Zinger Key Points

- Ongoing rally may loose steam as investors book profit.

- Bullish exposure to S&P 500 Index, highest in three years.

- Markets are messy—but the right setups can still deliver triple-digit gains. Join Matt Maley live this Wednesday at 6 PM ET to see how he’s trading it.

Citigroup Inc. forecasts a blip in the ongoing stock market rally, which has been unfolding since the U.S. presidential elections. As per the strategists at Citigroup, the rally fueled by Donald Trump‘s return to the White House will lose steam as investors start to book profits.

What happened: The markets have been upbeat since last week as the S&P 500 Index hit its 51st record high this year. Citigroup strategists led by Chris Montagu said that the long positions in the technology-heavy Nasdaq 100 Index and the small-cap Russell 2000 reflect "an extremely bullish outlook,” according to a Bloomberg report.

The strategists also added that the bullish investors have pushed the exposure to the S&P 500 Index to the highest level in three years.

Why It Matters: "Profits are elevated for both S&P and Russell and this could lead to near-term profit-taking, which may limit further upside," Chris Montagu, managing director and global head of quantitative research at Citigroup, wrote in a note dated Nov. 11.

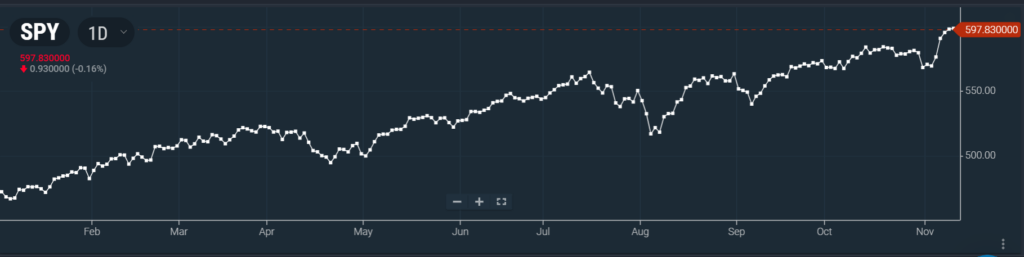

Price Action: The S&P 500 Index closed at 6,008.86 points on Monday, it has yielded 25.82% on a year-to-date basis and 37.84% over the last year. The SPDR S&P 500 ETF SPY which tracks the S&P 500 Index has had a similar momentum in 2024.

On Tuesday morning, the Nasdaq 100 futures dipped by 0.35%, while the S&P 500 futures saw a slight decline of 0.29%. The Dow Jones futures were also down, albeit to a lesser extent, at 0.19%. Meanwhile, the Russell 2000 index (R2K) experienced the largest drop among the indices, falling by 0.80%.

In premarket trading, the SPDR S&P 500 ETF Trust fell 0.23% to $597.41 and the Invesco QQQ ETF QQQ declined 0.28% to $512.40, according to Benzinga Pro data.

Image Via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.