Zinger Key Points

- Micron Technology may acquire two AUO plants in Tainan for up to $628.6M, boosting its chip production capacity.

- Taiwan Semiconductor's recent $547M plant acquisition enhances its advanced chip packaging capabilities in Taiwan.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-Day free trial now.

Micron Technology Inc MU is reportedly considering acquiring two facilities owned by AUO Corp, mirroring Taiwan Semiconductor Manufacturing Co’s TSM recent deal to purchase a plant and equipment from Innolux Corp.

Micron, ranked as the third-largest memory chip manufacturer globally, is expected to buy two AUO plants in Tainan for a purchase price of 10 billion New Taiwan dollars-20 billion New Taiwan dollars ($314.3 million-$628.6 million), the Taipei Times reports.

AUO is selling the facilities it shuttered in August 2023 to optimize its resources.

Taiwan Semiconductor recently announced its acquisition of a 5.5th-generation plant from Innolux, located in the Southern Taiwan Science Park, for 17.14 billion New Taiwan dollars.

The deal will significantly enhance Taiwan Semiconductor’s advanced 3D chip-on-wafer-on-substrate (CoWoS) packaging capacity.

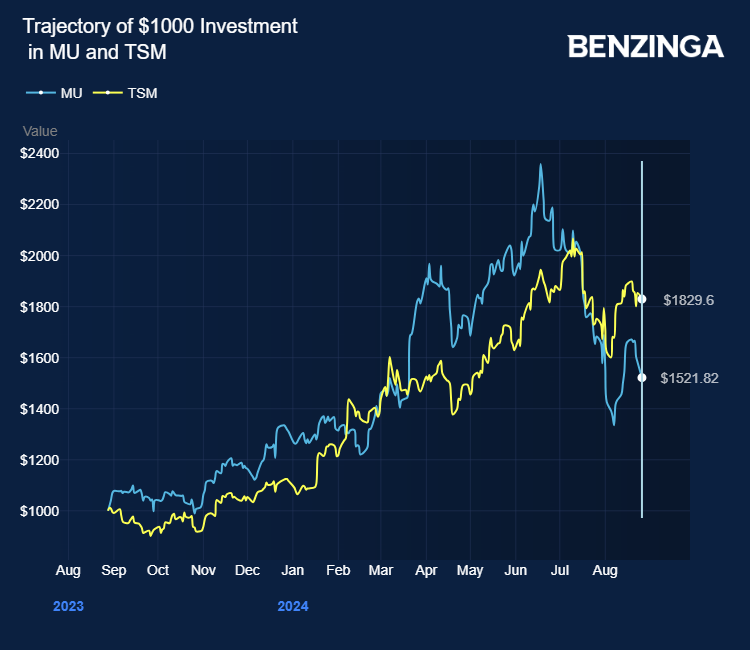

Micron Technology stock gained 52% in the last 12 months. The high-bandwidth memory (HBM) supplier was impacted by the U.S. semiconductor sanctions on China. It will likely secure 5% of the market share in 2024, as per TrendForce.

Investors can gain exposure to Micron stock through Vanguard Value ETF VTV and Vanguard Information Tech ETF VGT.

Will Micron Tech Stock Go Up?

When trying to assess whether or not Micron Technology will trade higher from current levels, it's a good idea to take a look at analyst forecasts.

Wall Street analysts have an average 12-month price target of $168.56 on Micron Technology. The Street high target is currently at $225.0 and the Street low target is $138.0. Of all the analysts covering Micron Technology, 26 have positive ratings, one has neutral ratings and no one has negative ratings.

In the last month, 3 analysts have adjusted price targets. Here's a look at recent price target changes [Analyst Ratings]. Benzinga also tracks Wall Street's most accurate analysts. Check out how analysts covering Micron Technology have performed in recent history.

Stocks don't move in a straight line. The average stock market return is approximately 10% per year. Micron Technology is 17.91% up year-to-date. The average analyst price target suggests the stock could have further upside ahead.

For a broad overview of everything you need to know about Micron Technology, visit here. If you want to go above and beyond, there's no better tool to help you do just that than Benzinga Pro. Start your free trial today.

Price Action: MU stock traded lower by 1.41% at $97.52 at last check Tuesday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.