President Donald Trump is proposing aggressive tax cuts that would lower the U.S. corporate tax rate from 35 percent down to 15 percent. In addition, Trump is also proposing a one-time repatriation tax holiday to allow U.S. companies to bring overseas cash back into the country at a tax rate of only 10 percent.

For some of the biggest tech companies in the world, Trump’s plan could serve as a major tailwind. Not only would it reduce their annual tax bills, it would also give them access to huge overseas cash hoards that have been piling up since the last corporate tax holiday back in 2004.

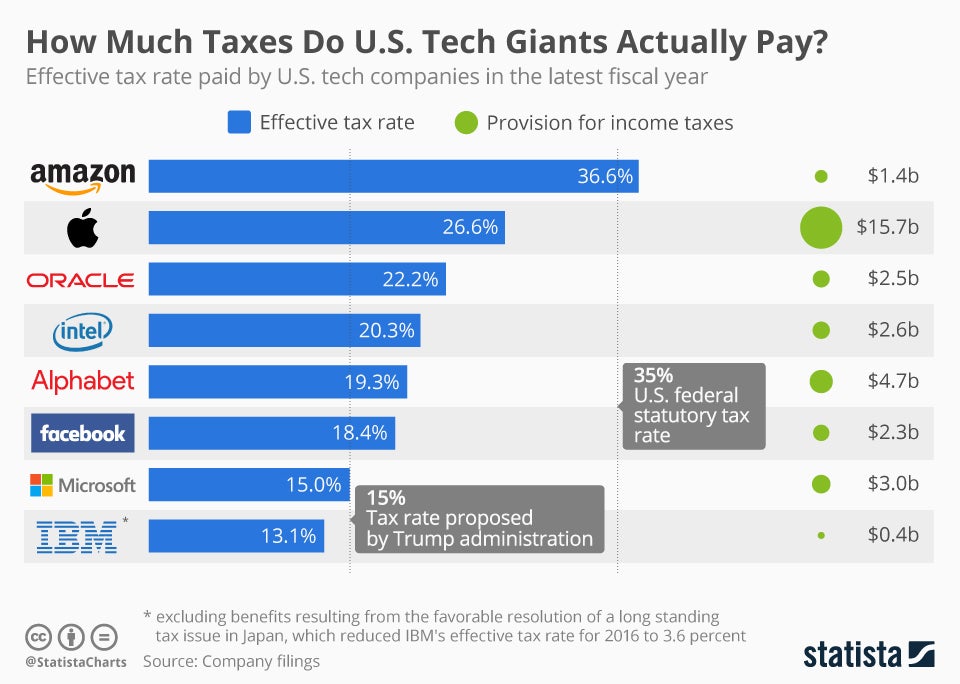

According to Statista, Amazon.com, Inc AMZN is the only U.S. tech giant that has been paying an effective tax rate of more than 35 percent. In the last fiscal year, Apple Inc. AAPL was by far the biggest taxpayer in the tech world, forking over an incredible $15.7 billion in income taxes. Still, even Apple only paid an effective tax rate of 26.6 percent by channeling some earnings overseas.

Here’s a look at how Amazon, Apple, Oracle Corporation ORCL, Intel Corporation INTC, Alphabet Inc GOOG GOOGL, Facebook Inc FB, Microsoft Corporation MSFT and International Business Machines Corp. IBM would have their tax burden changed if Trump’s plans for 15-percent corporate income tax and 10-percent repatriation tax get implemented.

Benzinga used Statista’s estimates for effective tax rates and total tax payments along with Reuters estimates for year-end 2016 overseas cash hoards to estimate three metrics.

First, the potential repatriation tax payment is the amount of taxes each company would pay to the government if it brought 100 percent of its overseas cash back into the country. Second, the repatriated cash total is amount of the overseas cash that would be free and available for the companies to invest domestically after repatriation. Finally, the annual income tax savings is the change in the annual income tax payments that each of these companies would see if their effective tax rates were shifted to Trump’s proposed rate of 15 percent.

Parsing Through Repatriation

Here’s a look at the numbers:

Alphabet

- Repatriation tax payment: $5.2 billion.

Repatriated cash total: $46.8 billion.

Annual income tax savings: $1.0 billion.

Amazon

- Repatriation tax payment: $860 million.

Repatriated cash total: $7.7 billion.

Annual income tax savings: $826 million.

Apple

- Repatriation tax payment: $25.6 billion.

Repatriated cash total: $230.4 billion.

Annual income tax savings: $6.8 billion.

- Repatriation tax payment: $510 million.

Repatriated cash total: $4.5 billion.

Annual income tax savings: $425 million.

IBM

- Repatriation tax payment: $6.5 billion.

Repatriated cash total: $58.5 billion.

Annual income tax savings: -$58 million.

Intel

- Repatriation tax payment: $1.3 billion.

Repatriated cash total: $11.7 billion.

Annual income tax savings: $678 million.

Microsoft

- Repatriation tax payment: $11.6 billion.

Repatriated cash total: $104.4 billion.

Annual income tax savings: $0.

Oracle

- Repatriation tax payment: $5.1 billion.

Repatriated cash total: $45.9 billion.

Annual income tax savings: $810 million.

Overall, these eight tech giants alone would pay a combined $106.1 billion in repatriation tax if they choose to repatriate all of their overseas cash. At the same time, these eight companies will free up a combined $510.0 billion dollars in cash that they can return to shareholders or invest in their U.S. businesses. However, after the one-time $106 billion tax payment, these companies would theoretically save a combined $10.5 billion in annual income tax if their effective rates are lowered to 15 percent.

Related Links:

What Will Companies Do With Their Tax Savings? Cramer Has The (Disappointing) Answer

5 Donald Trump-Inspired Leveraged ETFs Make Their Debut ____________ Image Credit: By The White House [Public domain], via Wikimedia Commons

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.