Zinger Key Points

- Pfizer’s stock has dropped 50% since 2021, with a $20 billion loss in market value since 2019.

- Starboard claims Pfizer needs $29 billion in additional revenue by 2030 to meet industry standards.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

Activist investor Starboard Value has sharpened its criticism of Pfizer Inc. PFE, holding the pharmaceutical giant’s management accountable for failing to deliver on its promises of innovation and growth.

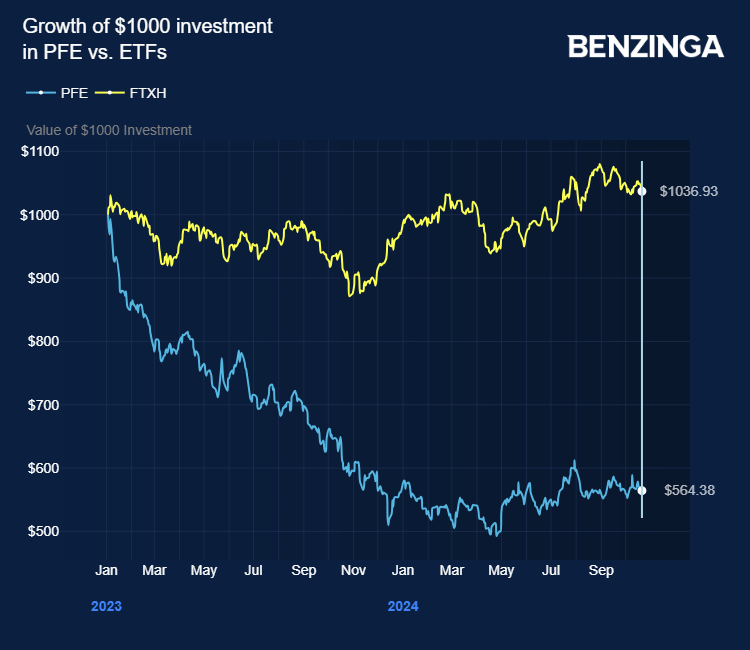

Despite its relatively small stake in Pfizer, Starboard’s critique reflects broader investor frustration with the company’s stock, which has dropped about 50% since 2021.

During the Active-Passive Investor Summit, Starboard argued that Pfizer’s leadership, under CEO Albert Bourla, has not fully capitalized on the company’s momentum following the COVID-19 pandemic, leading to significant underperformance in R&D and M&A.

In a presentation released Tuesday, Starboard pointed out Pfizer’s $20 billion loss in market value since 2019, despite a $40 billion boost from its COVID-19 franchise.

The activist investor also expressed concerns that Pfizer’s leveraged balance sheet could hamper future acquisitions, further limiting growth.

Starboard’s presentation highlighted Pfizer’s failure to meet its ambitious targets, such as the plan for 15 potential blockbuster drugs by 2022, which Bourla had outlined when he took over as CEO in 2019.

A significant focus of Starboard’s critique lies in Pfizer’s investment in external innovation.

The company has spent nearly $70 billion on M&A since 2022, including high-profile deals like the $43 billion acquisition of Seagen, yet the returns have been lackluster.

The investor notes that Pfizer used more than its COVID-19 cash benefit for ‘inorganic investments over the last five years.’

In September, Pfizer withdrew Oxbryta (voxelotor) for sickle cell disease, added via its $5.4 billion buyout of Global Blood Therapeutics in 2022.

Starboard contended that Pfizer overpaid for its post-COVID acquisitions, noting that analysts’ expectations for sales from these deals are $7 billion lower than Pfizer’s target of $20.5 billion by 2030.

Pfizer’s ongoing challenges extend to its internal innovation efforts, particularly in its GLP-1 program, danuglipron.

In the presentation, Starboard highlights a substantial decline in expected 2030 sales from danuglipron to $592 million from $1.73 billion Wall Street forecast in March 2023 compared to the management’s forecast of $10 billion.

According to Starboard, Pfizer’s expected revenue return on R&D and M&A investments is projected at 15% between 2023 and 2030, far below the industry median of 38%.

The hedge fund claimed Pfizer would need an additional $29 billion in revenue by 2030 to reach the industry standard.

“We believe it is unlikely that Pfizer will be able to achieve $79 billion in revenue by 2030, thereby making Pfizer’s return on R&D and M&A insufficient,” Starboard said.

“We believe the board needs to actively hold management accountable for earning appropriate returns on R&D and M&A moving forward,” Starboard continued. “Pfizer deserves to be best in class.”

Price Action: PFE stock is down 0.12% at $28.90 at the last check on Tuesday.

Read Next:

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.