Source: The Credit Blog

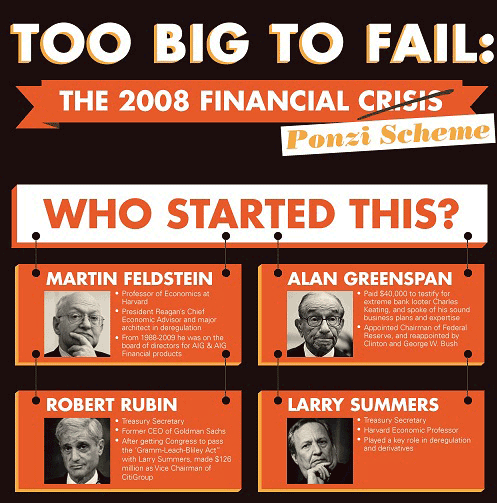

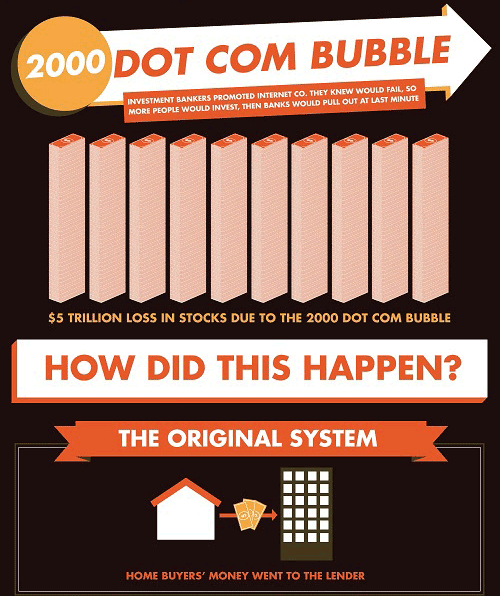

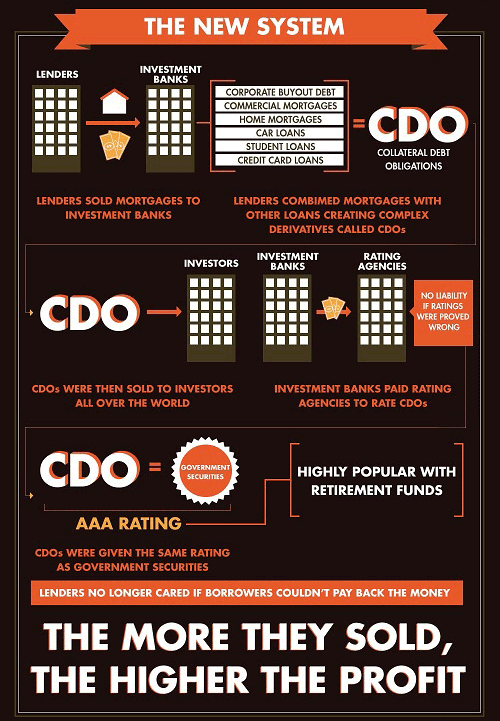

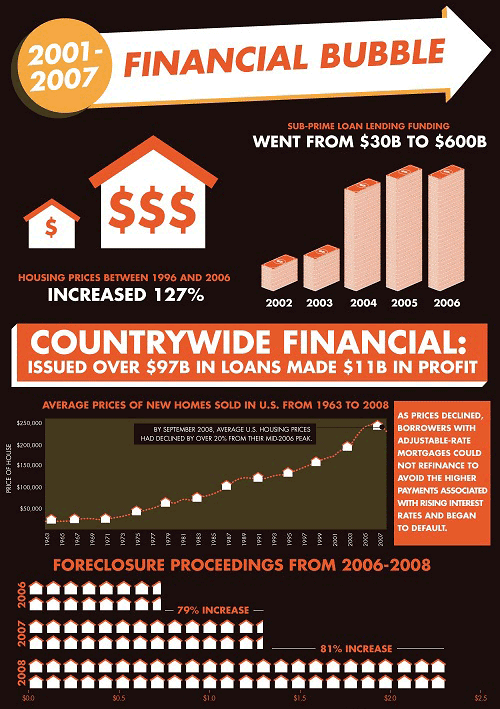

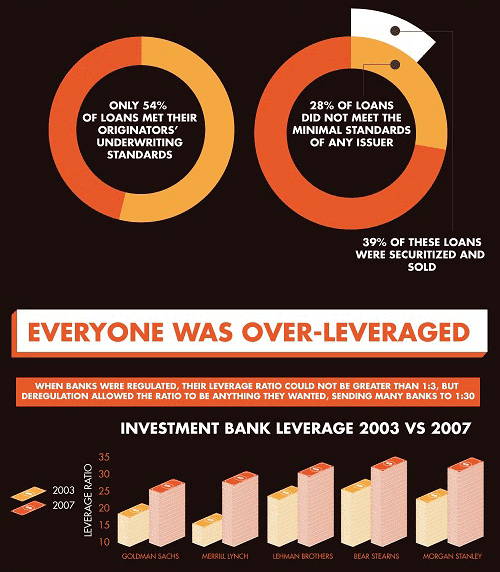

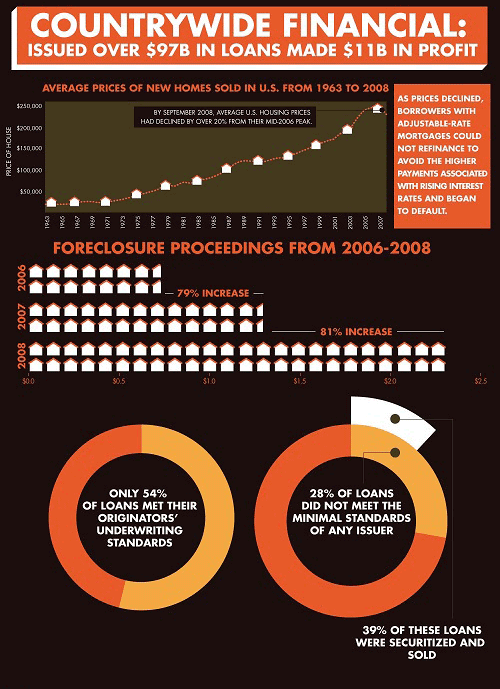

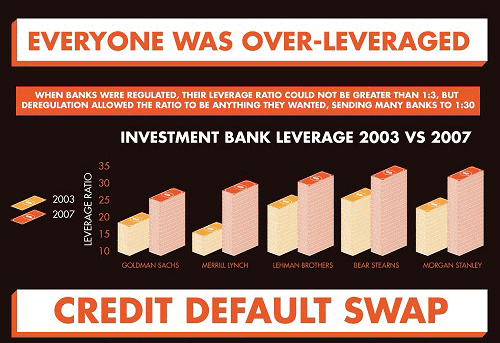

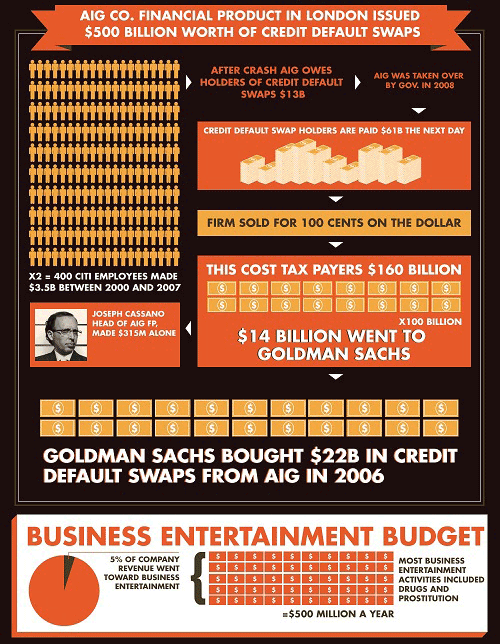

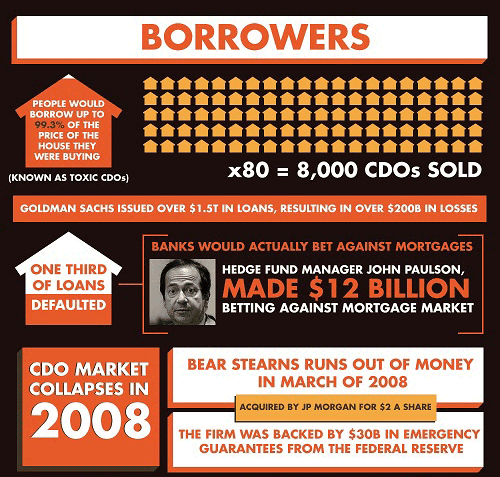

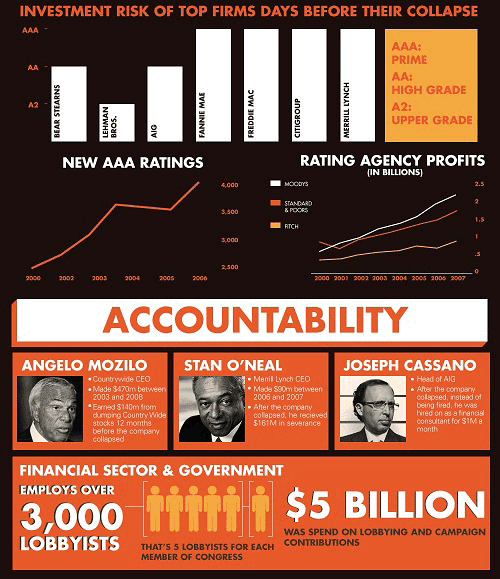

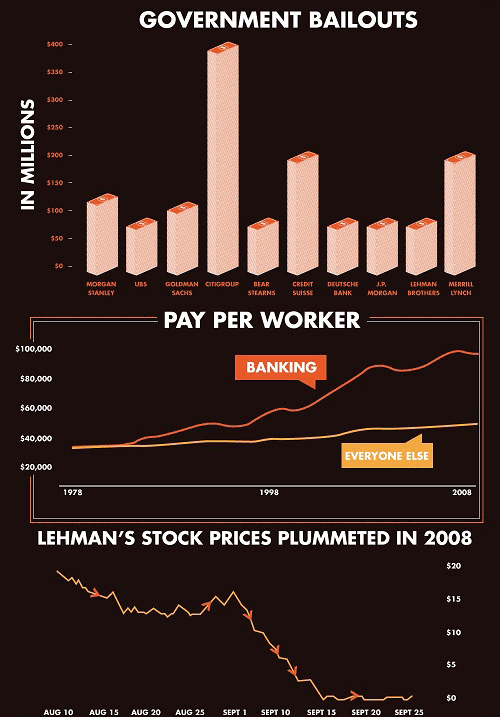

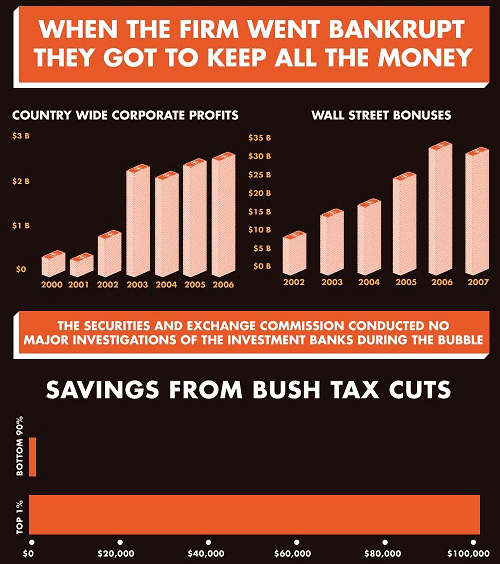

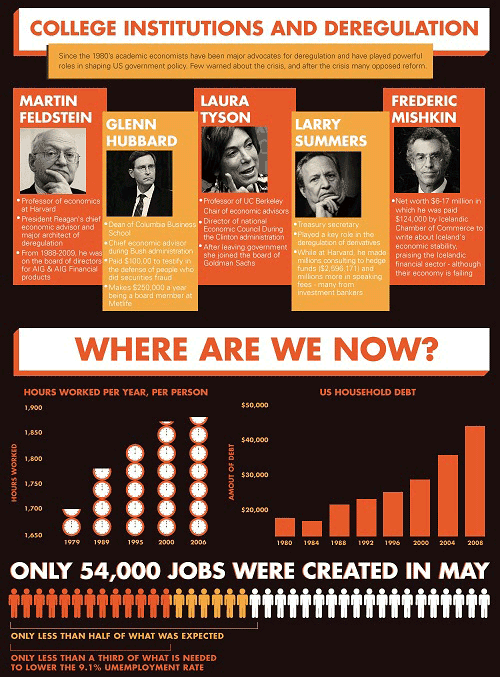

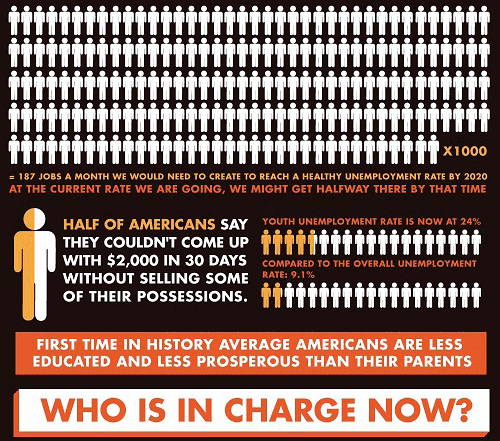

Source: The Credit Blog(Note: some of the information in the INFOGRAPHIC is a bit out of date. For example, Larry Summers no longer works for the Obama administration.) As banking and investing regulations were altered, money flowed into mortgage backed securities. In days gone by, mortgages were held by the issuer. Thus, the issuing party had a vested interest in ensuring that the lender was credit-worthy. However, during the formation of the housing bubble, issuing banks sold their mortgages to investment banks, which then bundled the mortgages into derivative instruments and sold them to investors. Investors demanded these instruments in large quantities, as they were given the highest recommendations by ratings agencies. The rating agencies were supposed to provide investors with accurate information to asses the risk potential of their investments. Yet, as the rating agencies were paid by the investment banks which sold the mortgage instruments, their loyalties remained with the investment banks rather than the investors themselves. When the system finally collapsed, many of the investment banks were bailed out of their bad bets. Perhaps most auspiciously for these institutions, many alumni of the banks held key government positions. With regulatory reform in the pipeline, perhaps a disaster such as this can be avoided in the future. Originally posted here.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.