Zinger Key Points

- TSMC is central to Taiwan's defense strategy.

- Retail investment in TSMC hits record highs.

- Get access to your new suite of high-powered trading tools, including real-time stock ratings, insider trades, and government trading signals.

Taiwan Semiconductor Manufacturing Co TSM has garnered significant support from retail investors in Taiwan, driven by financial interests and national security concerns.

The chipmaker, also known as the “holy mountain that safeguards the nation,” has seen a surge in retail ownership despite foreign investors’ withdrawal, Bloomberg reports.

This trend reflects a broader belief among Taiwanese citizens that TSMC’s success is integral to the island’s defense against potential Chinese aggression.

Taiwan Semiconductor has become a cornerstone in many Taiwanese investment portfolios. Notably, the number of small shareholders with fewer than 1,000 shares has reached unprecedented levels.

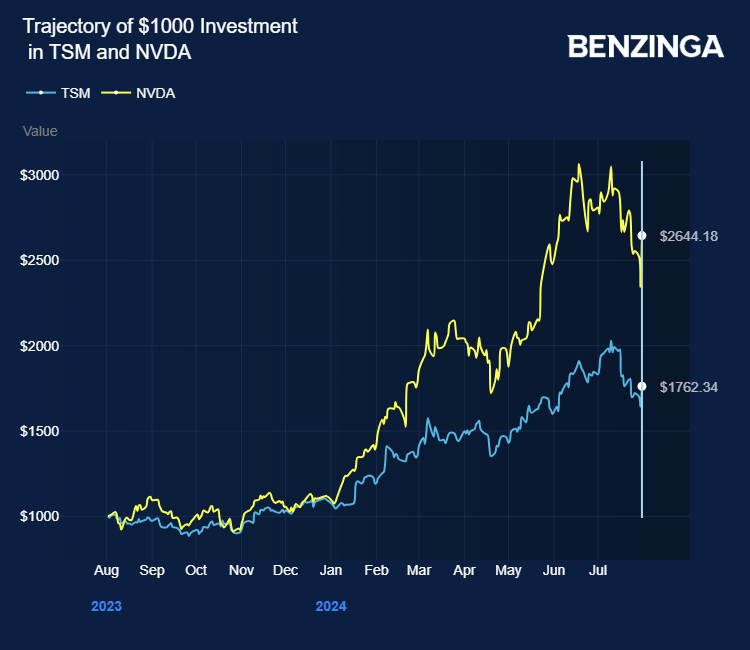

Taiwan Semiconductor holds a near-monopoly on the world’s most advanced semiconductors, which are essential for products from Apple Inc AAPL and Nvidia Corp NVDA.

Beyond its strategic value, Taiwan Semiconductor is vital to Taiwan’s economy, contributing 8% to its GDP in 2022.

Retail investors are increasingly optimistic, even taking out loans and diverting savings to invest in Taiwan Semiconductor shares, according to the Bloomberg report.

U.S. Presidential candidate Donald Trump recently criticized Taiwan Semiconductor, highlighting the absence of a formal defense treaty between the U.S. and Taiwan following a more significant downturn in the semiconductor industry.

Taiwan Semiconductor stock surged 69% in the last 12 months, driven by the artificial intelligence frenzy. Investors can gain exposure to the stock through the iShares Semiconductor ETF SOXX and the First Trust NASDAQ Technology Dividend Index Fund TDIV.

Price Action: TSM shares closed higher by 7.29% at $165.80 on Wednesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Jack Hong via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.