One Big Thing In Fintech: Fintech has seen record-breaking investment activity this year.

As of Q3’21, YTD funding to the space had already surpassed 2020’s year-end total by 96% to reach $94.7B, and it has continued to climb since then.

Growth can be attributed in part to long-standing modernization initiatives, but it has also been accelerated by the increased demand for digital financial services and e-commerce amid the pandemic.

Source: CB Insights

Other Key Fintech Developments:

- Cove.tool secures $300M raise.

- Revolut secures Europe license.

- Kraken adds $65M for new fund.

- Nasdaq, Equinix team on cloud. NDAQ EQIX

- DebtBook adds $2M seed round.

- BOE eyeing tighter crypto rules.

- Tiger Global backed CreditBook.

- D. Börse bought Crypto Finance. DBOEY

- Kraken will launch NFT platform.

- Razorpay secures $375M funds.

- Uni raises $70M at $350M value.

- Ebanx adds Remessa for $229M.

- Mana taps $7M in seed funding.

- Barclays, Amazon partnering up. BCS

- Avant launches post-acquisition.

- Clikalia beefs up iBuying efforts.

Watch Out For This: To be non-fungible is to be irreplaceable.

Non-fungible tokens (NFTs) are digital certificates of ownership that can be bought and sold; ownership can be transferred from one entity on the blockchain to another.

These NFTs are trending because consumers and producers are looking for new ways to exchange and maintain ownership transparency of items they value.

In understanding the value of NFT projects, Benzinga spoke with Los Angeles-based Chris Ho of the Shark Boy Fight Club (SBFC) digital gaming art initiative.

Source: Benzinga

Interesting Reads:

- Matt Levine on finance, writing.

- SEC punts BTC ETF proposals. BTC/USD

- The big cracks in ESG’s armor.

- The financialization of artwork.

- New regime and tail strategies.

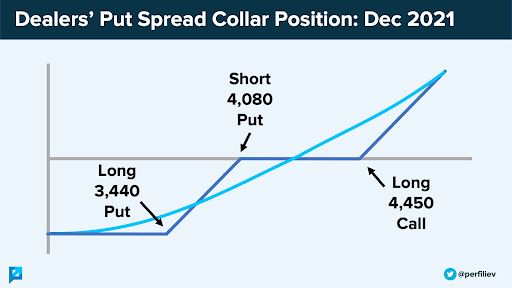

Market Moving Headline: JPMorgan Chase Asset Management JPM created funds providing participants exposure to “equity market upside while mitigating volatility during market declines.”

In other words, JPMorgan sells customers a packaged long equity + put spread collar.

The roll, as well as the hedging of this position, through time, may have a material impact.

According to a great thread by Andy Constan, if the S&P is above the $4,450.00 call strike of the strategy, JPMorgan has “to buy $8B in the illiquid mid-holiday end of year market.”

“December looks calm for now and a massive buy is your post-Christmas present.”

Source: SpotGamma

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.