Shares of ImmunityBio IBRX were down 55.1% on Thursday after management announced that FDA issued a complete response letter ("CRL") to its biologics license application ("BLA") seeking approval for the combination use of its lead pipeline candidate, Anktiva (N-803), in patients with a certain type of bladder cancer.

The BLA sought approval for a combination of Anktiva (N-803) with Bacillus Calmette-Guérin ("BCG") vaccine to treat patients with BCG-unresponsive non-muscle invasive bladder cancer ("NMIBC") with carcinoma in situ ("CIS") with or without Ta or T1 disease.

Per management, the CRL was issued as the FDA identified deficiencies during its pre-license inspection of the company's third-party contract manufacturing firms. For the BLA to be approved, ImmunityBio needs to resolve these deficiencies to the agency's satisfaction.

Though the agency did not request ImmunityBio to conduct any additional studies, it did request for an updated duration of response data and a safety update at the time of BLA resubmission.

Based on the responses received in the CRL, ImmunityBio will request a meeting with the FDA to address the latter's concerns and plans to re-file the BLA as soon as possible.

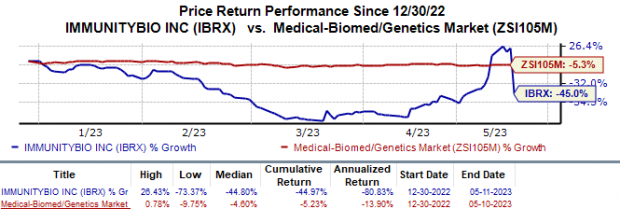

In the year so far, ImmunityBio has lost 45.0% compared with the industry's 5.2% fall.

Image Source: Zacks Investment Research

Management had previously disclosed that it was exploring a strategic partnership with a large unnamed biopharmaceutical company to market Anktiva. The company confirmed that negotiations with this unnamed company will continue despite the CRL issued by the FDA.

A novel IL-15 superagonist complex, Anktiva is yet to be approved by the FDA for any indication. Apart from bladder cancer, management is evaluating the therapy in combination with other drugs as a potential treatment across multiple indications, including lung cancer, pancreatic cancer and Lynch syndrome.

With no marketed drugs in its portfolio, ImmunityBio faces uncertainty in its ability to continue. In a recent quarterly SEC filing, the company disclosed that as of March 2023-end, it had an accumulated deficit of $2.5 billion.

Alongside the above news, ImmunityBio announced that the company's executive chairman and the global chief scientific and medical officer agreed to provide immediate non-convertible debt amounting to $30.0 million at an interest rate of term secured overnight financing rate ("SOFR") plus 8% per annum. This loan is to be repaid by the end of this year.

Zacks Rank & Stock to Consider

ImmunityBio currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are Allogene Therapeutics ALLO, Athira Pharma ATHA and Ligand Pharmaceuticals LGND, each carrying a Zacks Ranks #2 (Buy).

In the past 60 days, the estimate for Allogene's 2023 loss per share has improved from $2.56 to $2.31. During the same period, the loss estimate per share for 2024 has narrowed from $2.53 to $2.20. In the year so far, the shares of Allogene have declined 1.8%.

Allogene Therapeutics beat earnings estimates in three of the last four quarters, while missing the mark on one occasion. On average, the company's earnings witnessed an earnings surprise of 5.08%. In the last reported quarter, Allogene delivered a negative earnings surprise of 7.94%.

In the past 60 days, the estimate for Athira's 2023 loss per share has improved from $2.88 to $2.64. During the same period, the loss estimate per share for 2024 has narrowed from $5.22 to $4.76. In the year so far, the shares of Athira have lost 6.9%.

Athira Pharma beat earnings estimates in three of the last four quarters, while missing the mark on one occasion. On average, the company's earnings witnessed an earnings surprise of 5.17%. In the last reported quarter, Athira delivered a negative earnings surprise of 12.86%.

In the past 60 days, the estimate for Ligand's 2023 earnings per share has increased from $4.15 to $4.16. During the same period, the earnings estimate per share for 2024 has increased from $4.28 to $4.58. In the year so far, the shares of Ligand have risen 16.3%.

Ligand Pharmaceuticals beat earnings estimates in two of the last four quarters, while missing the mark on the other two occasions. On average, the company's earnings witnessed an earnings surprise of 21.50%. In the last reported quarter, LGND delivered an earnings surprise of 121.36%.

Image by National Cancer Institute on Unsplash

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.