Most traders have heard of the role quantitative analysts, or "quants" play on Wall Street. Quants use advanced mathematical and modeling to anticipate market moves and stay one step ahead of unsophisticated traders.

Benzinga recently had the chance to talk to Matt Kelly, founder of quantitative analysis firm Macrowonk. Macrowonk uses its unique, complex algorithm to identify economic signals and predict how the signals will impact financial markets based on massive hoards of data. The algorithm performs more than 3,000 daily calculations based on real-time economic data to compute scores that underpin Macrowonk’s market indicators.

Understanding An Unpredictable Market

According to Kelly, Macrowonk takes into account so many different variables to stay one step ahead of an unpredictable market.

“There is a lot of head scratching at the moment because the economy isn’t sticking to the rules,” Kelly told Benzinga. “Inflation remains low and wage growth is stagnant yet employment and growth indicators are very strong. Basically, technology could be disrupting the traditional economic model by keeping costs (and inflation) low while boosting markets and growth in general.”

The Macrowonk Model

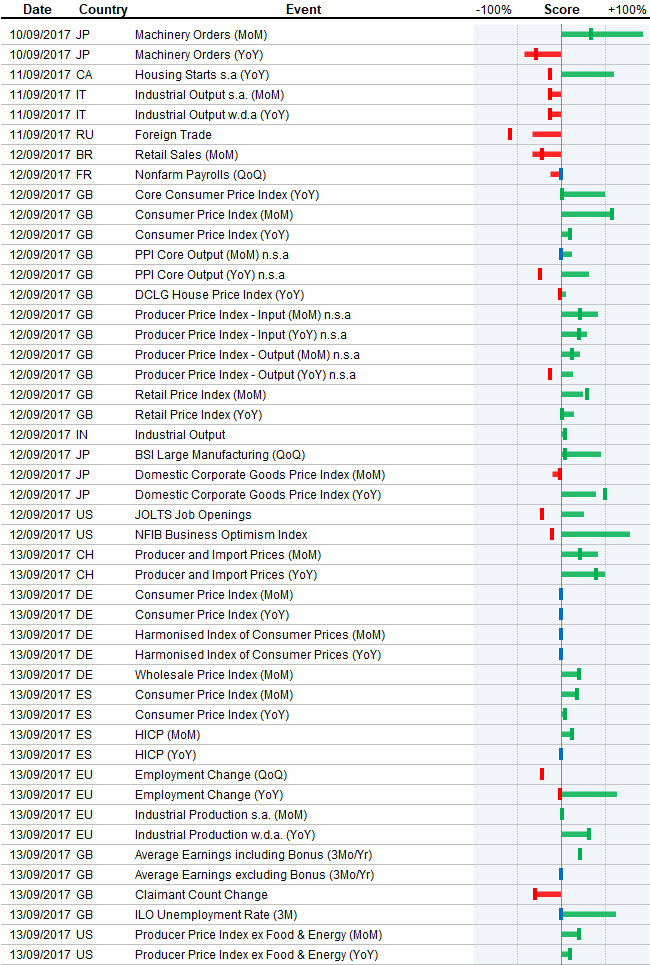

Macrowonk’s algorithm scores economic indicators on a scale of -100 to +100, where a signal of 0 should have no impact on the market. A -100 event indicates an extremely bearish signal, and a +100 score would be an extremely bullish signal.

“Too much focus is spent on the raw numbers without considering the broader implications and the often contradictory nature of macro indicators,” Kelly said. “For example, August Nonfarm Payrolls came in below expectations at 156k. On the surface, it looked pretty poor. However when viewed in the context of the recent history of the indicator and the broader employment environment, it’s an insignificant blip. Our scoring algo had it at -10%. In other words, nothing to worry about. Had the release been something like -400k, the scoring algo would have been approx. -100%.

"This is just a single data point and it’s important to understand it in the context of the broader employment environment. That’s exactly what our employment index does.”

Unlocking The Power Of Data

While traders have access to more data than ever before, the key to utilizing it successfully is understanding how that data fits together and interpreting its potential impact on the market in the long-term.

“The economy doesn’t move quickly, yet we’re flooded by information on a daily basis that gives us clues into the future,” Kelly said. “To invest successfully, you need to step out of this noise and try and uncover the macro trends that can point to significant turning points in the market.”

Kelly has used Macrowonk’s algorithm to create several case studies that are detailed on the company’s website. These case studies include actionable signals Macrowonk has identified in the SPDR S&P 500 ETF Trust SPY, certain forex pairings and even commodity ETFs, such as the SPDR Gold Trust (ETF) GLD.

A New Era Of Investing

Surprisingly, despite the edge that quants and big data can potentially provide, BCG recently reported that less than half of the 153 asset managers the firm surveyed use advanced quantitative analysis. Technology has forever changed the world of investing, but traders who refuse to adapt to the changing world and leverage the power that technology provides are destined to be left in the past.

Related Links:

How Quants Will Use Macroeconomic Indicators To Sidestep The Next Recession

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.