While this holds true for everyone developing a spending plan/savings strategy, the crux of the matter is that for “Sandwichers” – the current demographic of adults with aging parents in need of financial support and their own young-adult children who aren’t yet financially independent, remembering the little tips and tricks from living on a shoestring budget are often long forgotten by the time they are most needed.

Remembering the basics, the budgeting 101 tips and the “hacks” that made eking out a life possible when things were financially the most difficult can help ensure your financials stay on track at all times.

Unfortunately, once a certain level of financial security is reached, those steps that helped individuals survive up until that point are often shoved to the wayside, ignored as steps reserved for the young and truly needy – not those who have reached adulthood, have the stable job, the house and the car.

’Living Like You’re Broke’

There’s a popular quote of unknown origin that reads, “Rich people stay rich by living like they’re broke. Broke people stay broke by living like they’re rich.”

It may sound harsh, but there’s truth in the adage. Living above your means, whatever those means may be, will ultimately lead to financial challenges, while living below your means can ensure a stable future and help you maintain a specific lifestyle.

There are many popular methods for staying on track, but they all boil down to telling your money where to go instead of your money telling you what you can or cannot do.

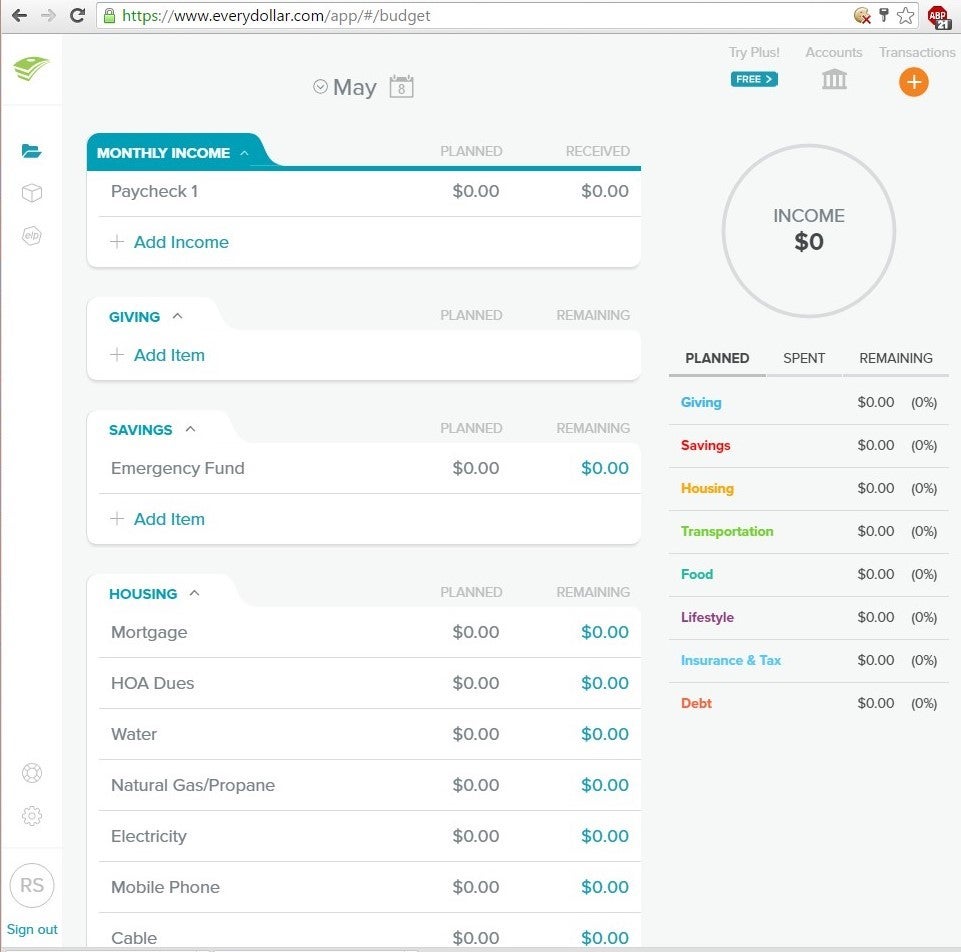

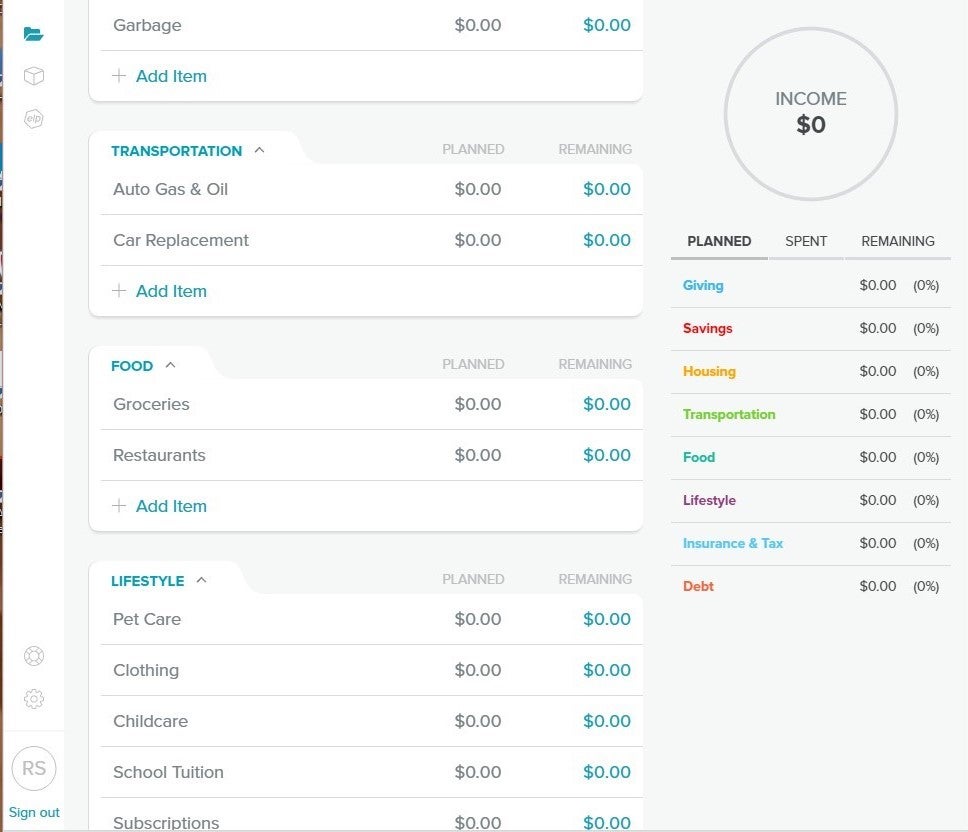

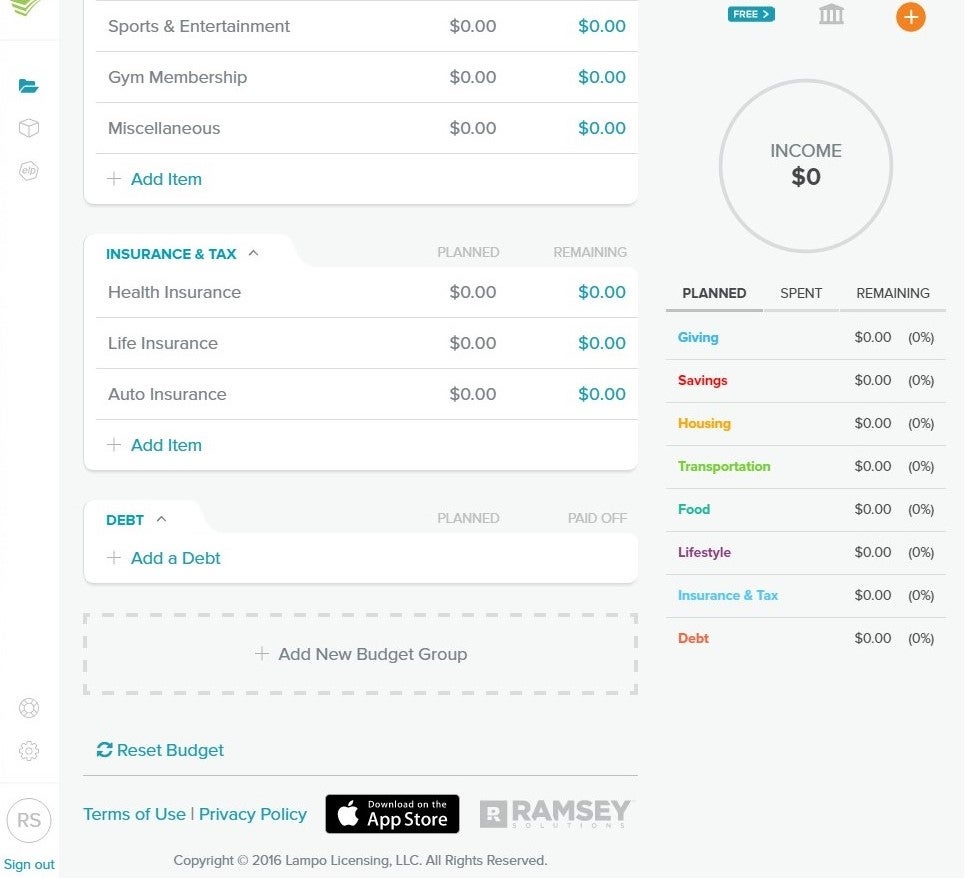

Dave Ramsey’s EveryDollar Budget

One such plan that has proven beneficial to many households is the highly touted EveryDollar Budget from money guru Dave Ramsey. One anecdote explains how a couple was completely unaware of how much the little things add up. By not dictating what their income was supposed to do, they were living shackled to their every financial move, and did not even realize it.

“We didn’t realize how much we spent on eating out and grocery trips […] we weren’t telling our money where to go, so we were just spending it! I remember looking back and saying ‘What did we buy this month? Where did it all go? We have no money!” the couple said.

The Little Things

Whether you decide to use a budgeting app or go old-school style and develop your own pencil-and-paper method, keeping track of all expenses is the easiest step to recognizing just where your money is going. With just that awareness, it becomes much simpler to be cognizant of your financial actions and make changes that will lead to healthy financial habits, ultimately leading to financial independence and control.

For instance, stopping by the gas station for a cup of coffee and a snack just every time you fill up the tank can quickly add up. If you get gas once a week and each time you run in for a $1.00 coffee and $1.50 snack pack, it’s easy to lose sight of how $2.50 could ever impact your budget. But, put within the context of the whole year, that $2.50 becomes $130.

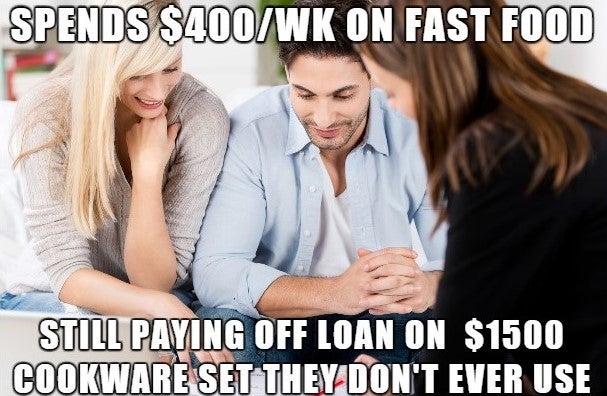

Expand the scenario for a moment. What if you have the tendency to run through a fast-food joint drive-through just a few times a week to grab a beverage? At your typical burger joint, a large soda will run you about $2. If that habit happens just three times a week, that totals $312 a year.

What about eating fast-food for just one night a week? A New York Times piece from five years ago found that it would cost twice as much as a healthy, home-cooked meal to feed a family of four. As a reminder, half a decade ago, prices for this fast-food meal were lower than they are today.

Look at another common habit: pizza night. The delicious treat of a meal can really add some punch to a monthly budget. If the typical pizza night runs you an average of $25 for a family of four, that's an extra $100 a month and $1,200 a year.

Or, movie night. Even if going to the movies is a once a month activity, and you spend wisely, going to the matinee, ordering a medium drink and popcorn to share instead of jumbo-sized individual snacks, you're looking at easily $40 for two tickets and those snacks ($480 a year).

These aren't tendencies of the exuberant or uncontrollable spenders. These habits are common themes from common families from middle of the road incomes. While it's easy to look at the coffee aficionado who spends $7 a day, five days a week at a fancy coffee joint and point fingers, shouting, "I know why you're budget is out of control!" becoming self-reflective and recognizing the tiniest of tiny spending habits also add up is humbling.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.