This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

AT-A-GLANCE

- Federal funds futures markets suggest there may be several quarter percentage point short-term interest rate increases in 2022

- The only time the Federal Reserve was both raising rates and shrinking its balance sheet was in 2018, but inflation pressure could create a different environment this year

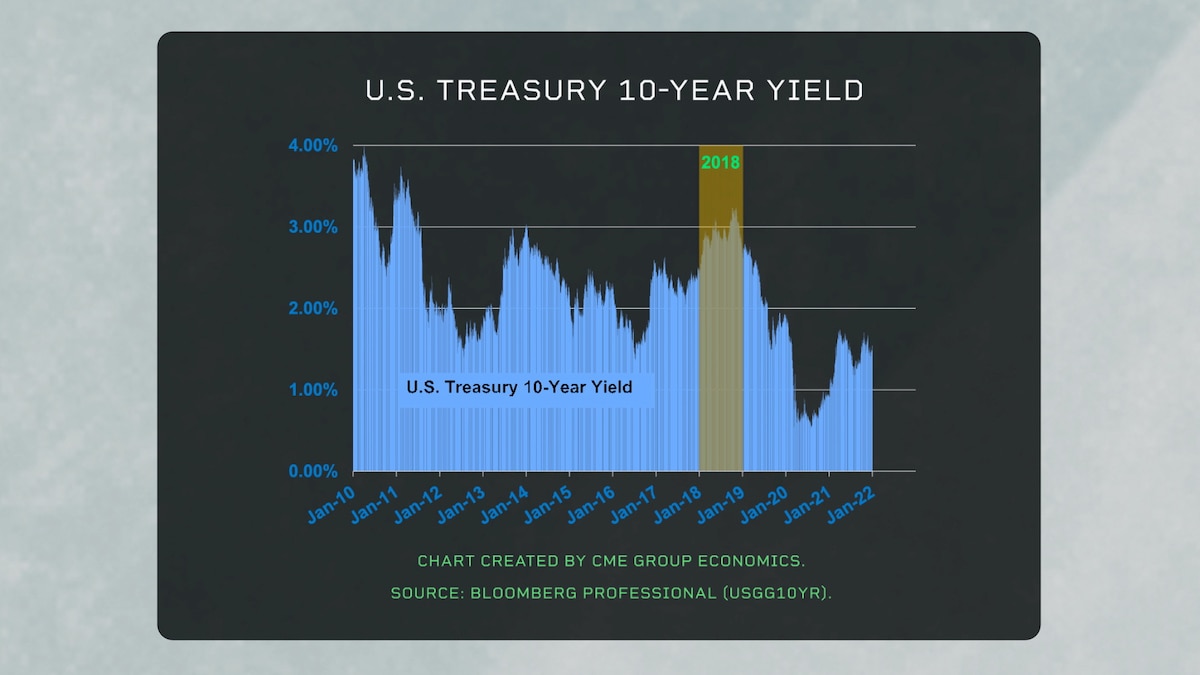

For the year 2022, a mix of inflation, the possibility of rising short-term rates, and Federal Reserve debates about whether to shrink its balance sheet signals what could be a volatile year for U.S. Treasuries.

The Fed effectively only uses two policy tools: (1) raising or lowering short-term interest rates, and (2) whether to grow or shrink its asset holdings.

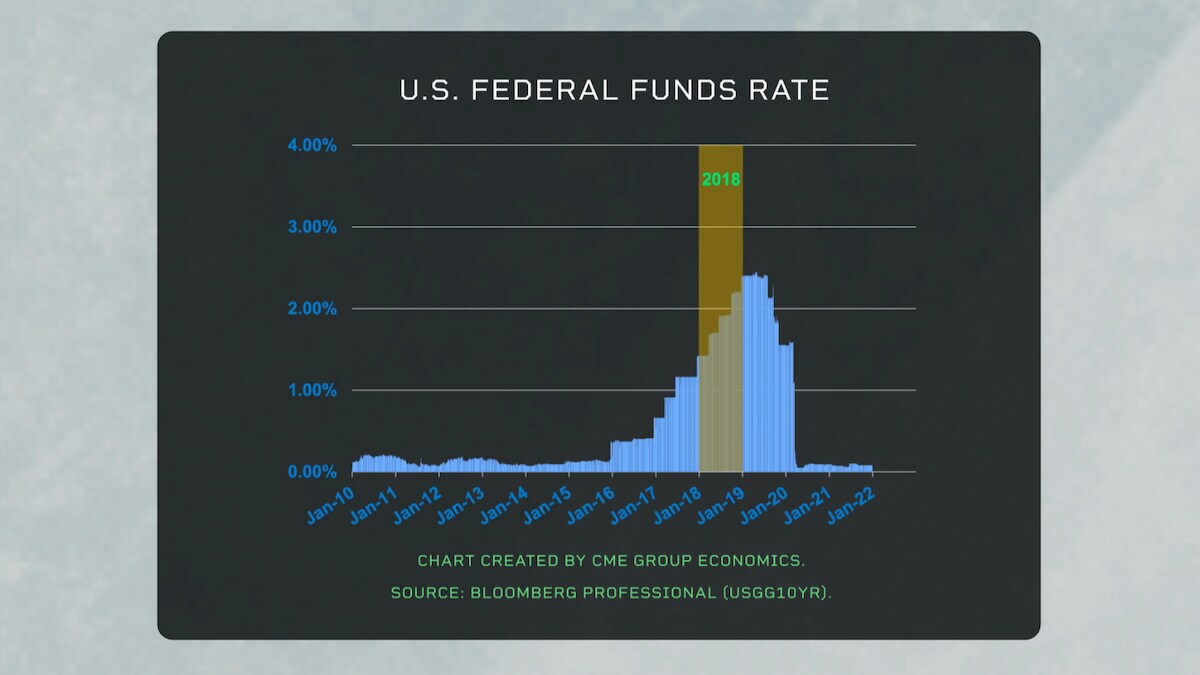

In late 2021, the Fed started to withdraw from asset purchases with the objective of stabilizing the overall size of Fed’s balance sheet by the spring of 2022. After that task is complete, the Fed has said it will consider raising short-term rates toward a more neutral policy stance. Federal funds futures markets suggest that there may be several quarter percentage point short-term interest rate increases during the year.

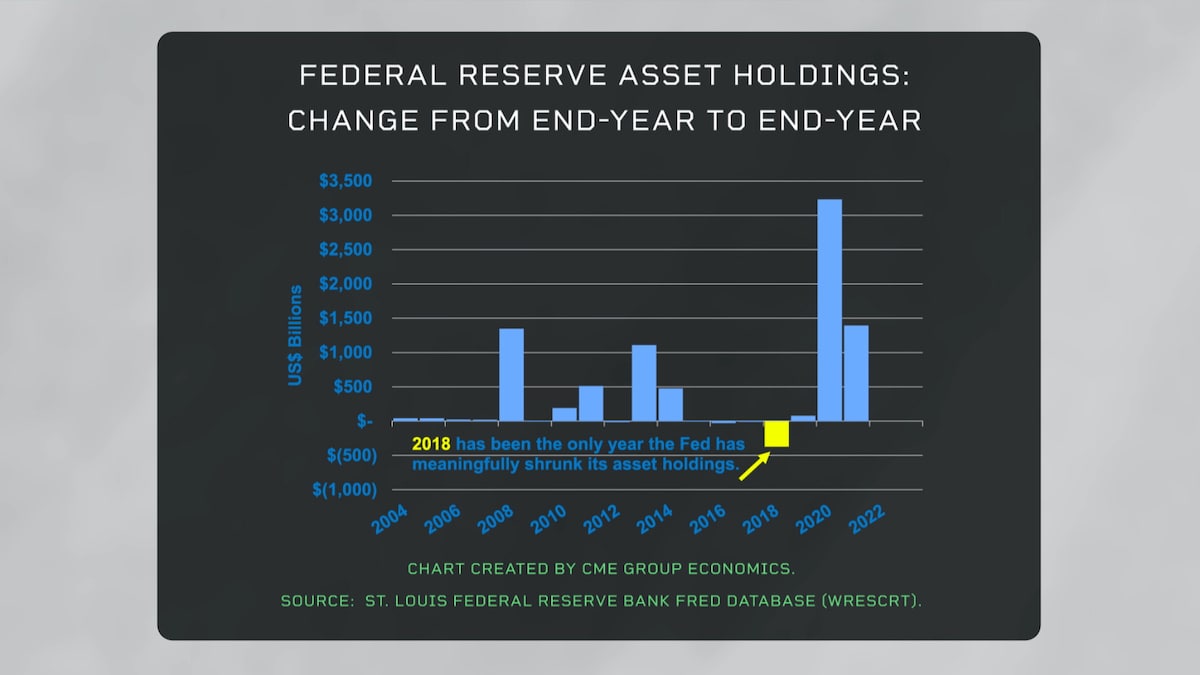

That leaves open the question of whether the Fed will take a further decision to shrink its asset holdings, by allowing maturing securities to run-off and not be replaced, as well as not re-investing any coupon or interest payments the Fed receives. This question of whether to shrink the Fed’s balance sheet is likely to be seriously debated in 2022.

What does this mean for U.S. Treasury yields? The only time the Fed was both raising rates and shrinking its balance sheet was in 2018.

There was no inflation pressure then, but, as in 2022, Fed was trying to get back to a more neutral policy. U.S. Treasury yields rose during most of the year 2018. This time around, we have inflation pressures, too.

The bottom line: the mix of inflation, the possibility of rising short-term rates, and Fed debating whether to shrink its balance sheet signals what could be a volatile year for U.S. Treasuries.

Image provided by CME Group

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.