Zinger Key Points

- CBO projects federal deficit rising to $1.9 trillion (6.7% of GDP) for fiscal-year 2024, up from $1.5 trillion (5.4% of GDP).

- Escalating interest costs to surpass defense spending, with budget deficits at or above 5.5% of GDP through 2034.

The Congressional Budget Office (CBO) is once again sounding the alarm on the rising federal deficit, highlighting a growing financial strain for the U.S. government.

Escalating interest costs are set to outpace defense spending for the first time. This trend is expected to keep budget deficits at or above 5.5% of GDP through 2034.

In CBO’s latest June projections revealed Tuesday:

- The federal deficit is expected to rise to $1.9 trillion (6.7% of GDP) for fiscal-year 2024

- This marks a solid increase from its February estimate of $1.5 trillion (5.4% of GDP).

- The updated deficit projection of $1.9 trillion for 2024 is also a significant jump from the $1.7 trillion deficit recorded last fiscal year; it represents 6.3% of GDP.

- The deficit is expected to climb to $2.9 trillion by 2034, $300 billion more than the previous baseline.

- By the end of 2034, the CBO projects that debt held by the public will total $50.7 trillion — $2.4 trillion more than previously estimated.

- This will equal 122% of GDP, up from the February projection of 116% of GDP.

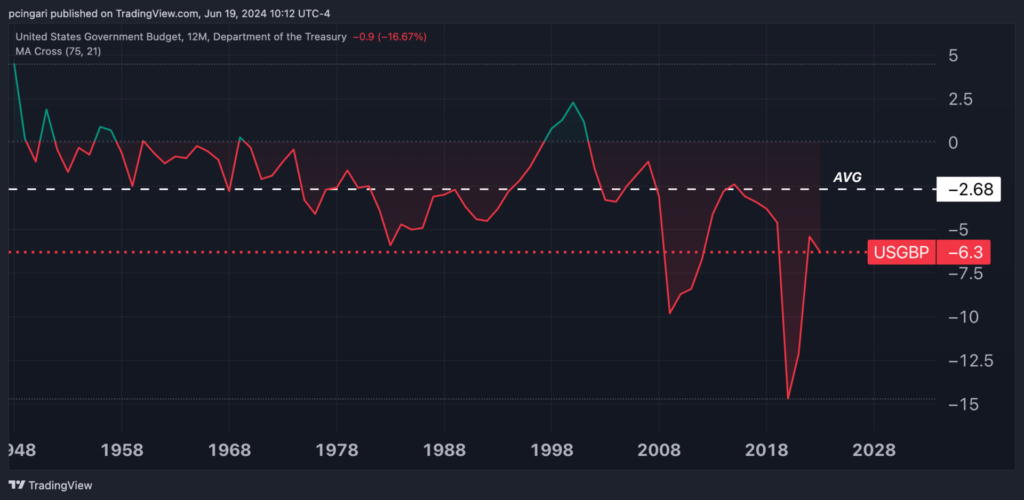

Chart: US Budget Deficits Runs Way Wider Than Its Post-War Average

A May CBO report estimated that extending provisions of former President Donald Trump's Tax Cuts and Jobs Act would increase deficits by nearly $5 trillion into 2034.

According to current White House spokeswoman Karine Jean-Pierre, the report exemplifies “the need for Congress to pass President [Joe] Biden's Budget to reduce the deficit by $3 trillion — instead of blowing up the debt with $5 trillion of more Trump tax cuts."

Persistent High Deficits

Measured as a percentage of the economy, the CBO’s projections indicate that total deficits will equal or exceed 5.5% of GDP every year from 2024 to 2034.

“Since at least 1930, deficits have not remained that large for more than five years in a row. Over the past 50 years, the total annual deficit has averaged 3.7% of GDP,” the CBO wrote.

Rising Interest Costs

The main driver behind these sizable deficits is the escalating interest cost on the federal debt.

The CBO projects net interest outlays will increase from 3.1% of GDP this year to 4.1% by 2034, totaling $12.9 trillion over the 2025–2034 period. For 2024 alone, net interest outlays are expected to reach $892 billion, surpassing discretionary outlays for defense.

By 2034, these interest costs are expected to climb to $1.7 trillion. This shift marks a significant milestone, as interest payments on the national debt are poised to become the largest expenditure item in the federal budget.

“Beginning in 2025, interest costs are greater in relation to GDP than at any point since at least 1940 (the first year for which the Office of Management and Budget reports such data) and exceed outlays for defense and outlays for nondefense programs and activities,” the nonpartisan federal agency wrote.

Spending And Revenue Trends

Primary deficits, which exclude net interest outlays, are projected to amount to 3.9% of GDP in 2024. They are expected to decline to 2.1% in 2027 and 2028 before increasing again to 2.7% by 2034. Over the next decade, primary deficits are anticipated to average 2.5% of GDP—a level rarely seen in historical records.

This signifies that the federal government will continue to spend more than it earns, even when interest payments are excluded.

Federal outlays are forecasted to rise significantly, from $6.9 trillion in 2024 to $10.3 trillion in 2034. More than half of this increase will be driven by Social Security and Medicare costs.

By 2034, expenditures for Social Security, major healthcare programs, and interest are expected to account for 68% of total federal spending.

On the revenue side, federal income is projected to grow from $4.9 trillion in 2024 to $7.5 trillion in 2034. Despite this revenue growth, rising costs, particularly for interest payments and entitlement programs, are expected to keep the federal budget under considerable pressure.

The Economist Take

“While the Fed may be done, Treasury is not!” said John Lynch, chief investment officer for Comerica Wealth Management.

The expert highlighted that federal interest costs have skyrocketed to approximately 17% of U.S. tax receipts, a level historically linked “with bond market vigilantes demanding austerity measures via higher market interest rates.”

Lynch believes that bond investors are exposed to heightened volatility as the benchmark 10-year Treasury note, as tracked by the US Treasury 10 Year Note ETF UTEN, “could break either way, depending on fears of inflation/deficit spending, or geopolitics/ economic slowdown.”

Check Out: Goldman Sachs Reaffirms September Rate Cut Forecast, Downplays Fed’s ‘Hawkish Surprise’

Image: Flickr

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.