Zinger Key Points

- Tesla is facing a two-way threat of both supply side shocks and demand slowdown.

- The company, which delivered close to 1 million vehicles in 2021, has a long-term delivery growth target of 50%.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Tesla, Inc. TSLA recently hiked the prices of its more affordable Model 3 sedans and Model Y SUVs in the U.S. and China.

Although the company did not disclose any specific reason for the increases, raw material cost inflation exacerbated by geopolitical tension may have been the culprit.

EV-ICE Price Parity Could Be Delayed: One of the premises behind the thesis of wider electric vehicle adoption is the ability of green energy vehicles to attain price parity with internal combustion vehicles. The timeframe for achieving this is likely to be pushed out, given abounding macroeconomic and geopolitical risks.

Even ahead of the Russia's invasion of Ukraine, battery manufacturers began raising prices, blaming the action on the higher cost of cathode, anode and the other raw materials that go into batteries. The crisis in Eastern Europe that intensified last month has indiscriminately pushed up metal prices due to fears of a supply squeeze.

Earlier, it was assumed that price parity will be achieved by 2028 in a bear case scenario and by 2025 in a bull case scenario, according to BloombergNEF. Now, with all the uncertainties and supply chain shocks, the schedule could be pushed back.

Geopolitical Tensions Put Tesla's LiFP Bet At Risk: Tesla initially used batteries with nickel-cobalt-aluminum chemistry manufactured at its Nevada Gigafactory for its Model 3 and Model Y vehicles sold in North America.

Late last year, the company said it will embrace the lithium-iron-phosphate (LiFP) battery chemistry with prismatic cells as opposed to the cylindrical cells in the older chemistry.

The motive behind the transition is to replace the more expensive cobalt in the cells. Tesla CEO Elon Musk suggested in mid-2021 the company envisions making a long-term shift toward cheaper LiFP cells, with these eventually accounting for two-thirds of the batteries used across its products.

LiFP batteries are not without their demerits. They have relatively lower energy density, limiting the range of the vehicles using them, although over the years considerable improvement has been achieved on this front.

The break-down of battery cost is as follows, Visualcapitalist reported, citing BloombergNEF:

- Cathode: 51% (made up of lithium and other battery metals such as nickel, cobalt and manganese)

- Manufacturing: 24%

- Anode: 12%

- Separators: 7%

- Electrolyte: 4%

- Battery housing material: 3%

Typical chemistries used for cathodes are LiFP, lithium nickel manganese cobalt (NMC) and lithium nickel cobalt aluminum oxide (NCA).

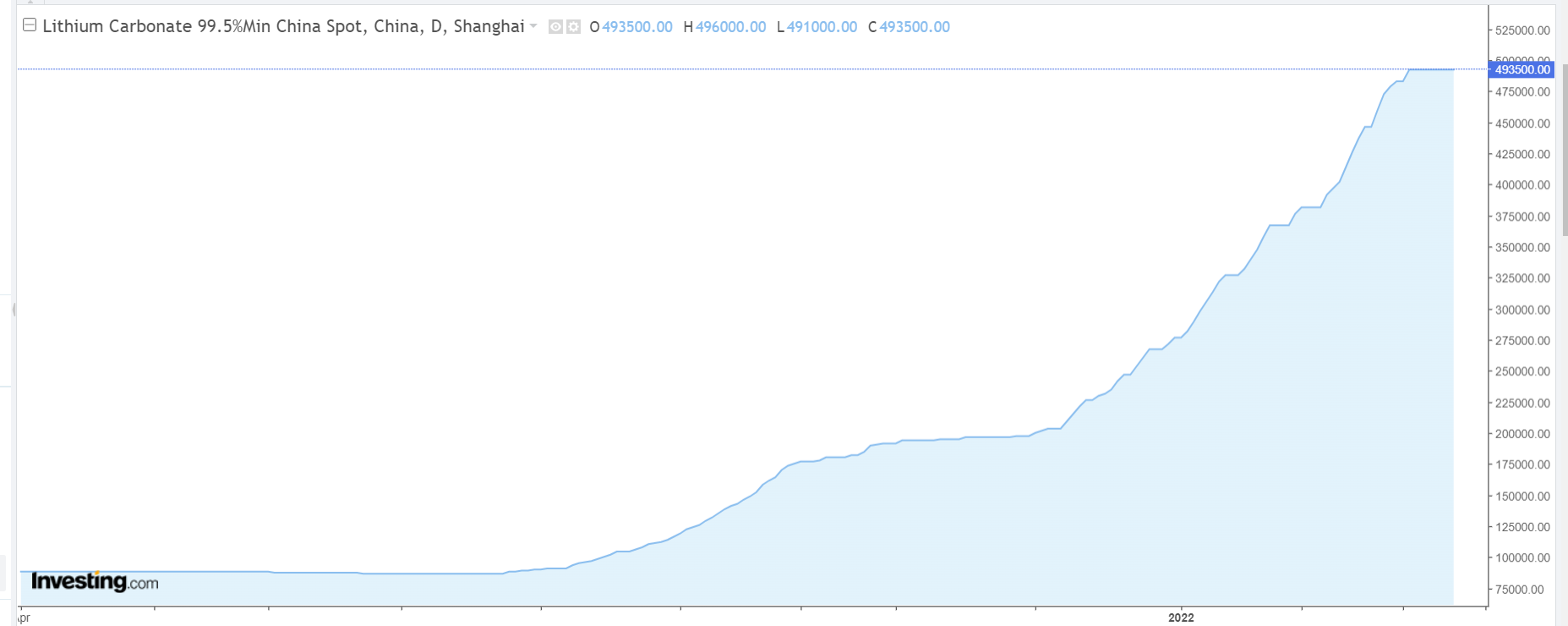

Since the commencement of the war in Ukraine, the price of lithium and nickel have gone through the roof. Battery-grade Chinese lithium carbonate spot prices on the Shanghai market have rallied to a high 493,500 yuan ($77,671) per ton in the second week of March, up about 78% since the start of the year.

Source: Investing.com

Nickel prices on the London Metal Exchange, meanwhile, more than doubled to go above $100,000 a ton last week before pulling back.

Related Link: Tesla Takes Fight to Rival Camp: EV Marker's February Sales Trounce Volkswagen And Other Domestic Rivals In Germany

What Evolving Dynamics Mean For Tesla: One of the pushbacks for EV adoption has been higher EV prices. With batteries accounting for a significant chunk of EV prices, EV makers were eyeing to bring down prices by using cheaper battery materials such as LiFPs.

The unexpected price hikes in the cheaper avenues being considered by EV makers has thrown their strategy into disarray.

The metal price rally, especially the spike in nickel prices, has the potential of increasing EV prices by $1,000, Teslarati reported, citing Morgan Stanley analyst Adam Jonas.

Morgan Stanley was forecasting a nickel shortfall by 2026 even before the Ukraine war started. Since Russia is one of the most the world's top producers of nickel, potential sanctions will likely raise prices. If that happens, it may be time for earnings estimates for EV makers to be taken down, Jonas reportedly said.

With lithium prices also galloping, EV makers, led by Tesla, could be facing an inflationary input prices environment. This in turn will impact their margins. If they choose to absorb the incremental costs, the viability of their businesses will suffer. On the contrary, if they decide to pass on the higher costs to consumers, demand will take a hit.

Consumer spending is expected to see softness in the near term due to economy-wide inflationary pressure. Ukraine is known as Europe's breadbasket and is among the top wheat exporters of the world. The war portends supply shortage of staples such as wheat, which in turn could send their prices spiraling. With consumers forced to set aside more money for staples, spending on consumer discretionary items such as cars would take a backseat.

Tesla is facing a two-way threat of both supply side shocks and demand slowdown. The company, which delivered close to 1 million vehicles in 2021, has a long-term delivery growth target of 50%.

If these risks continue to play out, Tesla shares, which have pulled back about 36% from their all-time high of $1,243.49 on Nov. 4, 2021, are likely to remain under pressure in the near-term.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.