Quote To Start The Day: Best friends don’t expect anything from you. They just accept you the way you are.

Source: Maxime Lagacé

One Big Thing In Fintech: M1 Finance is a platform for digital investing, borrowing and banking.

As part of its vision to help self-directed investors build wealth for the long-term, M1 Finance is lowering the barriers to financial wellness through comprehensiveness and automation.

To scale access to its financial wellness portal, M1 Finance said it will expand the depth and breadth of its customer-driven product portfolio through a $75-million Series D funding round led by Coatue.

The Series D follows a $45-million Series C and $33-million Series B in 2020. Previous investors Left Lane Capital and Clocktower Technology Ventures also participated in this round.

Source: Benzinga

Other Key Fintech Developments:

- Veem releases new product package.

- Users link $1T + on Personal Capital.

- ETH ETP lists on the Deutsche Börse.

- JPMorgan filing reveals crypto basket.

- Flutterwave raising $170M in funding.

- SoFi acquiring a bank in $22.3M deal.

- Opportunities in Lending as a Service.

- LendingPoint closes on $110M facility.

- Zeni intros tech, AI finance concierge.

- BNP Paribas rolls out A2A payments.

- N26 and Dosh teamed up on rewards.

- JPMorgan closes Chase Pay method.

Watch Out For This: Finance is a tough, but rewarding career.

That’s according to the founder of the finance meme account Litquidity, an anonymous Wall Street banker in his late 20s who uses social media as a creative outlet.

Litquidity’s founder decided to start the media brand in 2017 to share humor drawing on his time in investment banking and venture capital.

Source: Benzinga

Interesting Reads:

- IeAD, InStudio eyeing sport technology.

- Workhorse loses deal and getting sued.

- Companies use Clubhouse for earnings.

- Dropbox to acquire DocSend for $165M.

- TechCrunch talks about memes for sale.

- Real Estate: Post-pandemic investment.

- Top tech trends to watch closely in 2021.

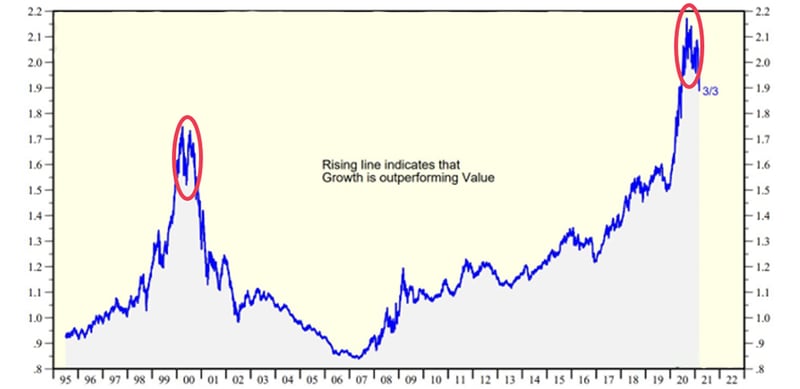

Market Moving Headline: Growth versus value worst month since 2000. What does that portend?

For equity bulls, they better hope it’s different this time. In the mid/late 1990s new technologies proliferated and changed the way the world worked. In hindsight, there was a manic period during the last year (1999) that ended poorly for those overly exposed to growth names.

As you can see in the chart below, growth companies have outperformed relative to value for more than a decade. That’s a big cycle. The pandemic work-from-home environment catalyzed a massive move higher in favor of growth. That trend started to reverse in Q4 of last year, with significant capital flows out of growth and into value in February 2021. That cycle warrants attention.

Source: CBOE

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.