Source: CME Group

Compare and contrast CME Group Precious Metals products on a side-by-side basis to improve context and decision making.

The Metal Market Profile dashboard allows traders to compare and contrast CME Group Precious Metals products on a side-by-side basis, offering improved context and decision-making opportunities. You can quickly analyze our Precious Metals futures markets and the OTC spot equivalents on EBS Market to understand the bid-ask spreads when the markets are active and the available liquidity in the order book out to 10 levels.

The dashboard can be used to:

- Compare trading activity across markets to see which platforms are busiest throughout the trading day.

- View the volumes of CME Group Precious Metals futures traded in both contract and volume (tr. oz.) terms to determine when the market is most active.

- Determine the times of day where the tightest spread volume occur and compare CME Group Metals futures and OTC spot precious metals.

- View statistical plots available for top of book (TOB) spreads.

- Review historical data to determine how spreads, order book depth, and trading activity performed over a determined time range.

Note: All times are shown in GMT and all data is exportable down to the five-minute level. (Only one-hour buckets are available for the percentile plots.)

Getting started

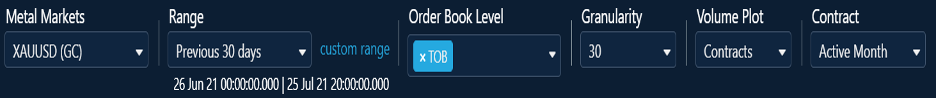

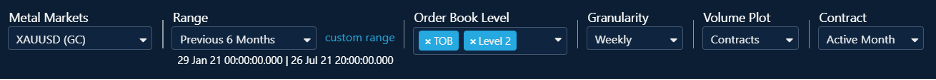

The top toolbar allows you to configure the dashboard to display the information you are interested in.

Metal markets

The dashboard currently features COMEX Gold and Silver futures markets and their cash equivalents on EBS Market and EBS Direct. XAUUSD (GC) and XAGUSD (SI).

Date range

You can choose to review recent calendar months, the last 30 days, or you can enter your own custom date range. You can also choose the intra-day time period that is shown in the dashboard. Note that selecting a different date range via the drop-down will update the start and end times.

By default, the tool displays 00:00 – 20:00 GMT.

Order book level

In addition to TOB data, you can choose to view spread and order size data for up to 10 levels of the order book. This allows traders to see how the spreads and order book depth change as multiple levels are selected. There is also a “Futures VWAP” selection which provides a volume-weighted bid-ask spread from the metal futures order book for the equivalent volume quoted on EBS Market top of book; this allows you to compare spreads based on like for like order volumes from each market.

Granularity

The tool enables traders to select the time granularity that they wish to see – from 60 minutes down to five-minute intervals.

Update frequency

Data is updated on a T+1-day basis – the tool does not provide real-time/trade date data, it is providing backward-looking data for analysis.

Types of analysis

The dashboard has three separate panels, showing:

- Cash Futures Analysis

- Futures Volume Analysis

- Historical Analysis

Cash Futures Analysis

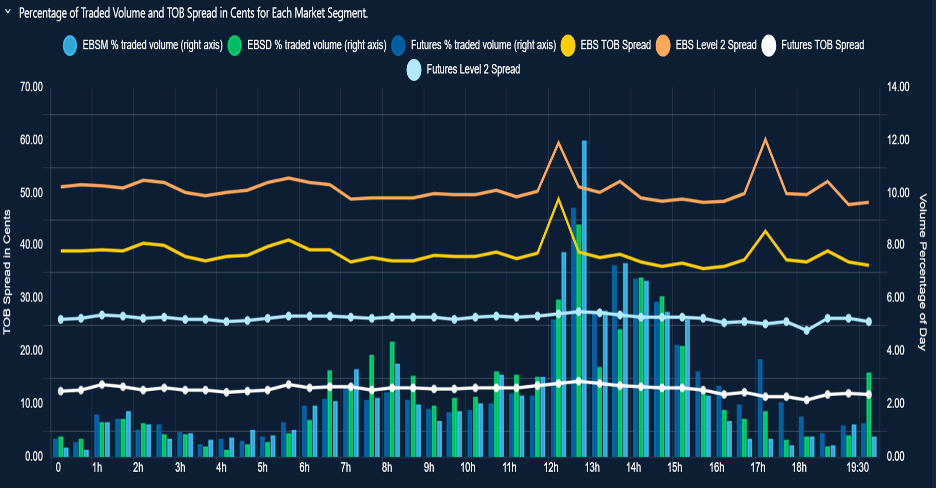

Percentage of traded volume and TOB spread in cents for each market segment

- Plots the traded volume for each of the three markets: CME Group Metals futures, EBS Market, and EBS Direct as a percentage of the hours selected.

- Overlays the bid-ask spread for the selected order book levels for EBS Market and futures.

Note: EBS Direct TOB spreads are not available as they are bilaterally quoted between counterparties.

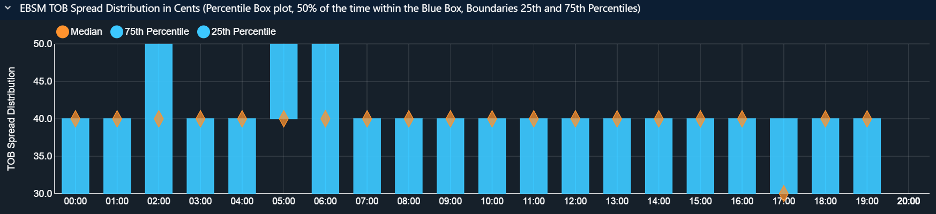

EBSM TOB spread distribution in cents

A box-whiskers (percentile) plot that buckets TOB EBS Market spreads into an hourly statistical plot. The median spread is shown in orange. The blue box highlights the range observed 50% of the time between the 25th and 75th percentiles.

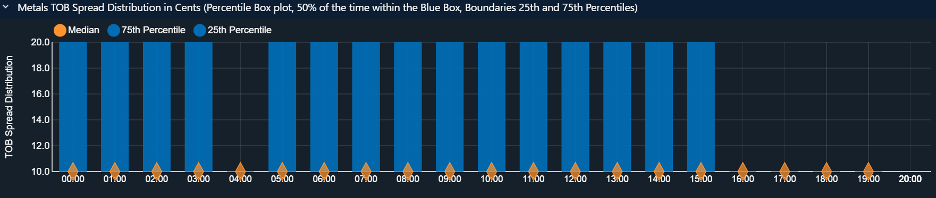

Metals futures TOB spread distribution in cents

Similar display to EBS Market TOB spread distribution but displaying TOB CME Group Metals futures spreads.

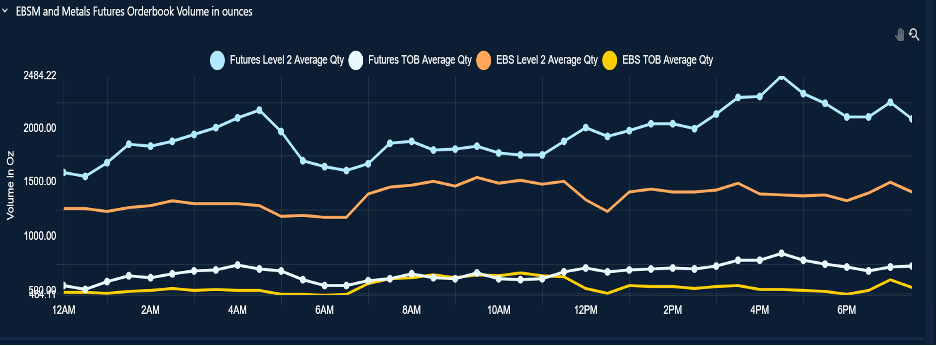

EBSM and Metals futures order book volume in ounces

A side-by-side comparison of available EBS Market and CME Group Metals futures order book volume for the selected order book levels.

Exporting the data

To export the data, click on the “Data” tab and then on your preferred export format. Excel and CSV are available.

Futures Volume Analysis

Getting started

As before, the top toolbar allows you to configure the dashboard to display the information you are interested in.

Metal markets

The dashboard features the same metals as the Cash Futures Analysis. Futures volume data is available for precious metals.

Date range

You can choose to review recent calendar months, the last 30 days, or you can enter your own custom date range. You can also choose the intra-day time period that is shown in the dashboard. Note that selecting a different date range via the drop-down will update the start and end times.

By default, the tool displays 00:00 – 20:00 GMT.

Order book level

In addition to TOB data, you can choose to view spread and order size data for up to 10 levels of the orderbook for CME Group futures markets.

Granularity

The tool enables traders to select the time granularity that they wish to see – from 60 minutes down to five-minute intervals.

Volume plot

The traded volume chart can be displayed in terms of the number of contracts traded, the number of ounces traded, or the percentage of volume observed in each time period.

Contract

This allows you see volume data for either the most active contract month or all contract months blended together.

Types of analysis

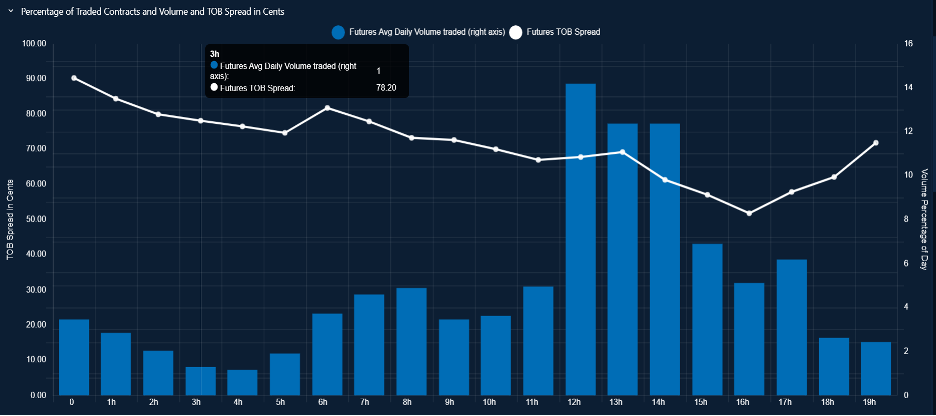

Traded contracts and volume and TOB spread in cents

Percentage of traded contracts and volume and TOB spread in cents for each market segment.

- Plots the traded volume for CME Group Precious Metals futures.

- Traded volume is shown in terms of the number of contracts traded, the volume in ounces traded, or as a percentage of the hours selected.

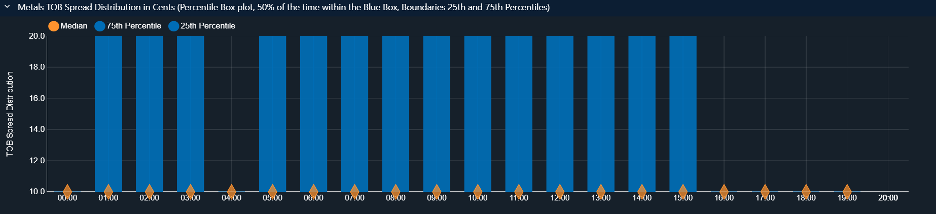

Metals TOB spread distribution in cents

A box-whiskers (percentile) plot that buckets TOB metals spreads into an hourly statistical plot. The median spread is shown in orange. The blue box highlights the range observed 50% of the time between the 25th and 75th percentiles.

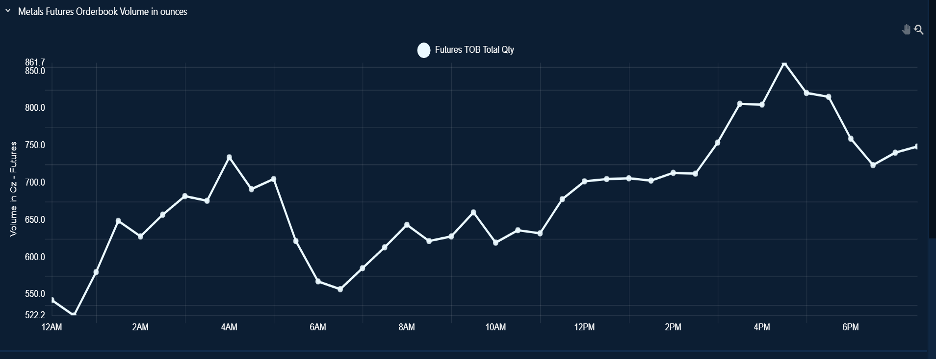

Metals futures order book volume in ounces

A look at CME Group Metals futures order book volume for the selected order book levels.

Historical Analysis

Getting started

Again, the top toolbar allows you to configure the dashboard to display the information you are interested in.

Metal markets

The dashboard features the same precious metals as the Cash Futures Analysis and the Futures Volume Analysis.

Date range

The default setting for the Historical Analysis is the previous six months. You can also choose your own custom date range as well as defining the intra-day time period that is shown in the dashboard. Note that selecting a different date range via the drop-down will update the start and end times.

By default, the tool shows 00:00 – 20:00 GMT

Order book level

In addition to TOB data, you can choose to view spread and order size data for up to 10 levels of the orderbook, plus the “Futures VWAP” spread as previously described.

Granularity

This allows you to choose the desired granularity as daily, weekly, or monthly.

Volume plot

The traded volume chart can be displayed in terms of the number of contracts traded, the number of ounces traded, or the percentage of volume observed in each time period.

Contract

This allows you to see spread and volume data for either the most active contract month or all contract months blended together.

Types of analysis

This panel provides the analysis formats seen on the Cash Futures Analysis and Futures Volume Analysis panels, presented for the chosen granularity.

Exporting the data

On any of the three panels, to export the data click on the “Data” tab and then on your preferred export format. Excel and CSV are available.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.