Teslas getting charged in a Wawa parking lot on Tuesday. Four are pictured, but there was a fifth off-camera to the right. The ubiquity of Tesla vehicles on the road should have given Tesla bears pause. Photo via author.

Tesla Joins The Trillion Dollar Market Cap Club

Tesla, Inc. TSLA shares spiked to over $1,000 this week on news that Hertz Global Holdings, Inc. HTZZ had placed a $4 billion fleet order with the electric car maker. That share price move gave Tesla a market capitalization of over a trillion dollars for the first time, putting it in the same league as Microsoft,Inc. MSFT, Apple, Inc. AAPL, Alphabet, Inc. GOOG, GOOGL, and Amazon, Inc. AMZN.

We've Been Bullish On Tesla...

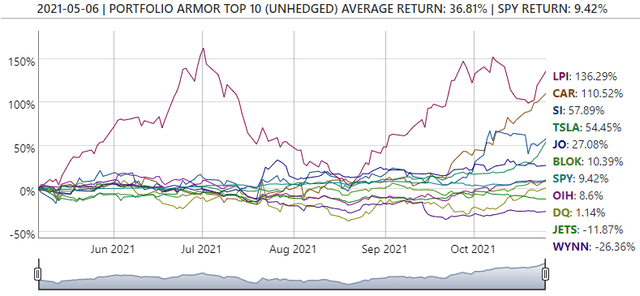

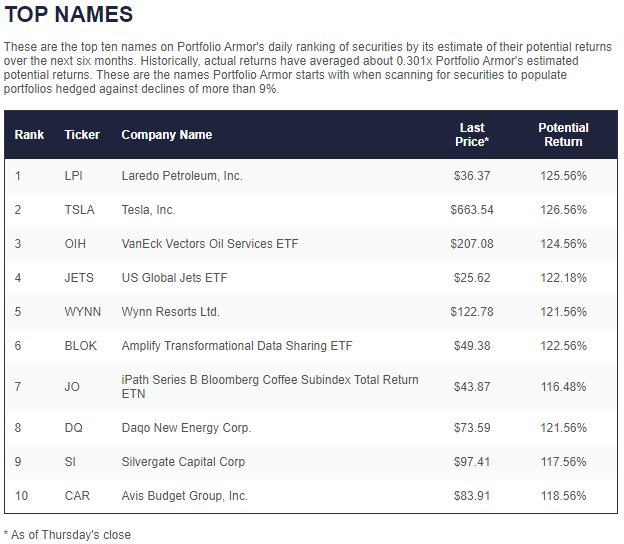

As we noted in our article last week (Tesla Undoomed By S&P 500 Inclusion), our system has been bullish on Tesla, often featuring it among its top names. For example, Tesla was one of our top ten names last May.

Screen capture via Portfolio Armor on 5/6/2021.

Tesla was up more than 54% since then, as of Tuesday's close, making it the fourth best performer from our May 6th cohort.

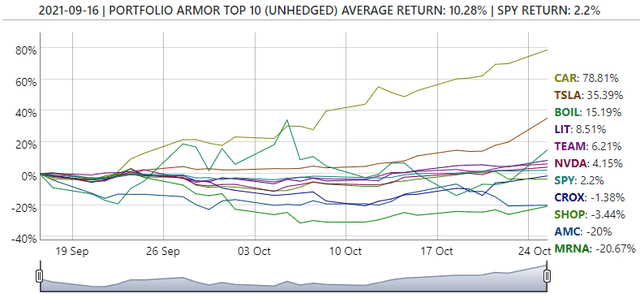

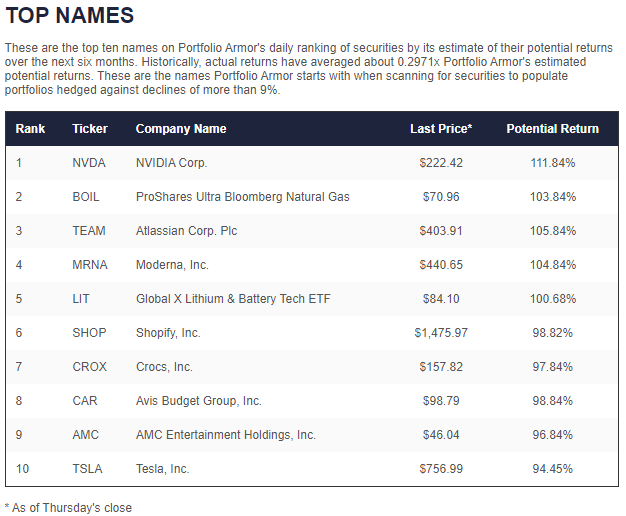

More recently, Tesla was one of our top ten names in September.

Screen capture via Portfolio Armor on 9/16/2021.

It was the second-best performer from that cohort so far as of Tuesday.

But Now May Be A Time For Some Caution

Our system was still bullish on Tesla on Tuesday, but it wasn't one of our top names, as our gauge of options market sentiment had cooled on the stock. Similarly, long term Tesla bull Cathie Wood's flagship Ark Innovation ETF (ARKK) trimmed its Tesla holdings on Tuesday.

For readers who are Tesla shareholders, below we'll look at a couple of ways to stay long while limiting your risk over the next few months.

Adding Downside Protection To Tesla

Uncapped Upside, Positive Cost

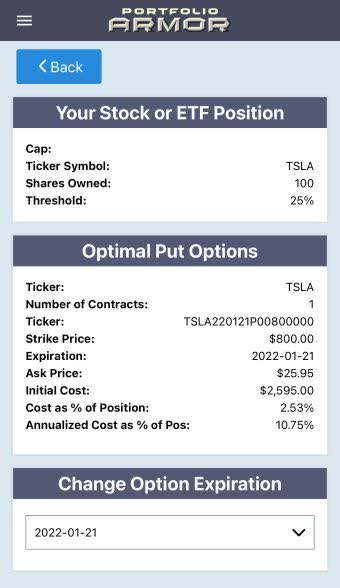

As of Tuesday's close, this was the optimal, or least expensive put option to protect against a greater-than-25% drop in Tesla by late January.

This and subsequent screen captures are via our iPhone app.

In this case, the cost was $2,595, or 2.53% of position value (that cost was calculated conservatively, using the ask price of the puts; in practice, you can often buy and sell options at some price between the bid and ask).

Capped Upside, Negative Cost

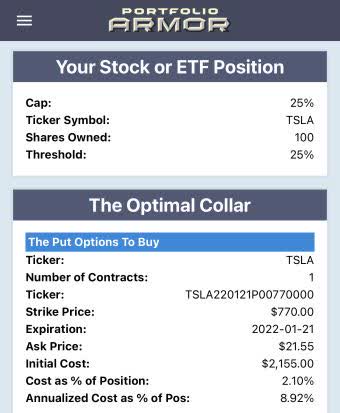

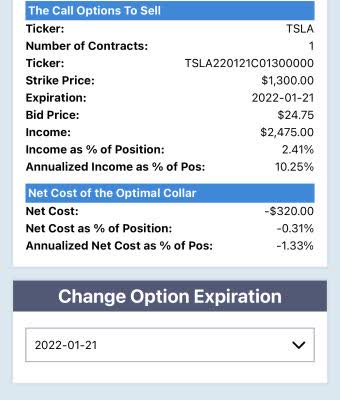

If you were willing to cap your possible upside at 25% over the next few months, this was the optimal collar to hedge against a >25% drop over the same time frame.

In this case, the cost was negative, meaning you would have collected a net credit of $320 when opening the hedge, assuming you placed both trades at the worst ends of their respective spreads (buying the puts at the bid, and selling the calls at the ask).

Why Hedging Makes Sense For Long Term Bulls

Because there will be pullbacks, and being hedged will limit your drawdowns, and give you dry powder to buy more shares at lower prices if you want. Being hedged will also protect you in case your long term bullishness ends up being wrong, or the market goes against you.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.