The iConic Apple Inc. AAPL breakthrough iPhone is going from strength to strength. Ever since Steve Jobs mesmerized all and sundry with his typical captivating style of product launch on January 9, 2007, this product has undergone several iterations and improvements. The first generation iPhone released on June 29, 2007, had a capacity of merely 16 GB; it could handle only 128 MB of memory, and the camera of 2.0 mega pixels — primitive by today's standards.

Subsequently, since it was all about 3G technology, Apple skipped the No. 2, so there never was an iPhone 2. Including the iPhone S and iPhone C additions, there have been about 12 iPhone versions thus far. Now, the markets have set sights on the iPhone 8, which is rumored to be launched in the fourth quarter of 2018. So much so for the product.

Mooooving On

How has the product fared in revenue terms? The company has been a cash cow for this company known for its innovative appeal. Now, what is a cash cow? The portfolio planning model developed by Bruce Henderson of the Boston Consulting Group in the 1970s has helped classifying the company's business into four categories. The businesses categorized as cash cows have the following features:

- The return on assets greater than the market growth rate, signaling that they generate more cash than they consume.

- These businesses should be milked, extracting the profits with very little investment going into it.

- These businesses provider cash required for other promising business opportunities in the works, R&D and other administrative costs to pay off corporate debt and pay dividends to shareholders.

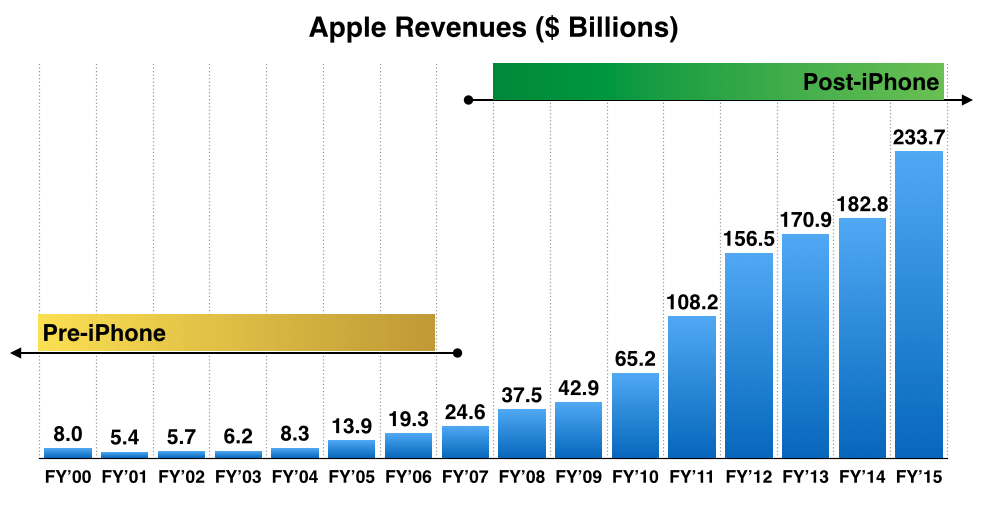

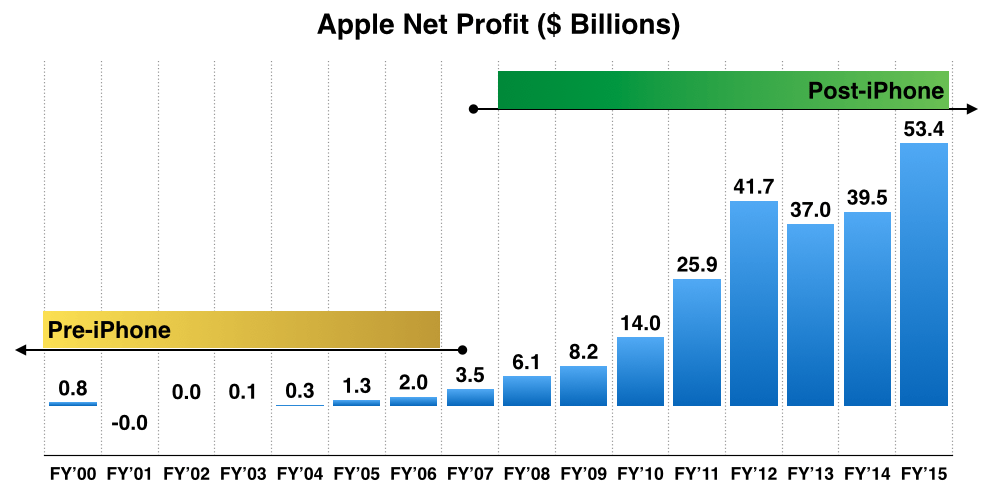

To make sense of how the product has played a huge role in the continued outperformance of the company, we present the revenue and profitability scenario of Apple pre and post the iPhone era.

Pre And Post iPhone Revenue & Profit Performance

Immediately after the introduction, iPhone sales boosted Apple's revenues by over 50 percent in 2008. This was an improvement from the roughly 27 percent revenue growth in 2007. Although revenue growth slackened to 14 percent in 2009, it subsequently improved to over 52 percent in 2010, accelerating to 66 percent in 2011.

After growing roughly 45 percent in 2012, it slid further to 9 percent in 2013 and 7 percent in 2014. Revenue growth at Apple began to pick up pace to 28 percent in 2015. In 2016, total annual revenues fell about 8 percent.

Source: revenuesandprofits.com

Source: revenuesandprofits.com

Source: revenuesandprofits.com

Source: revenuesandprofits.com

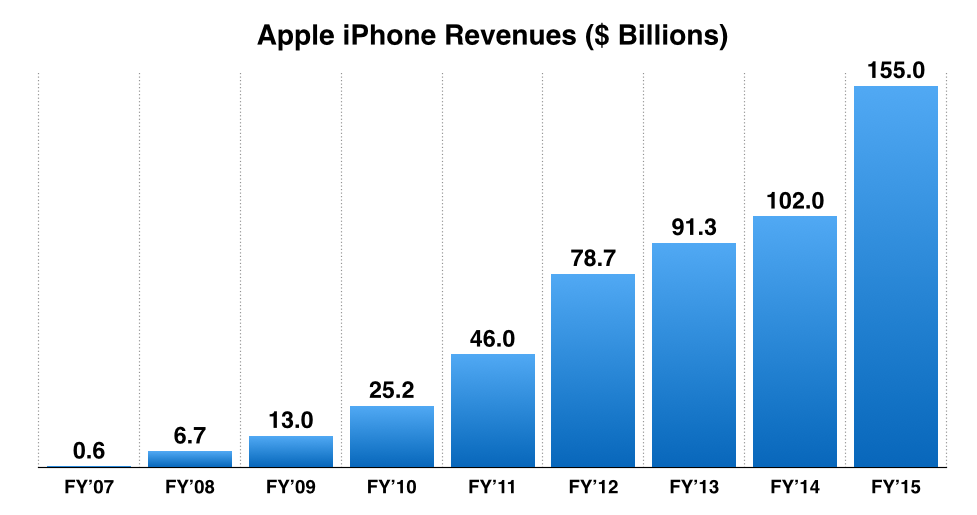

iPhone Revenues Over The Years

IPhone revenues rose an astounding 1,000+ percentage in 2008 and continued to grow at a scorching pace in subsequent years until 2012 (94 percent in 2009, 94 percent in 2010, 83 percent in 2011 and 71 percent in 2013). After rising at a moderated pace of 16 percent in 2013 and 12 percent in 2012, sales rose by 12 percent in 2016.

Source: revenuesandprofits.com

Source: revenuesandprofits.com

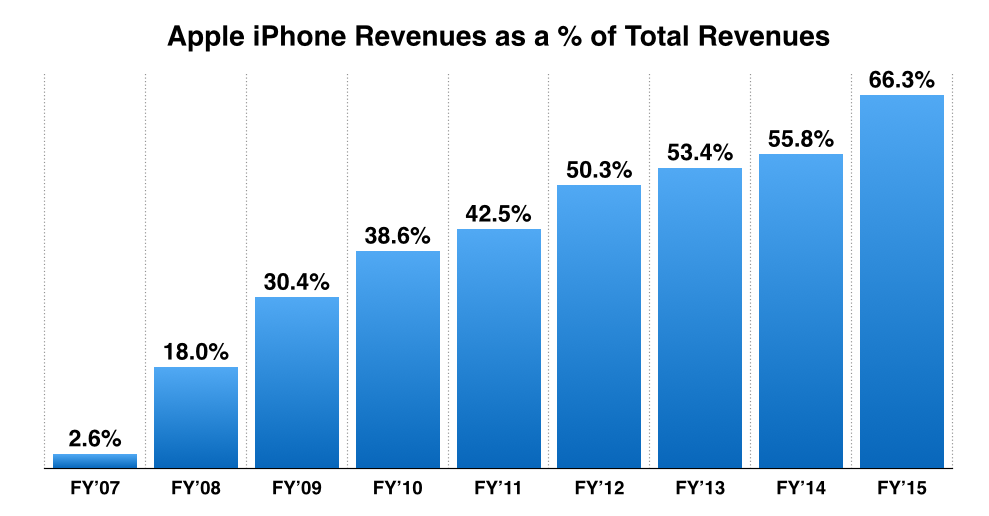

iPhone's Contribution To Total Revenues

Notwithstanding the uneven iPhone revenue performance, the share of iPhone revenues as total percentage of revenues has been largely on the rise. From a mere 2.6 percent in the introductory year, it rose to 18 percent in 2008, 30.4 percent in 2009, 38.6 percent in 2010, 42.5 percent in 2011, 50.3 percent in 2012, 53.4 percent in 2013, 55.8 percent in 2014 and 66.3 percent in 2015. In 2016, the share plateaued off to roughly 63 percent.

Source: revenuesandprofits.com

Source: revenuesandprofits.com

Thus, iPhone continues to serve as THE product of the company, despite being in service for a decade now. How many more years will this cash cow business continue to fuel the company? The answer depends on how soon Apple can zero in on another breakthrough innovation that can take the world by storm.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.