Zinger Key Points

- Applied Materials received another U.S. Commerce Department subpoena in May for information on China shipments.

- The company is under criminal investigation for potentially evading export restrictions on China’s SMIC.

- Get 5 stock picks identified before their biggest breakouts, identified by the same system that spotted Insmed, Sprouts, and Uber before their 20%+ gains.

The U.S.-China geopolitical tensions gained traction, with Applied Materials Inc AMAT receiving another subpoena from the U.S. Department of Commerce in May seeking more information on China shipments.

The Taiwan Semiconductor Manufacturing Co TSM supplier received an SEC subpoena and two from the U.S. Attorney’s Office for the District of Massachusetts, Reuters reports.

In November 2023, the Commerce Department sent a subpoena seeking information relating to specific China customer shipments.

Applied Materials is under U.S. criminal investigation for potentially evading export restrictions on China’s top chipmaker, Semiconductor Manufacturing International Corporation (SMIC), Reuters cited familiar sources in November.

According to reports, China accounted for 43% of Applied Materials’ second-quarter revenue.

The Justice Department is investigating Applied Materials for shipping hundreds of millions of dollars worth of equipment to SMIC via South Korea without export licenses.

Some Analysts recently hailed Applied Materials as a long-term share gainer, citing the recovery in the Logic/Foundry and DRAM markets, which is backed by the data center market. TSMC just projected a 10% annual revenue growth in the global semiconductor industry, excluding memory chips. It is expected that second-quarter sales will grow by up to 30%.

Applied Materials’ second-quarter revenue was $6.646 billion, flat year over year, beating the analyst consensus of $6.537 billion. The company reported adjusted EPS of $2.09, beating analyst consensus of $1.99.

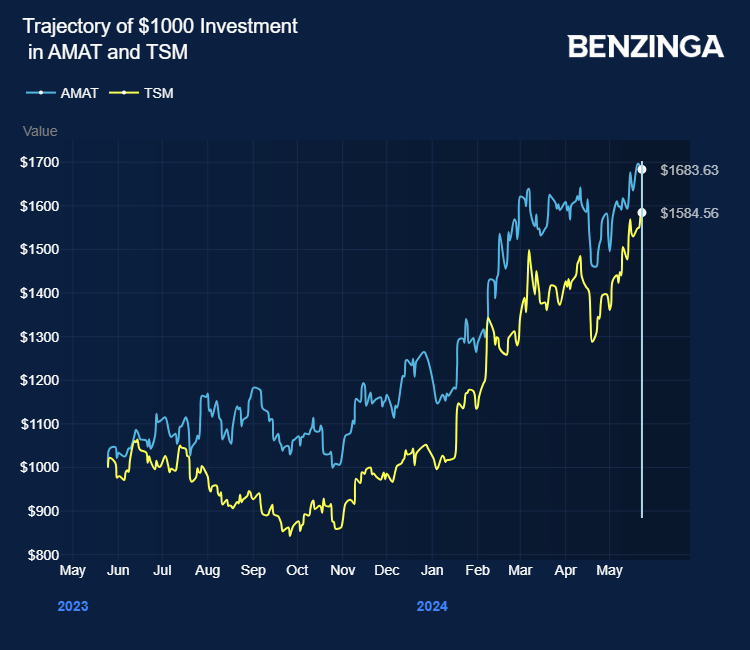

Applied Materials stock gained over 79% in the last 12 months. Investors can gain exposure to the stock via First Trust Nasdaq Semiconductor ETF FTXL and Pacer BlueStar Engineering The Future ETF BULD.

Price Action: AMAT shares were trading higher by 0.45% at $218.93 premarket at the last check on Friday.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.