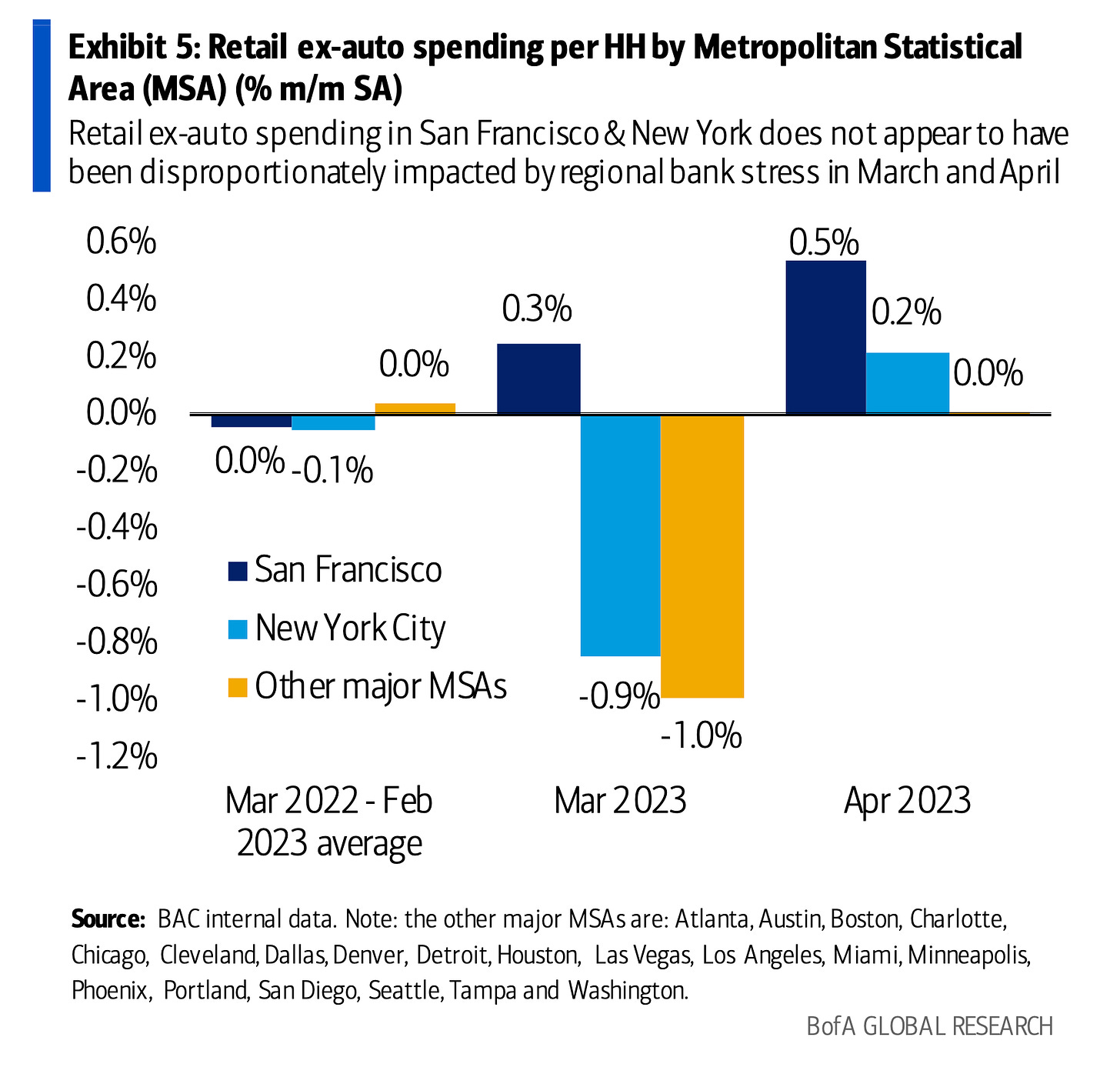

Furthermore, here’s a fascinating regional stat: BofA (via Notes) found “that San Francisco and New York, the headquarters of the three failed domestic banks, outpaced the other major metros in terms of retail ex-auto spending in both March and April.“

(Source: BofA via Notes)

So while consumer spending may be cooling, it doesn’t appear any worse in the regions that would be most directly affected by the banking turmoil.

The Bottom Line

We still see headlines every once in a while about some regional banking potentially facing problems. But as I wrote back in March, banks fail. This is not new.

And while metrics related to lending don’t look great, there’s not much to suggest financial instability in banking has evolved into a systemic problem.

Even if there is a material impact lending as a result of recent banking turmoil, it may ironically be a development that policymakers embrace.

“Fed officials may actually welcome this news since tighter bank credit should slow the economy and bring inflation down,” Ed Yardeni, president of Yardeni Research, wrote on Tuesday.

A version of this post was originally published on TKer.co

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.