Zinger Key Points

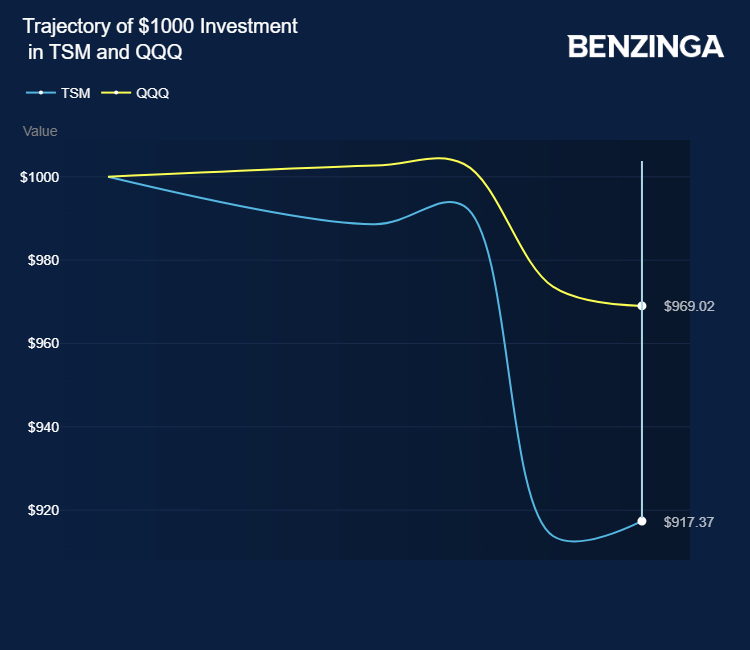

- TSM shares fell Friday despite strong Q2 profits and AI demand boost. AI chip stocks led by Nvidia also saw a selloff.

- Trump questioned US defense of Taiwan, adding to TSM's political risks.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Taiwan Semiconductor Manufacturing Co TSM saw its shares decline Friday despite reporting substantial second-quarter profits following a verbal attack from former President Donald Trump.

Trump questioned the U.S. obligation to defend Taiwan, flagging the lack of a formal defense treaty between the U.S. and Taiwan, unlike with South Korea and Japan, the Financial Times reports. Taiwan Semiconductor stock lost over 6% so far this week.

The key Nvidia Corp NVDA supplier announced a net profit of $7.6 billion for the June quarter, surpassing market expectations as continued artificial intelligence demand translates into tailwinds.

It also projected a more than one-third increase in third-quarter sales.

With Taiwan holding a 90% market share in AI server production, Taiwan Semiconductor’s role in the global supply chain is irreplaceable.

In 2023, the AI chip market reached $53.6 billion, as per Statista. Projections indicate it will rise to $71.3 billion by the end of 2024 as interest in AI applications continues to grow, with estimates suggesting the market will exceed $90 billion in 2025.

However, political risks for Taiwan Semiconductor and other Taiwanese companies are rising as China intensifies threats and military exercises around the island, FT writes. Approximately 80-90% of Taiwan Semiconductor’s production capacity is based in Taiwan.

Taiwan Semiconductor has consistently stated that it will maintain most of its manufacturing, research, and development in Taiwan while investing $65 billion in three factories in Arizona, USA.

Trump, a Republican presidential candidate, added to the uncertainty by suggesting that Taiwan should compensate the U.S. for its defense.

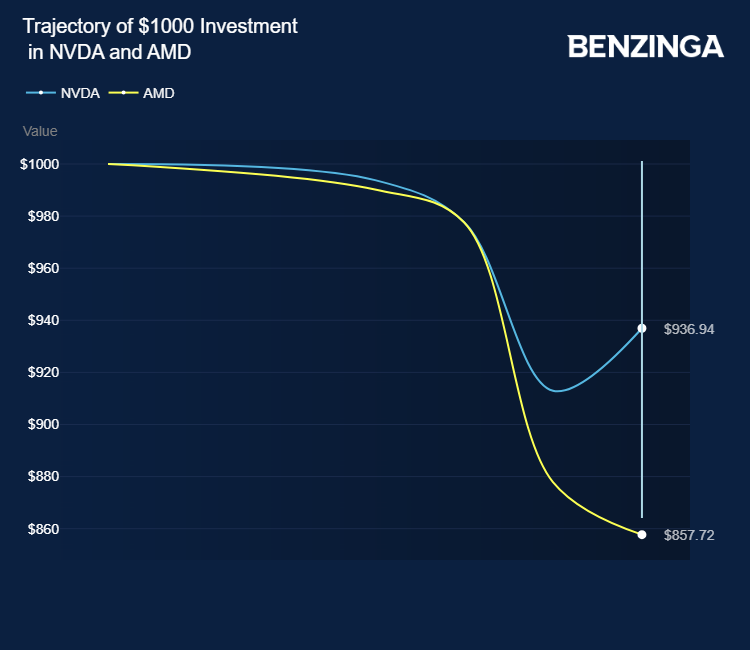

Consequently, AI chip stocks mainly dependent on Taiwan Semiconductor, like Nvidia and Advanced Micro Devices, Inc AMD, saw a selloff this week. Nvidia lost over 5%, and AMD lost over 14% so far this week. AI server company and a key Nvidia supplier Super Micro Computer, Inc SMCI lost 10% so far this week.

According to Precedence Research, the global semiconductor market was valued at $584.17 billion in 2024 and is projected to grow to approximately $1.14 trillion by 2033, with a CAGR of 7.64% from 2024 to 2033. Investors can gain exposure to the semiconductor sector through Invesco Semiconductors ETF PSI and SPDR S&P Semiconductor ETF XSD.

Price Actions: TSM shares traded lower by 0.62% at $170.80 premarket at the last check Friday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.