The following post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga.

With the development of China's economy, more Chinese citizens can count on a level of disposable income that has changed their consumption habits. As a result, pets have begun to play a more important role in Chinese families, becoming indispensable members of the empty nest that elderly and young people experience. In recent years, the number of pets and the scale of the pet market in China have increased rapidly.

Status of the Chinese Pet Market

In 2020, the Chinese pet market totaled$46.3 billion, a significant increase from $11.24 billion in 2015. The annual compound growth rate (CAGR) from 2015 to 2020 was 32.74%. In the same period, the CAGR of the global pet market was 8.74%. The global pet market has gradually matured and maintained a low growth rate, while the Chinese pet market is in a high-speed development stage with a lot of space for growth in the future.

(Data source: IResearch consulting)

Among all pet types, cats and dogs account for the vast majority of Chinese pets. In 2020, dogs made up 51% of the pet population, and cats accounted for 46%, followed by fish, reptiles, rodents and birds. The majority of pet owners in China are young people born after 1985 and 1995, who together account for more than 40% of pet owners. The dominance of these groups results primarily from their economic strength. This age group represents the largest proportion of people living alone, so it is easier for them to afford a pet.

(Data source: <White Paper on China's Pet Industry in 2020>)

With China’s nationwide pet market growth, the entire pet consumption industry has expanded, including pet food, pet medical necessities, pet supplies and pet services. Among them, the pet food market is the largest segmented consumer market, which accounted for about 37% of consumption in 2020. Products to meet the daily needs of pets accounted for about 20% of the market, and health care supplies reached 14%. Pet medical services made up 9%, and pet services such as grooming, bathing, training, foster care and other pet services accounted for 20% of the total proportion.

(Data source: white paper on pet industry published by goumin.com)

The pet food market has the highest proportion of demand. Chinese pet food sales are dominated by overseas brands, but the competition of domestic brands is fierce. According to JD Big Data and IResearch Consulting, in 2020 the market share of the Chinese pet food company Jingdong Pets was 57.8%, of which the share of overseas brands accounted for 42.9%. The first and second places in sales were Royal Canin and Orijen respectively.

Among the top 10 Chinese pet food brands, the domestic brands of Mcfadi, Bernard Tianchun and Bridge hold the lion’s share of sales at 6.1%, 5.3% and 3.5% respectively. The share is relatively small, however, with competition from many other domestic brands in China. The potential of these competitors cannot be ignored.

(Data source: JD big data, IResearch consulting)

Driving Factors for the Chinese Pet Market

Economic

From 2015 to 2020, Chinese per capita disposable income increased from $3,406 to $4,990, with a compound growth rate of 7.94%. The per capita consumption expenditure increased from $2,435 to $3,288, with a CAGR of 6.18%. The increase of income enhanced the consumption confidence of residents, thus increasing the demand for pet services.

(Data source: National Bureau of Statistics)

Population Structure

The change in the Chinese population structure drives growth in the Chinese pet industry. According to the National Bureau of Statistics, China's sizeable population of people over age 65 shows an upward trend, from 144.76 million in 2015 to 190.59 million in 2020, with a CAGR of 5.66%, while the CAGR of China's total population in the same period was 0.41%. The growth rate of the elderly population is much higher than that of the total population, and the proportion of the elderly population also increased from 10.47% in 2015 to 13.50% in 2020. China's rapidly aging population is likely to increase the demand for pet companionship.

(Data source: National Bureau of Statistics)

Increased Pet Population

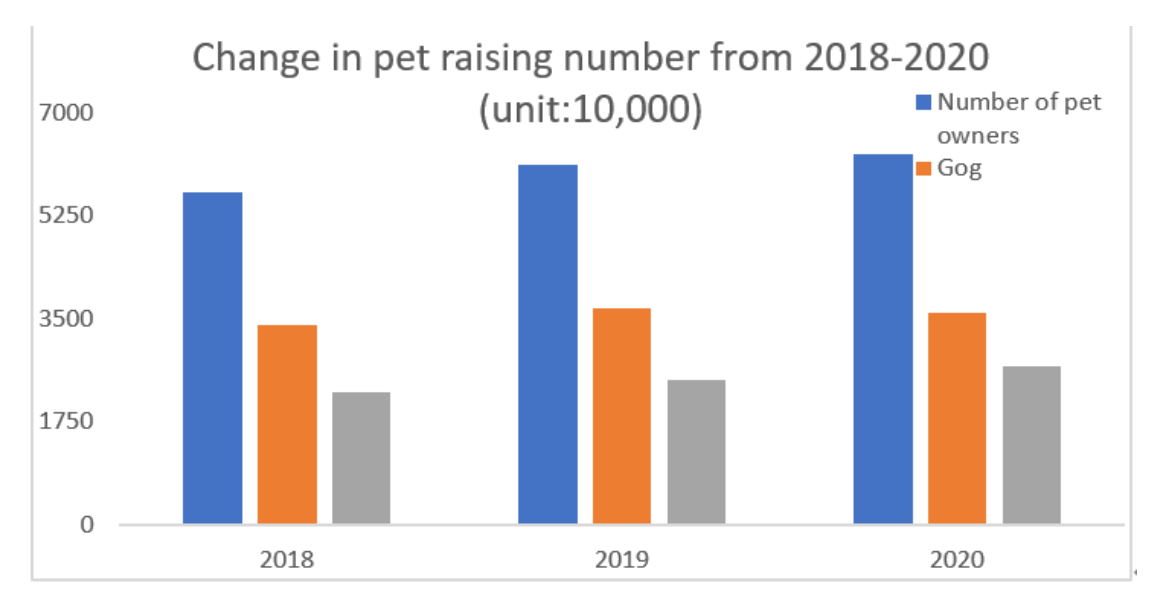

The continuous expansion in the pet population and the interest in breeding pets have broadened and commercialized Chinese pet ownership. Most Chinese pet owners prefer dogs and cats for pets. In 2020, the number of dog and cat pet owners in China reached 62.94 million, including 35.93 million dog owners and 27.01 million cat owners. In 2020, the number of dogs and cats in populated areas exceeded 100 million. With the increase of the pet population, the demand for pets will continue to increase, and pet services will continue to be refined and innovated as a result of this demand.

(Data source: Goumin.com <Pet Industry White Paper>)

The Emergence of Outstanding Companies in China's Pet Market

In recent years, with the rapid development of China’s pet market, a number of highly competitive local companies have also emerged such as Boqi Pet BQ, E-Pet Mall, LePet.com, Dogmin.com and Wenwen. Among them, Boqi Pet has become the leader in China's pet industry with its unique ecosystem and leading business model.

Boqi Pet is the largest pet ecological platform in China. It has built an ecological platform of community + omni-channel sales network (e-commerce + online distribution) + own brand + membership service + upstream and downstream investment in the industrial chain. Among these offerings, the vertical online retail platform of Porch Pet is the largest pet e-commerce platform in China. Its self-operated Boqi Mall cooperates with hundreds of domestic and foreign brands and is committed to providing pet owners with a "one-stop integrated pet service platform."

E-pet mall is also a representative B2C pet e-commerce platform in China. It has successively cooperated with well-known pet brands at home and abroad to provide pet products to Chinese pet families. It is an e-commerce platform in the pet industry with self-supporting logistics and storage systems.

LePet.com is a comprehensive platform that integrates pet online-to-offline (O2O) services in communities and shopping malls in China. Its subsidiaries include Grace Pet Products, Beijing Boai Animal Hospital and PetChina.com, relying on the "chain store + e-commerce" business model to gain market recognition.

Overall, in recent years, China's economy has developed rapidly. The change in population structure and the growth of the pet owner base have become the main factors driving the rapid growth of China's pet market. Although China's pet market has doubled in the past decade, the relatively low rate of pet ownership in China shows great growth potential.

Although China's pet food market is dominated by imported brands, the rise of domestic goods and the emergence of pet supply enterprises in China are bound to break the current situation of the market. With the improvement of the quality of domestic products and the strong demand for pet care, domestic brands will usher in more development opportunities. China's pet market has a bright future.

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. This content is for informational purposes only and not intended to be investing advice.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.