After Palo Alto Networks Inc.’s PANW management expressed its opinions about being open to using more affordable, open-source artificial intelligence models, this analyst has warned that the demand for AI hardware could be a larger problem going ahead.

What Happened: Palo Alto’s CEO, Nikesh Arora, hinted at adopting a pragmatic approach to AI spending, prioritizing cost-effectiveness and utilizing resources efficiently.

According to Dan Niles, the founder and portfolio manager of Niles Investment Management, over the weekend, Arora told the Information that "For the tasks where we're getting efficiencies and driving lower costs, I don't think the model's IQ needs to be much higher than it already is…and I don't want to pay a dollar for that. I'd rather pay five cents.”

This led Niles to express concerns about future AI-related hardware demand, which implies chipmakers. According to him, if major companies like Palo Alto Networks are reducing their projected AI spending, this could have a large effect on the companies that produce the hardware required to run AI.

“The AI digestion phase may be a larger problem than I am anticipating for hardware demand,” said Niles.

According to the financial disclosures filed on Jan. 17, former House Speaker Nancy Pelosi (D-Calif.) exercised 140 call options of Palo Alto on Dec. 20, 2024. She owns 14,000 shares worth $1 million to $5 million as of the last disclosure.

PANW CEO Arora later clarified in an X post that the company’s approach suggests a move towards task-specific AI spending, where they allocate resources based on the specific requirements of each task.

He explained, they are not committed to a ‘one-size-fits-all’ approach to AI, but rather a more targeted and economical one.

Why It Matters: Niles said that capital expenditure on AI was a larger problem than he anticipated because in a post dated March 31, he had said, "AI capex spending by mid-year will be going through a digestion phase due to a slowdown in training demand.”

"Longer-term, I still believe AI capex spending is likely to double by the end of the decade from current levels driven by inference demand,” he added.

This also follows Alibaba Group Holding Ltd. ADR BABA chairman, Jack Ma‘s March 25 statement on AI spending, where he said that pouring a lot of money ahead of significant demand wasn't "entirely necessary".

Price Action: Shares of PANW declined 1.23% on Tuesday and fell further by 0.44% in after-hours. Invesco QQQ Trust, Series 1 QQQ, tracking the Nasdaq 100 index, slipped 0.004% to $468.92 during the same session.

PANW has fallen 5.59% on a year-to-date basis, whereas it was up 22.14% over a year.

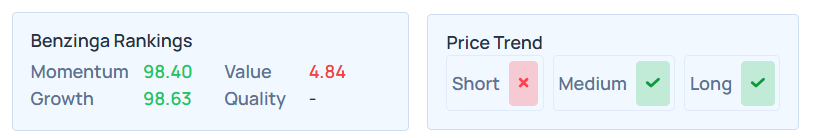

Benzinga Edge Stock Rankings shows that PANW’s price trend is strong over the medium and the long term, whereas the short-term trend was weak. It has a sturdy momentum ranking at the 98.40th percentile. To know more about its fundamentals and valuation, you could check the other rankings with greater detail over here.

Its consensus price target was $321.4, with a ‘buy' rating, based on the 41 analysts tracked by Benzinga. The price targets ranged from a low of $130 to a high of $450. The latest ratings from Jefferies, Truist Securities, and Rosenblatt averaged $218.33, implying a 28.51% upside.

Read Next:

Photo courtesy: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.