It’s a natural instinct to want to help those we love, particularly if we are in a position where that financial assistance is feasible. However, it’s often inadvisable to loan money to friends or family, and even more imprudent to co-sign on a debt. Keep in mind, that is exactly what you are doing by co-signing a loan — agreeing to take on the debt of someone else if for whatever reason they are unable/unwilling to fulfill their financial obligations.

While the arguments in favor of co-signing do exist (yes, it can help boost both parties’ credit scores), the consequences far outweigh those benefits the vast majority of the time.

Mom, Dad: Just Say No

Particularly if the person asking you to co-sign on a loan is an adult child, seriously consider declining the offer. Psychologically speaking, financial assistance for grown children can lead to more monetary problems and inter-relational problems down the road. While the initial “no” may sting, over the course of a lifetime, that "no" can be a gift.

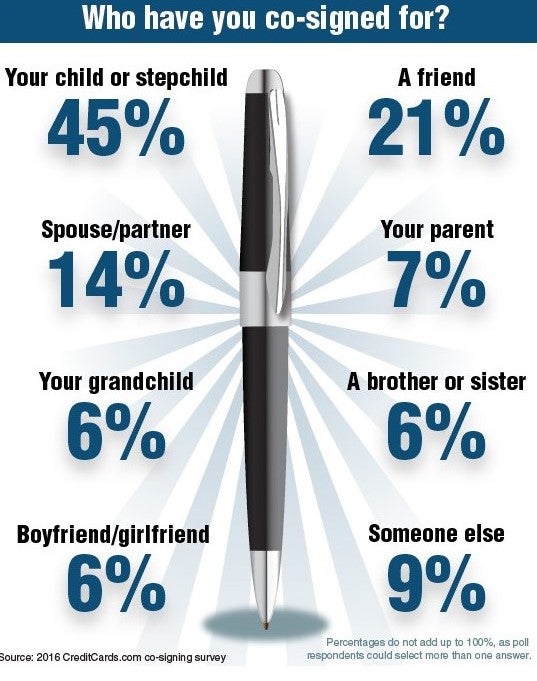

If you find yourself facing the decision, however, and the “no” is not coming as easily as you had hoped, find solace in the fact that you are not alone. According to research conducted this year by CreditCards.com, 45 percent of respondents indicated that they have co-signed a loan for a child or stepchild.

Of Money And Lending

The relationship between a lender and a borrower is innately complicated; that partnership becomes all the more convoluted when the relationship is more than business. When going into any sort of contract with financial and legal ramifications, it’s absolutely crucial to understand the implications bad money management can have on both parties. Because so many things can go wrong and relationships can be utterly destroyed, it is often strongly advised against having business come into familial or fraternal relationships.

On average, 75 percent of co-signers end up paying the loan themselves, according to the FTC.

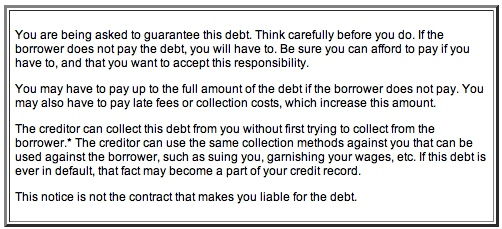

Therefore, the decision should not be taken lightly. Carefully read the typical language of a co-signers agreement, and you will begin to see how serious the matter is.

If you are still weighing the options, ask yourself the following questions.

Things To Consider When Asked To Co-Sign

- Can you afford to make the payments on the loan if the primary signer defaults?

- By co-signing, how will that affect your credit score?

- How will co-signing affect your likelihood of being approved for future loans? Your liability for the loan can impact your ability to get new credit, even if the primary signer is up-to-date.

- What are the chances that the primary signer will default on the loan?

- Do you fully understand that even death cannot erase your loan liability?

- Do you understand that if the primary co-signer is late or defaults, the lender can come after you first before the primary co-signer? While this is not true for all states, in some states, creditors can approach you the co-signer first.

- Do you understand that late payments made by the primary signer can negatively impact your credit score?

- What are the chances that the primary signer will have late payments?

- How secure is the primary signer’s financial situation? Their income?

- What doors will be opened if you agree to co-sign, even just once?

- What is the likelihood that a single instance of co-signing will help that individual in the long run?

Remember: You have a choice in the matter. No one can force you to co-sign for them. Even your children are not entitled to your financial security in this manner. It is a personal and very private decision. If you need help making the decision, stop. Call or visit your financial advisor, and go through your particular situation step by step. As with all things financial, nothing can truly be gained by an impromptu decision made in haste and without the financial literacy to back up the decision.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.