Zinger Key Points

- The Benzinga Stock Whisper Index looks at five stocks seeing increased interest from readers during the week.

- Several stocks on the list could be impacted by the incoming White House administration led by Donald Trump in January.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get Matt’s next trade alert free.

Each week, Benzinga's Stock Whisper Index uses a combination of proprietary data and pattern recognition to showcase five stocks that are just under the surface and deserve attention.

Investors are constantly on the hunt for undervalued, under-followed and emerging stocks. With countless methods available to retail traders, the challenge often lies in sifting through the abundance of information to uncover new opportunities and understand why certain stocks should be of interest.

Here’s a look at the Benzinga Stock Whisper Index for the week ending Dec. 13:

Snap Inc SNAP: The social media and messaging company saw strong interest from Benzinga readers during the week, which is likely related to the continued fight to ban TikTok in the U.S.

Snap and TikTok social media rivals such as Facebook, Instagram and Reddit could benefit if the app is banned. TikTok lost a fight with the U.S. appeals court recently with parent company ByteDance facing a deadline of Jan. 19, 2025, to sell the U.S. arm to a non-Chinese owner or face app stores removing the platform in America.

While this could be good news for Snap, the ban is far from over with ByteDance continuing to fight and also concerns that President-elect Donald Trump could halt the ban when he takes over the White House. Snap and other social media platforms are also being targeted in several countries and states over age restrictions on usage of the platforms, which could push the stock down further.

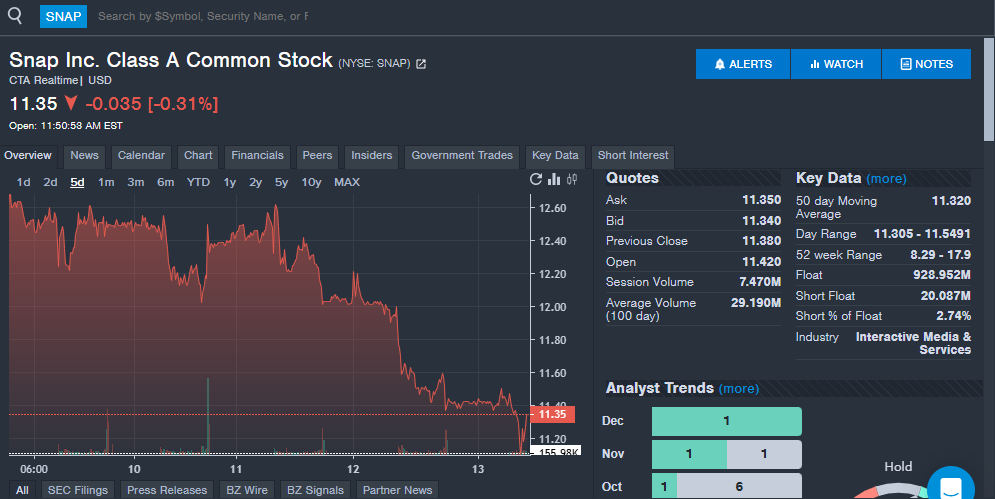

Snap stock was down on the week, as shown on the Benzinga Pro chart below. The stock is down 30% year-to-date in 2024.

SEALSQ Corp LAES: The microchip company saw shares surge on several news items related to drones. The company announced partnerships with leading drone manufacturers Parrot and AgEagle.

The company plans to launch its new Quantum-Resistant Secure Chips portfolio in 2025, which could keep the stock on the radar of Benzinga readers. Testing for these chips is underway. SEALSQ also announced a partnership with IC'ALPS to accelerate the development of secure Application Specific Integrated Circuits.

"By combining agility with innovation, we are setting a benchmark for excellence in the competitive global semiconductor industry," SEALSQ CTO Jean Pierre Enguent said.

The drone market has been hot with investors looking for the company's that could benefit from the increase in commercial and military drone applications. Shares of the company surged over 200% on the week.

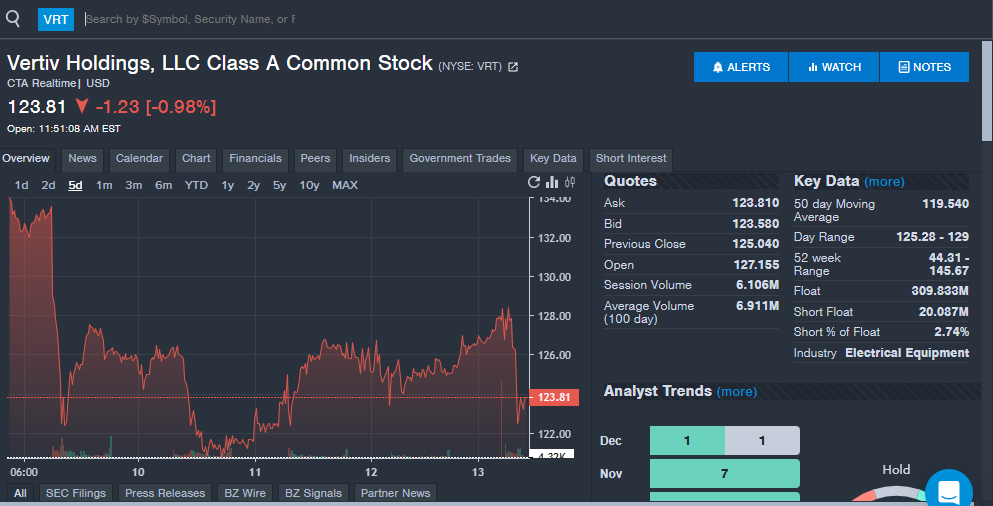

Vertiv Holdings VRT: The critical power and infrastructure company saw strong interest from readers during the week.

Bank of America analyst Andrew Obin recently reiterated a Buy rating with a price target of $150 on the stock. The analyst said the company revised its organic revenue growth forecast to 12%-14% CAGR for 2024 to 2029, up from prior guidance of 8%-11%. Other analysts have added their takes on the company recently with Barclays initiating shares with an Equal-Weight rating and $142 price target and Citigroup maintaining a Buy rating and raising the price target from $141 to $155.

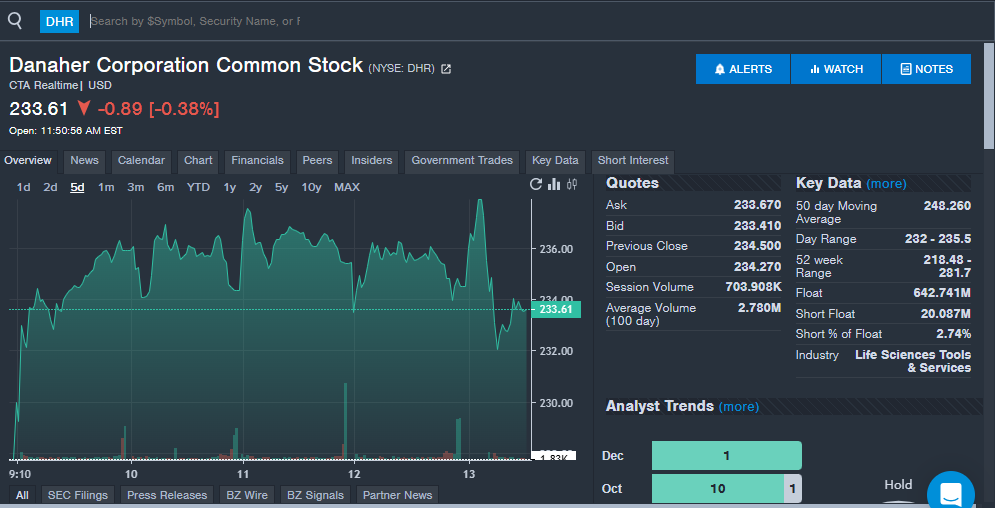

Danaher Corporation DHR: The scientific instrument manufacturing company saw increased interest from readers during the week.

The stock, which previously was featured on the Stock Whisper Index in June, saw an analyst upgrade send shares higher on the week. Bank of America upgraded shares from Neutral to Buy with a price target of $290. The analyst said strategic partnerships and pricing could help drive future growth.

Danaher reported third-quarter financial results in October with earnings per share and revenue each beating Street forecasts. The company has beaten analyst estimates in more than 10 straight quarters for both revenue and earnings per share. Fourth-quarter earnings are estimated to be in January, which could be a future catalyst for the stock.

Marvell Technology MRVL: The semiconductor stock is trading higher on the week, which comes with peers reporting results and less than two weeks after the company reported third-quarter financial results on Dec. 3. The company beat analyst estimates for both revenue and earnings per share.

Marvell CEO Matt Murphy highlighted the company's forecast for the fourth quarter, which is driven by custom AI silicon programs that are in volume production. The company recently announced the availability for new chips in its interconnect portfolio, which comes as AI-driven data centers could boost the need for optimizing interconnect solutions.

Several analysts raised their price targets on the stock after the company's third-quarter financial results. Shares are up over 100% year-to-date in 2024.

Stay tuned for next week's report, and follow Benzinga Pro for all the latest headlines and top market-moving stories here.

Read the latest Stock Whisper Index reports here:

Read Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.