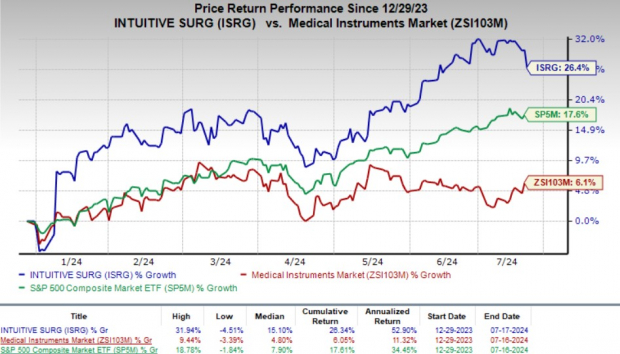

Intuitive Surgical ISRG is witnessing strong momentum, with its shares having rallied 26.4% year to date compared with 6.1% growth of the industry. The S&P 500 composite has risen 17.6% during the said time frame.

With healthy fundamentals and strong growth opportunities, this Zacks Rank #3 (Hold) company appears to be a solid wealth creator for its investors at the moment.

Intuitive Surgical Inc., a Sunnyvale, CA-based company, designs, manufactures and markets the da Vinci surgical system, Ion endoluminal system, and related instruments and accessories. The company's key product portfolio, da Vinci surgical system, is an advanced robot-assisted surgical system. It comprises a surgeon's console, patient-side cart, 3-D vision system, da Vinci Skills Simulator and Firefly Fluorescence Imaging.

Image Source: Zacks Investment Research

The robot-based da Vinci surgical system enables minimally invasive surgeries that reduce the trauma associated with open surgery. ISRG also manufactures EndoWrist instruments, such as forceps, scissors, electrocautery tools, scalpels, and other surgical tools, including wrist joints for natural dexterity for various surgical procedures. The company operates through three segments — Instruments and Accessories, Systems and Services.

Catalysts Driving Growth

Investors are upbeat about Intuitive Surgical's robot-based da Vinci surgical system that has been a key driver for the company's performance since its launch in 1999. The demand for medical procedures started to improve in 2023 after being disrupted by the COVID-19 pandemic in 2020, leading to robust growth. The procedure growth expectation for fiscal 2024 is slightly below the pre-pandemic growth rate of 18% for full-year 2019.

Per ISRG's first-quarter 2024 earnings call in April, the installed base of da Vinci systems grew approximately 14% year over year to 8,887 units. The utilization of clinical systems in the field increased 2% from the prior-year quarter's level. The metric was up 10% year over year for da Vinci SP. In the first quarter, procedures improved 14% in the U.S. market and 20% in the ex-U.S. market compared with the year-earlier quarter's figure.

Meanwhile, ISRG expects its gross margin in 2024 to be 67-68%, on par or lower than 68% in 2023. However, the rise in the cost of sales is likely to be driven by activities to support the launch of the company's new products and capital investments to aid its business growth.

Investors are also optimistic about the recent FDA approvals received by Intuitive Surgical. Last month, the FDA cleared a labeling revision for da Vinci X and Xi specific to radical prostatectomy. In March, Intuitive Surgical received the FDA's 510(k) clearance for da Vinci 5, the company's next-generation multiport robotic system.

Although ISRG has strong fundamental factors that should drive its growth going forward, it faces several challenges that hurt business performance. A constrained supply chain amid continuing geopolitical tensions may lead to choppy da Vinci 5 system placements in 2024. A challenging catheter supply may adversely impact Ion modulation system sales. Moreover, weakness in bariatric procedures, along with challenges in China from increasing provincial robotic competition and delayed tenders affecting capital placements, is likely to have a nearly three percentage point headwind for revenues in 2024.

Zacks Rank & Key Picks

Some better-ranked stocks in the broader medical space that have announced quarterly results are Globus Medical GMED, Haemonetics HAE and Boston Scientific Corporation BSX.

Globus Medical, sporting a Zacks Rank #1 (Strong Buy) at present, reported first-quarter 2024 adjusted EPS of 72 cents, which beat the Zacks Consensus Estimate by 30.9%.

Globus Medical's shares have risen 36.6% year to date compared with the industry's 6.1% growth. GMED has a long-term growth rate of 12.7%. Its earnings surpassed estimates in each of the trailing four quarters, the average surprise being 10.79%.

Haemonetics, currently carrying a Zacks Rank #2 (Buy), reported fourth-quarter fiscal 2024 adjusted earnings per share of 90 cents, which beat the Zacks Consensus Estimate by 2.3%.

Haemonetics' shares have risen 5.7% year to date compared with the industry's 3.2% growth. It has a long-term growth rate of 12%. HAE's earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.24%.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, which beat the Zacks Consensus Estimate by 9.8%. The company currently carries a Zacks Rank #2. Boston Scientific's shares have risen 33.9% year to date compared with the industry's 3.2% growth.

BSX has a long-term growth rate of 12.5%. Its earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.49%.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.