Zinger Key Points

- Shares of Marvell have risen by 75.82% over the last one year.

- Company expects a 26% growth in the topline in fiscal 2025 on an annual basis.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Wealth management companies have loaded up on Marvell Technology Inc.’s MRVL shares in the fourth quarter as it achieved a significant milestone with its new chip. Technical analysis of daily moving averages indicates a strong bullish uptrend.

What Happened: According to the 13F filings, Parisi Gray Wealth Management increased its stake in MRVL by 8,181 shares or 197% with its total investment valued at $1.363 million as of the quarter ended Dec. 31, 2024.

Nordea Investment Management, on the other hand, increased its stake by 14% which represents the addition of 571,005 shares. Its total investment value in the chipmaker stood at $518.435 million.

Graypoint, which just added 894 shares in the fourth quarter, increased its stake by 29%, with its investment value of $443,000.

On the contrary, International Assets Investment Management, which is an affiliate of IAA, offloaded 98% or 236,361 shares in the company. Its current investment value after the transaction stood at $405,000.

While there are many more companies yet to repost their fourth quarter, these firms represent the top trades among the 87 that have already disclosed their 13F filings.

Why It Matters: The semiconductor manufacturer’s new XPU chip with a fresh update accelerates the performance of AI servers. A slew of positive developments within the company has led to strong performance coupled with strong fundamentals and technicals for the semiconductor manufacturer.

Marvell’s CEO Matt Murphy during its third-quarter earnings call said that they expect a 26% growth in the topline in fiscal 2025 on an annual basis.

MRVL was up 0.20% in premarket, whereas it closed at $115.20 apiece on Tuesday, the technical analysis of daily moving averages shows strong support for the stock.

Marvell's shares were above its 20, 50, and 200-day simple moving averages, suggesting a bullish uptrend. The 20-day moving average price was $114.76 apiece, whereas the 50-day average stood at $103.14. The 200-day moving average was at $78.89.

On the other hand, the relative strength index of 55.54 suggested that the stock could be moderately overbought but still in the neutral zone.

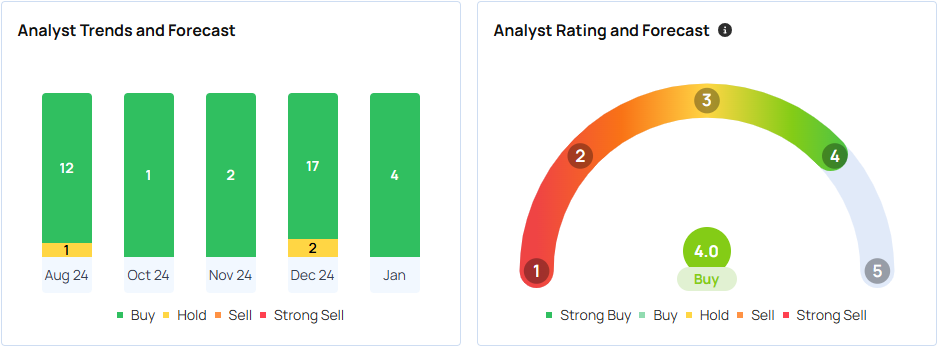

What Are Analysts Saying: According to the analysts tracked by Benzinga, MRVL has a consensus price target of $112.5 based on the ratings of 33 analysts. The highest price target is $149 apiece issued by Craig-Hallum as of Jan. 6, 2025. The lowest target price is $75 per share issued by Barclays on Jan. 16, 2024.

The average price target between Wells Fargo, Goldman Sachs, and Craig-Hallum implies a 21.29% upside for MRVL.

Price Action: Shares of Marvell have risen by 75.82% over the last year, whereas, the Invesco QQQ Trust ETF QQQ which mirrors the Nasdaq 100, rose 23.33% in the same period, according to Benzinga Pro.

Over the last six months, the shares gained 56.52%, outperforming QQQ which just rose 1.80% in the same period.

Read Next:

Photo courtesy: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.