Zinger Key Points

- Novo Nordisk stock experiences a Death Cross, signaling bearish momentum despite upcoming earnings and innovations.

- Investors should watch technical indicators closely, as potential bullish catalysts could drive future stock movement.

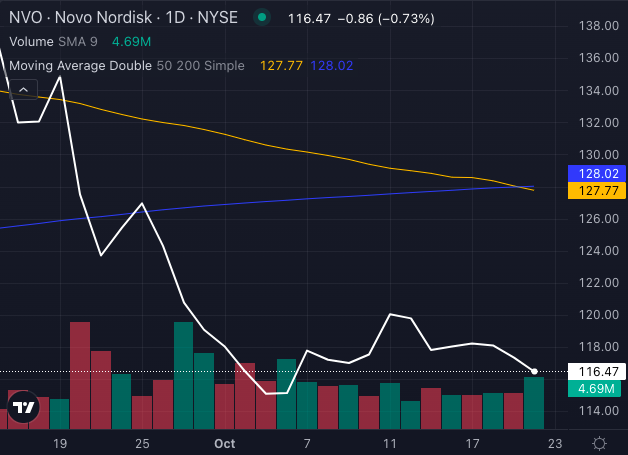

Novo Nordisk A/S NVO just hit a technical red flag — a Death Cross.

Chart created using Benzinga Pro

For those uninitiated, this bearish signal occurs when a stock's 50-day moving average drops below its 200-day moving average, hinting that more downside could be ahead.

However, Novo Nordisk's future might not be as grim as this technical omen suggests. Let's dig into the numbers and explore whether there's a silver lining for investors in this pharma heavyweight.

Bearish Signals Dominate, But Buying Pressure Builds

Novo Nordisk stock has had a bumpy ride, sliding 6.92% in the past month but still managing to remain up 12.76% year to date.

The share price sits below its five, 20-day and 50-day exponential moving averages, signaling a strongly bearish trend.

Chart created using Benzinga Pro

Add to that a Moving Average Convergence/Divergence (MACD) of negative 2.90 and a Relative Strength Index (RSI) of 34.00—verging on oversold territory—and it's clear that sellers are in control for now.

But here's the twist: Novo Nordisk stock is also seeing buying pressure despite this bearish setup. This could indicate a potential bottom, with some investors hoping the stock is ready for a rebound.

Novo Nordisk Pharma Strength

While the Death Cross sends a strong bearish signal, Novo Nordisk's fundamentals paint a rosier picture.

The company recently announced a once-daily diabetes pill that cuts heart attack and stroke risks by 14%. Plus, with a pipeline that includes blockbuster drugs like Ozempic and Wegovy, Novo Nordisk is making moves in the cardiovascular space, and even eyeing treatments for Alzheimer's and alcohol addiction.

Read Also: Wegovy Maker Novo Nordisk’s Oral Diabetes Pill Cuts Heart Attacks, Stroke Events By 14%

As Novo Nordisk navigates a Death Cross, traders should keep an eye on its upcoming third quarter earnings report and the ongoing success of its groundbreaking diabetes treatments. For now, investors should be wary, but not overly pessimistic—especially with potential catalysts on the horizon.

Novo Nordisk stock is at a critical juncture. Investors will be watching whether the bullish optimism around its pharma innovations outweighs the technical warning signals.

Read Next:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.