Zinger Key Points

- U.S. real GDP grew by 1.4% in Q1 2024, up from the 1.3% second estimate.

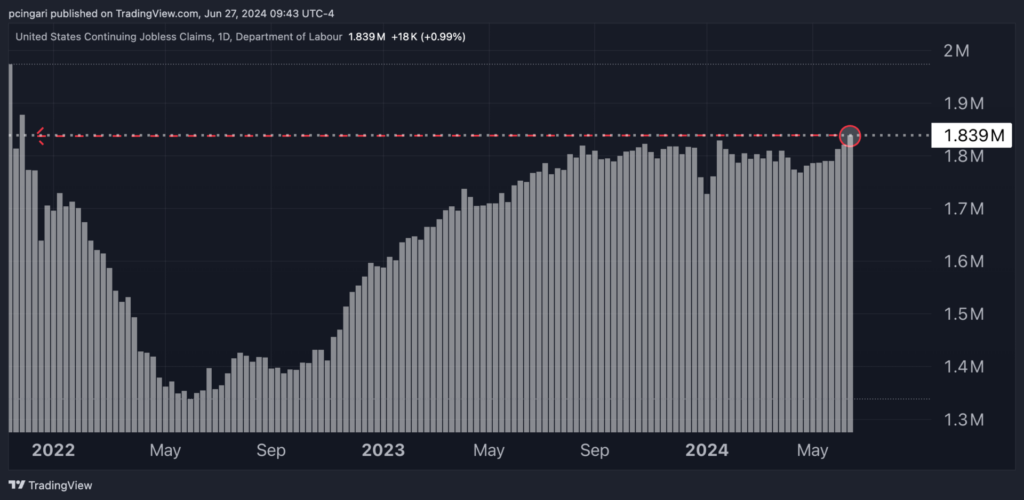

- Continuing claims increased by 18,000 to 1,839,000, the highest since November 2021.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

The U.S. economy saw a modest increase in real gross domestic product (GDP) at an annual rate of 1.4% in the first quarter of 2024, according to the “third” estimate from the Bureau of Economic Analysis (BEA). This outcome represents a slight rise from the 1.3% second estimate but a slowdown from the 3.4% growth in Q4 2023.

The slowdown compared to the Q4 2023 was driven by reduced consumer spending, exports, and government spending.

Compared to the second estimate of Q1 2024, downward revisions in imports and consumer spending were partly offset by upward revisions in nonresidential fixed investment, state and local government spending, exports, federal government spending, private inventory investment, and residential fixed investment.

Inflation, as measured by the price index for gross domestic purchases, rose by 3.1% in the first quarter, up 0.1 percentage point from the previous estimate.

Concurrently, the Labor Department reported a decrease in weekly jobless claims by 6,000 to 233,000 for the week ending June 22, slightly below market expectations of 236,000.

Conversely, the continuing claims rose by 18,000 to 1,839,000 for the week ending June 15, reaching the highest level since November 2021.

Chart: Continuing Unemployment Claims Hit November 2021 Highs

Expert Insights

Jeffrey Roach, chief economist for LPL Financial, highlights the stronger-than-expected residential fixed investment, which grew at an annualized rate of 16% from the previous quarter, contributing approximately 0.6% to the headline GDP growth of 1.4%.

However, he said that the downward revision in consumer spending signals a weakening trajectory for the rest of the year.

“Continuing claims inching higher indicate the labor market could be softening. We expect both consumer and business activity to slow in the latter half of 2024, giving the Fed ample opportunity to begin cutting rates later this year,” Roach commented.

Chris Zaccarelli, chief investment officer for Independent Advisor Alliance, acknowledged the slight upward revision in Q1 GDP to 1.4% as solid, yet indicative of a slowing economic growth.

“The Personal Consumption data shows a slowing in the consumer – down to 1.5% from 2.0% previously – and that is a cause for concern. The cycle that we're in has been led by consumer spending, and if that slows, it could signal the beginning of a downturn in economic activity, which would negatively impact corporate profits and the stock market,” Zaccarelli warned.

“This softness doesn't reach the Fed's bar to justify a rate cut at the July 31 decision, especially since the U.S. economy's return to more normal inflation took a bigger step back in the first quarter than previously understood,” said Bill Adams, chief economist for Comerica Bank.

Adams highlighted that layoffs are expected to result in higher unemployment in next week’s June jobs report, potentially raising the unemployment rate to 4.1% from May’s 4.0%.

Market Reactions

The S&P 500, as tracked by the SPDR S&P 500 ETF Trust SPY, was up 0.2% by 09:45 a.m. ET, while tech stocks, as tracked by the Invesco QQQ Trust QQQ, outperformed up 0.4%.

Top tech gainers were Salesforce Inc. CRM, Adobe Inc. ADBE and Meta Platforms Inc. META, up 2.4%, 1.6% and 1.5% respectively.

CVS Health Corp. CV and Goldman Sachs GS were the laggards within the S&P 500, down 4.4% and 2.6%, respectively, with the latter likely impacted by the Fed’s stress tests results.

Traders are now gearing up for the first presidential debate between President Joe Biden and former President Donald Trump, scheduled at 9 p.m. ET.

Read Next:

Major Banks Fall Short In Fed’s 2024 Stress Test Results: ‘The Market Will View The Results As Disappointing’

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.