Stocks ticked higher last week, with the S&P 500 rising 0.5% to close at 4,308.50. The index is now up 12.2% year to date, up 20.4% from its October 12 closing low of 3,577.03, and down 10.2% from its January 3, 2022 record closing high of 4,796.56.

As we discussed here last week, there continues to be a deluge of unsettling headlines about everything ranging from volatile energy prices to ongoing government dysfunction to uncertainty about the path for monetary policy.

Yet critical economic metrics like personal consumption expenditures and job creation continue to be very healthy.

What’s going on?

Much of the resilience in the economy can be explained by the strength of business and consumer finances, even despite rapidly rising interest rates.

While rising interest rates are usually considered a headwind, there’s some counterintuitive nuance to the narrative.

First, many companies refinanced much of their debt over the past three years, locking in very low interest rates. So as market interest rates have risen, the effective interest rate corporations are paying today remains low.

Similarly, the vast majority of outstanding mortgages have a locked-in rate that’s lower than the current market rate. So for many consumers, the financing cost of their largest liability has been unchanged.

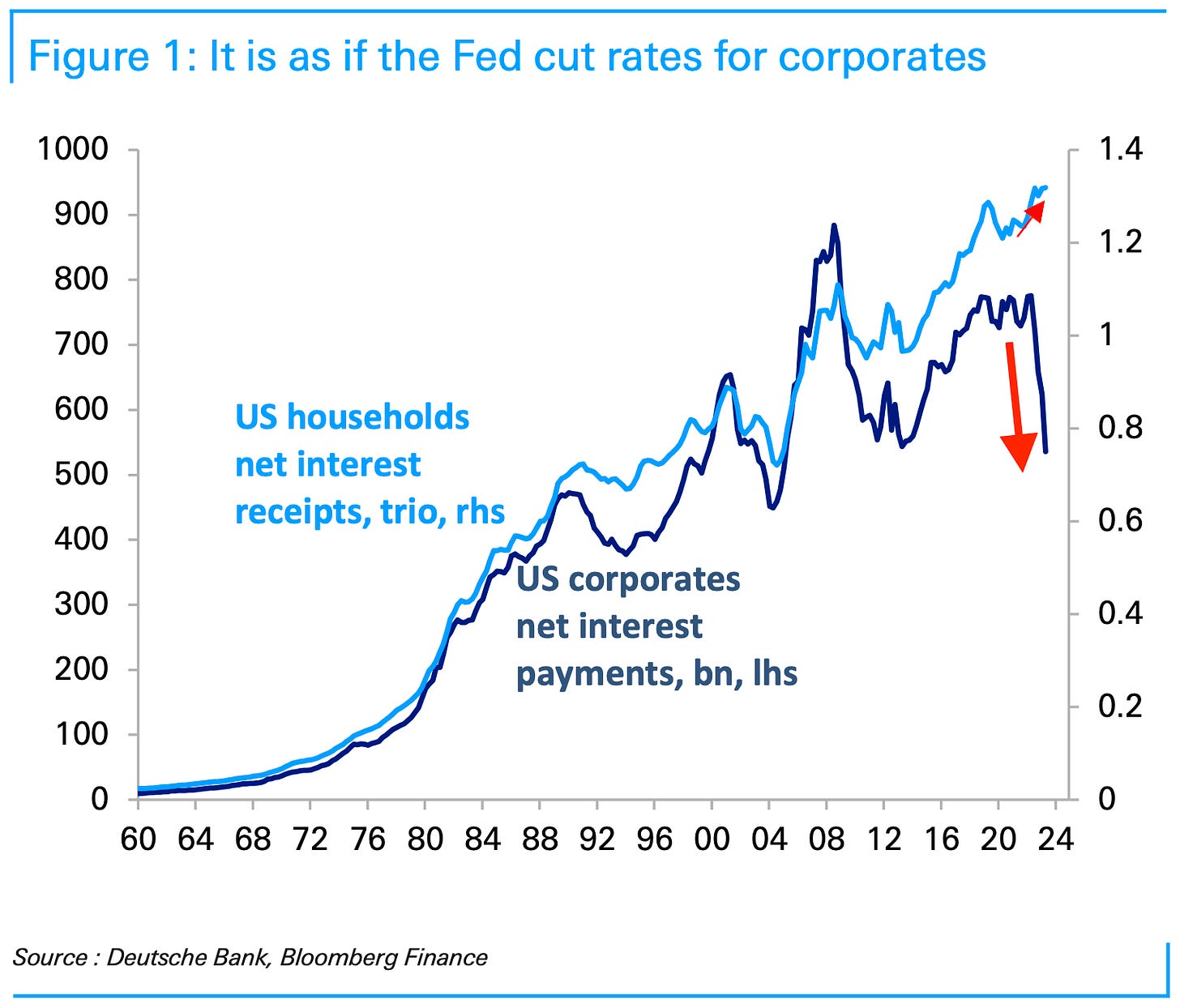

Second, many companies and consumers have quite a bit of cash. And higher interest rates means they’re earning more interest income. From Deutsche Bank’s George Saravelos on Monday:

“… It is effectively as if the Fed cut rates. Why? Because corporates took advantage of QE to term out borrowing at record-low rates and are now earning 5%+ interest on their cash. A similar dynamic can be seen with households: US aggregate household net interest receipts are still where they were before this hiking cycle started as the interest earned on cash has matched payments on borrowings.“

It’s counterintuitive but as Saravelos’ chart shows, the net interest corporations have been paying has actually declined as interest rates have risen thanks to the higher interest income.

Corporate net interest payments have declined as companies have earned more interest on their cash. (Source: Deutsche Bank)

To be clear, there are still businesses and consumers who are actively borrowing today at interest rates that are much higher than they were years ago.

And should today’s elevated rates persist, over time more borrowers could find themselves facing more onerous debt costs as they refinance at higher rates.

Of course, it’s also possible that interest rates come down. After all, there’s little about the future that is certain.

The bottom line: Rising interest rates are currently having a limited negative impact on businesses and consumers as a whole. For many, it’s actually been a net positive.

A Quick Note About Excess Savings

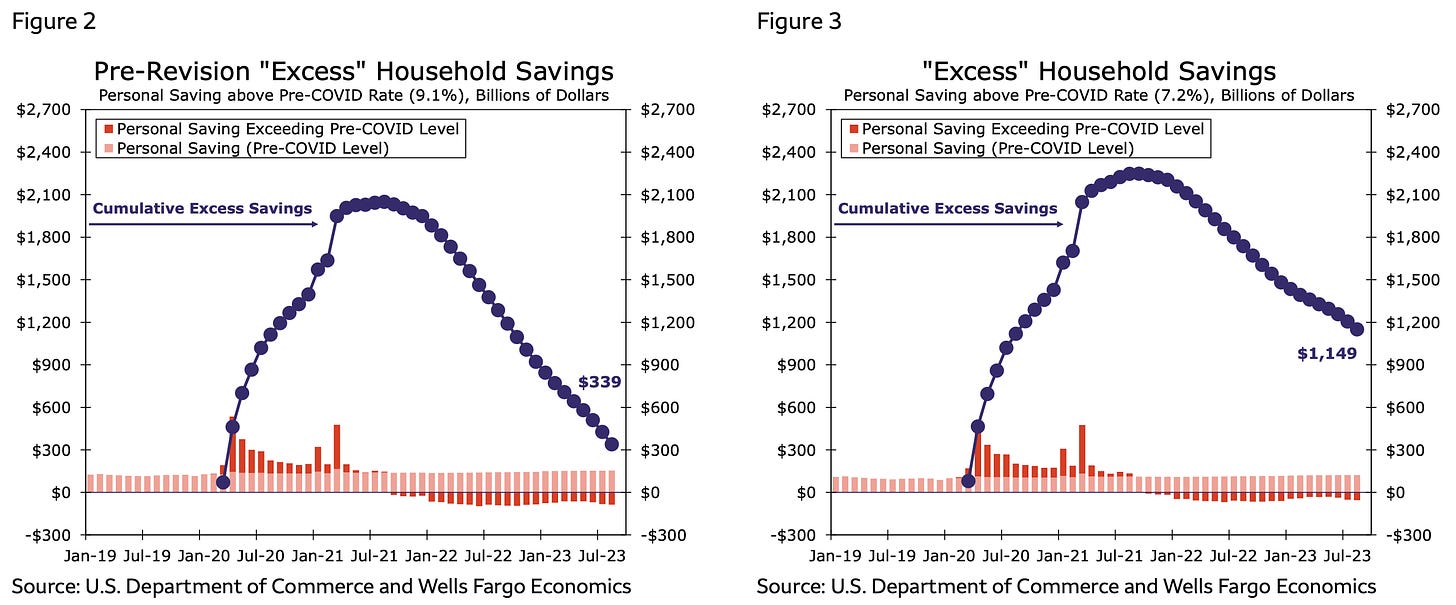

Excess savings — the extra cash that consumers piled up since February 2020, thanks to a combination of government financial support and limited spending options during the pandemic — has been a key driver of the economic recovery.

But as time has passed and these savings have been drawn down, the concept of excess savings has become less relevant. (Also, more comprehensive measures of household finances suggest cash levels are very high.)

Having said all that, new government data suggests these excess savings balances have actually been much higher than previously estimated. From Wells Fargo (emphasis added):

The benchmark revisions to the National Accounts last week caused some pretty big changes to our measure of excess savings again. Essentially, the data now suggest there is $1.1T remaining in excess savings through August, whereas the previous data suggested only about $339B remaining through July. This all comes down to our pre-pandemic baseline shifting from a 9.1% saving rate in January 2020 down to 7.2%. Since our baseline of comparison is now lower, the excess today looks higher because we are not as far from that base as we were. We have thus “spent it down” at a slower rate. The data now suggest there is more than three times the amount the pre-revised data suggested (~$340B) through July.

Old estimates are reflected on the left. New ones are on the right. (Source: Wells Fargo)

The Wells Fargo economists also argue that “it is not sensible to hang your hat on an estimate subject to such comically large revisions.“ They also point to the more comprehensive measures of checking and savings balances, noting the readings are “clearer and suggests households still have excess liquidity.”

Nevertheless, the idea that there continues to be a lot of excess savings helps us understand why consumer spending continues to be so resilient.

A version of this post was originally published on Tker.co

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.