Zinger Key Points

- Walmart was 1.77 times more expensive than its peers.

- Momentum indicators hinted at a potential pullback.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

Walmart Inc. WMT stock is hovering around its 52-week high, up nearly 14% this year, partly due to its recent $34 million acquisition of the Monroeville Mall in Pittsburgh. Despite increased investment positions by many funds in Q4, over-optimistic momentum indicators hint at a likely pullback.

What Happened: The stock surged to a 52-week high of $102.58 apiece in trade on Wednesday before the acquisition announcement on Thursday.

As of Thursday’s close at $102.46 per share, the company’s simple daily moving averages hinted at a bullish uptrend, owing to strength in the stock, according to Benzinga Pro. The share price was much above its 200-day simple moving average of $77.99, and 50-day average of $93.811. It is also higher than its eight-day average of $99.60 and the 20-day average of $95.54.

The momentum indicators were also very strong. While the positive MACD (moving average convergence/divergence) indicator of 2.60 suggested the potential for upward momentum in the near term, the relative strength index of 79.66 showed that the stock was overbought with a pullback or correction is becoming increasingly likely.

Who Bought And Sold Walmart In Q4: While the 13F filings just disclosed the changes for 2,036 holders as of Thursday, more disclosures for the quarter were still expected.

Among those disclosed, Jennison Associates LLC added 6.86 million WMT shares to its portfolio, increasing its stake by 37% with its investment valued at $2.289 billion as of the fourth quarter end. Similarly, Bank of New York Mellon Corporation added 3.927 million shares or 14%, valuing its investment at $2.893 billion by the end of Dec. 31.

| Company | Holdings (as of Sept. 30) | Holdings (as of Dec. 31) | Change (in %) | Value As Of Dec. 31 |

| Bank of New York Mellon Corporation | 28.093 million | 32.020 million | 14% | $2.893 billion |

| Jennison Associate | 18.479 million | 25.339 million | 37% | $2.289 billion |

| Proficio Capital Partners LLC | 84,658 | 1.600 million | 1790% | $8.169 million |

| Allspring Global Investments Holdings | 1.621 million | 1.330 million | -18% | $119.718 million |

| Nordea Investment Management | 3.097 million | 2.517 million | -19% | $227.676 million |

| Abrdn Plc | 1.607 million | 1.484 million | -8% | $133.895 million |

Valuation Picture: Walmart stock was 1.77 times more expensive with a forward price-to-earnings ratio of 37.175 as compared to the industry average of 20.93, according to Benzinga Pro.

However, its rival Costco Wholesale Corp. COST was the most expensive among all its peers with a forward P/E of 57.804, representing a 2.76 times higher valuation as compared to its competitors.

| Stocks | Forward P/E |

| Walmart Inc. WMT | 37.175 |

| Costco Wholesale Corp. COST | 57.804 |

| Target Corp. TGT | 14.225 |

| Dollar General Corp. DG | 12.034 |

| Dollar Tree Inc. DLTR | 11.947 |

Price Action: WMT was up 0.33% in the premarket on Thursday. The stock has risen 13.4% on a year-to-date basis, whereas the exchange-traded fund tracking S&P 500, SPDR S&P 500 ETF Trust SPY advanced 3.35% in the same period. Over the last year, WMT rose by 81.02% and SPY was up 22.32%.

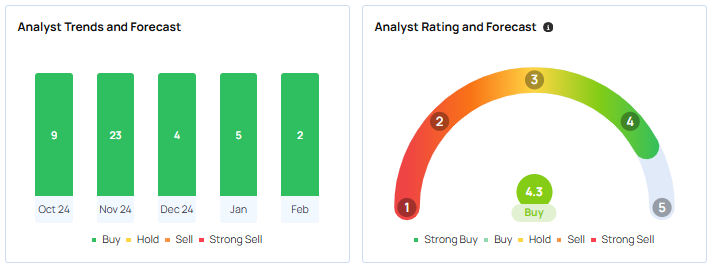

The average price target among 31 analysts tracked by Benzinga is $96.58 with a ‘buy' rating. The estimates range from $70 to $115 apiece. Recent ratings from Oppenheimer, Wells Fargo, and UBS suggest a $110.33 target, implying a potential upside of 7.19%.

Read Next:

Photo courtesy: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.