Zinger Key Points

- Amazon’s stock gains outpace Disney, with Prime Video boosting growth alongside its retail and cloud dominance.

- Disney struggles in both stock performance and streaming, facing pressure while Amazon maintains strong bullish signals.

Amazon.com Inc. AMZN might be the world's largest online retailer, but don't sleep on its Hollywood ambitions. Amazon Prime Video is giving traditional entertainment players such as Walt Disney Co DIS a run for their money.

Amazon: E-Commerce Juggernaut Flexes Its Streaming Muscle

While 75% of Amazon's revenue still comes from its core retail operations, its streaming service is an underrated gem, especially as part of the broader Amazon ecosystem. AWS (Amazon Web Services) chips in another 15%, making this company a multi-pronged powerhouse.

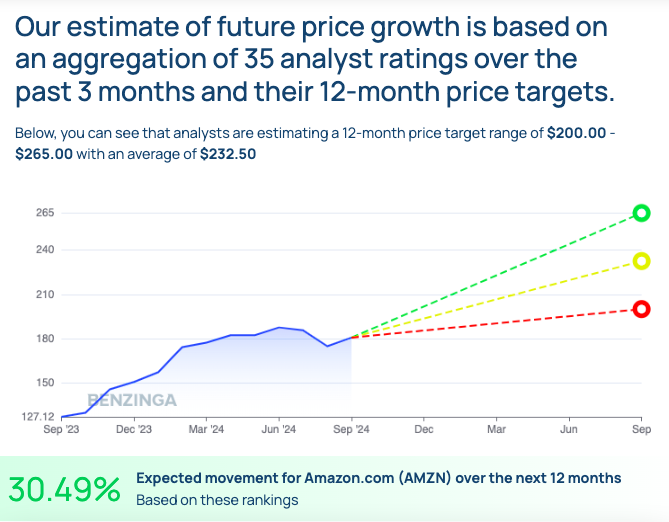

Source: Benzinga Report – AMZN

Amazon stock is up 31.81% over the past year and 23.06% year-to-date. Analysts are confident, too, projecting a 12-month price target range of $200 to $265, with an average of $232.50, signaling a potential 30.49% upside.

Chart created using Benzinga Pro

Technically, Amazon stock is in great shape. It's trading above its eight-, 20-, 50-, and 200-day simple moving averages, flashing bullish signals all over the place. But the options market is a bit more cautious, with sentiment leaning negative, and selling pressure is starting to build.

Still, with a five-year Sharpe ratio of 1.0927, Amazon is outperforming the competition, showing its resilience even in turbulent markets. Prime Video is a secret weapon in its continued dominance, offering consumers both retail therapy and binge-worthy content in one subscription.

Read Also: CrowdStrike, Amazon, And NVIDIA Team Up To Empower Cybersecurity Startups

Disney: Struggling To Reignite The Magic

Walt Disney is synonymous with entertainment, but lately, it's been lagging behind Amazon on the stock chart and in the streaming wars. Disney+ was meant to be its big-ticket to streaming success, but the numbers aren't as magical as investors hoped.

Disney’s stock is up a modest 7.61% over the past year and a paltry 0.86% year-to-date, making Amazon's gains look like a bull stampede.

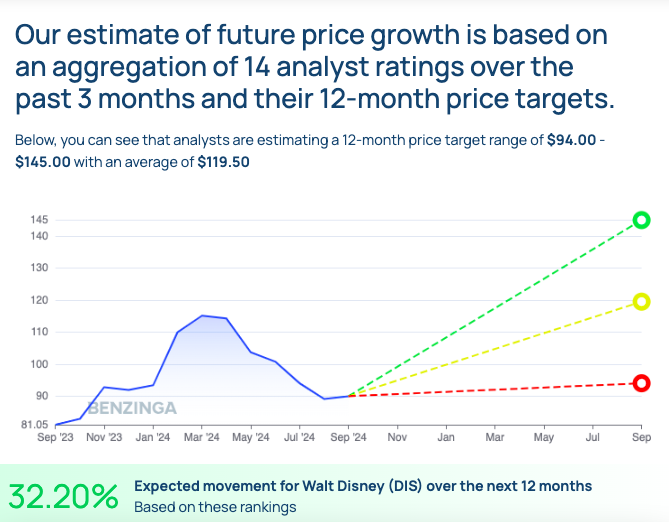

Source: Benzinga Report – DIS

Analysts are giving Disney a 12-month price target range of $94 to $145, with an average of $119.50, which represents a 32.20% potential upside. While Disney's entertainment, sports (ESPN) and theme parks still bring in significant revenue, its five-year Sharpe ratio of -0.8229 indicates it’s been a bumpy ride for shareholders compared to industry peers.

Chart created using Benzinga Pro

The technicals aren't helping Disney's case either. While Amazon stock is riding high on multiple bullish signals, Disney stock is struggling, with its stock trading barely above key moving averages.

The options market is showing negative sentiment here, too, leaving investors to wonder when, or if, the House of Mouse will return to its former glory.

Streaming Showdown: Prime Vs. Disney+

Amazon’s Prime Video and Disney+ are locked in a fierce battle for streaming supremacy, but it's clear which company is winning in the stock market right now. Amazon is leveraging its diversified business model and Prime bundle to stay ahead, while Disney is facing more hurdles than expected, from slower streaming growth to stock struggles.

With Amazon's stock showing bullish technicals and strong price targets, it's a safer bet for investors looking for both growth and entertainment. Meanwhile, Disney has some catching up to do, not just in the streaming wars but in restoring its magic touch with shareholders.

Read Next:

Photos: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.