Zinger Key Points

- U.S. semiconductor sanctions and Trump's remarks on TSMC hit chip stocks, including Nvidia and AMD.

- Trump's demand for TSMC to compensate U.S. defense intensifies market jitters, driving chip sector decline.

- Next: Access Our New, Shockingly Simple 'Alert System'

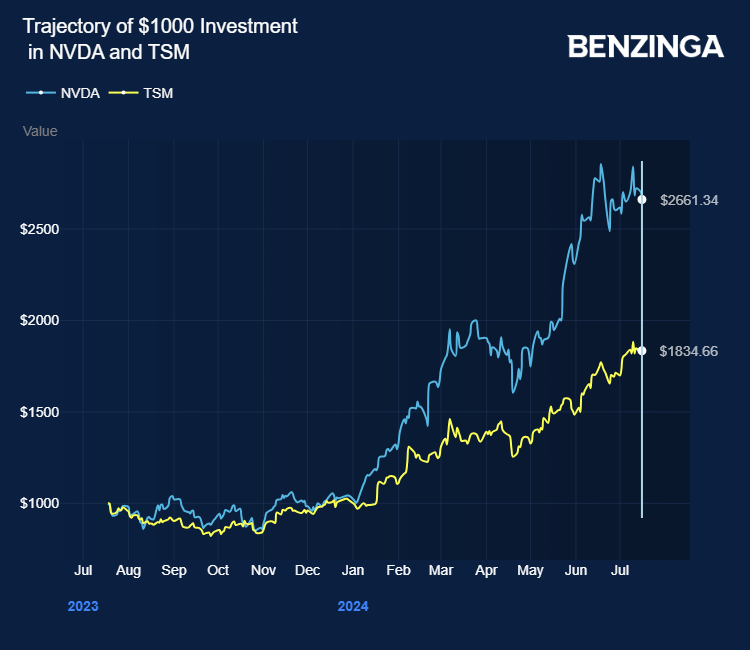

Chip stocks led by Nvidia Corp NVDA and Advanced Micro Devices, Inc AMD are trading lower Wednesday as the U.S. intensified semiconductor sanctions against China, followed by Presidential candidate Donald Trump’s attack against crucial contract chipmaker Taiwan Semiconductor Manufacturing Company TSM.

The Biden administration is contemplating using the Foreign Direct Product Rule (FDPR), which allows it to impose controls on foreign-made products that incorporate even minimal amounts of American technology, Bloomberg reports.

The U.S. has presented this possibility to officials in Tokyo and The Hague.

Also Read: Nvidia’s Growth Soars Despite French Investigation and Investor Skepticism

Additionally, the U.S. is considering further sanctions on specific Chinese chip companies.

The U.S. semiconductor companies have significant exposure to China. Prior reports indicated Nvidia could sell $12 billion of AI chips in China this year despite U.S. export controls.

Meanwhile, former President Donald Trump has triggered jitters in the semiconductor sector with the latest remark.

The key Nvidia supplier, Taiwan Semiconductor, is trading lower on Wednesday after Trump said that the contract chipmaker should compensate the U.S. for its defense.

Trump suggested this during a Bloomberg Businessweek interview on June 25, which was published on Tuesday.

The broader chip sector is trading lower Wednesday, including Broadcom Inc AVGO, Qualcomm Inc QCOM, Arm Holdings Plc ARM, Micron Technology Inc MU, Marvell Technology Inc MRVL, Microchip Technology Inc MCHP, STMicroelectronics Inc STM, ON Semiconductor Corp ON, GlobalFoundries Inc GFS, United Microelectronics Corp UMC, Skyworks Solutions Inc SWKS.

Investors can gain exposure to the semiconductor sector through ProShares Ultra Semiconductors USD and Invesco PHLX Semiconductor ETF SOXQ.

Price Actions: NVDA shares traded lower by 4.02% at $121.28 at the last check on Wednesday.

Also Read:

Photo by Tatiana Popova and rawf8 via Shuttterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.