Zinger Key Points

- Rx-to-OTC is emerging as a substantial self-care industry among pharmaceutical companies, it is expected to reach $66.5 billion by 2033.

- Petros deprioritized Peyronie's disease deal due to focus on switching flagship prescription ED medication.

- Every week, our Whisper Index uncovers five overlooked stocks with big breakout potential. Get the latest picks today before they gain traction.

Petros Pharmaceuticals Inc PTPI is a pharmaceutical company focusing on men’s health therapeutics.

In an interview with Benzinga, Fady Boctor, the President and Chief Commercial Officer of Petros Pharmaceuticals, said the company aims to expand access of key prescription pharmaceuticals as over-the-counter (OTC) treatment options.

Boctor added that Petros is a pure play in the Rx-to-OTC self-care market, focused on bringing its current lead erectile dysfunction (ED) therapeutic OTC while developing a pathway that would take future therapeutics OTC as well.

“Rx-to-OTC is emerging as a substantial self-care industry among pharmaceutical companies. According to FMI’s Rx-to-OTC Switches Market, the Rx-to-OTC switch market is projected to reach $66.5 billion by 2033,” Boctor told Benzinga.

Here’s a summary of the Q&A:

- Benzinga: Can you tell us more about your company and products and how you differentiate yourself from competitors?

- Fady Boctor: “We have a broad network and deep talent in the Rx-to-OTC switch marketplace. We have decades of experience in the Rx, switch, and FDA regulatory landscape. This enables us to leverage industry best practices and meaningful familiarity with the greatest rate-limiting factor in the process, the FDA.”

- Benzinga: Petros is pursuing increased access for its flagship prescription erectile dysfunction therapy, Stendra (avanafil), vi potential OTC designation. What could be the benefits of this move?

- Fady Boctor: The $1.4 billion prescription ED market could triple if an ED therapy is made available over-the-counter (OTC). Nearly 75% of men in the U.S. avoid seeking prescription ED therapy due to embarrassment and the stigma of discussing it with a doctor. This presents a significant opportunity to increase access and usage among the 30 million men in the U.S. currently suffering from ED.

- During the recent Type C meeting between Petros and the FDA, the Agency also aligned with the company regarding its 2H 2024 submission and review of its pivotal two-arm Self-Selection study, which is currently underway.

- Benzinga: What do you think is the future of the prescription-to-OTC market, and how does Petros Pharmaceuticals plan to tap the opportunities?

- Fady Boctor: “The prospects of the Rx-to-OTC switch market are significant. With the FDA proposing new rules for technology assistive utilities, products that have never been entertained for OTC switch are now viable prospects.

- Benzinga: What is your strategy for expanding the portfolio and pipeline?

- Fady Boctor: “We then plan on applying our diverse and deep experience in the switch process, including technology know-how, to bring those solutions to fruition.”

- Benzinga: Can you discuss the recently executed exclusive licensing agreement for treating Peyronie’s disease?

- Fady Boctor: “This deal has been deprioritized and retired due to our focus on switching our flagship prescription ED medication to OTC.”

- Benzinga: Any plans the company has to get into women’s health?

- Fady Boctor: The women’s health sector has recently made significant progress in increasing OTC access and awareness. The company is continuously collaborating with various partners on potential therapeutics for women’s health that show promise for transitioning to OTC status.

- Benzinga: As the company is focused on men’s health, what are the key challenges and opportunities?

- Fady Boctor: The main challenges in men’s health focus on two areas. First, the market is flooded with non-FDA-approved supplements claiming therapeutic benefits without rigorous clinical trials, creating confusion and misinformation.

- Second, transitioning certain pharmaceutical-grade products to over-the-counter status is complex and requires clear communication to consumers about safe and proper use.

- “We believe we are bullishly embracing this challenge as an opportunity.”

- Benzinga: Can you share the company’s growth prospects in the near and mid-term?

- Fady Boctor: Our growth prospects are focused on transitioning the first-ever prescription ED therapy to OTC status. It targets a significant portion of the multi-billion dollar ED market.

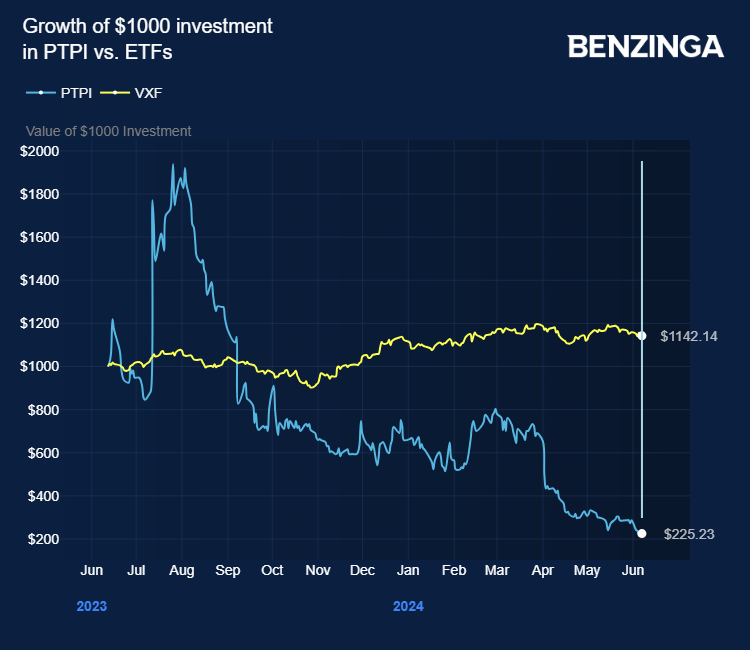

Price Action: PTPI shares closed at $0.41 on Friday.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.