Zinger Key Points

- SEC settles insider trading case against Chewy employee for trading Trupanion stock before partnership announcement

- Kauh to pay $35K+ penalty and faces 5-year ban from public company roles after violating antifraud provisions

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

On Friday, the SEC disclosed settling charges against Austin Kauh of Wilton, CT, for insider trading before the December 2021 announcement that Kauh’s employer, Chewy, Inc CHWY collaborated with Trupanion, Inc TRUP.

According to the SEC’s order, Kauh was part of Chewy’s due diligence team during the period leading up to the announcement.

In this role, he learned about plans for a partnership that would allow Trupanion to offer an exclusive suite of pet health insurance and wellness plans to more than 20 million Chewy customers.

Also Read: Adobe Chair and CEO Sold $13.04M In Company Stock

Between June 10, 2021, and August 25, 2021, Kauh purchased Trupanion stock using this material nonpublic information in violation of his duties to his employer.

Kauh conducted this trading in his personal account and in an account held in the name of another person.

When Trupanion’s stock price rose by 39% following the announcement, Kauh generated ill-gotten gains of $4,344 in his account and $12,093 in the other.

The SEC’s order finds that Kauh violated the SEC’s antifraud provisions.

Without admitting or denying the SEC’s findings, Kauh consented to the issuance of a cease-and-desist order and a five-year bar from acting as an officer or director of a public company and agreed to pay disgorgement of $4,344, prejudgment interest of $634.79, and a civil penalty of $30,297.14.

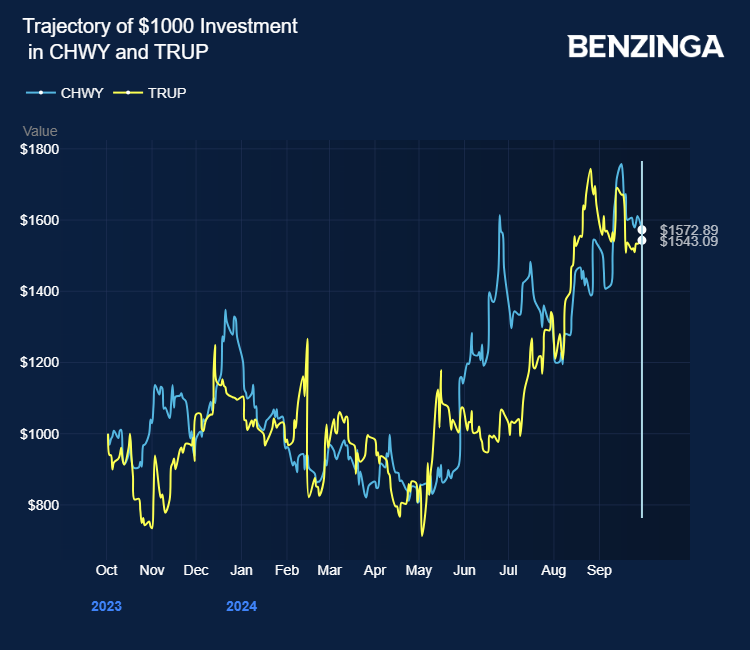

Chewy stock is up over 57% in the last 12 months. Trupanion stock is up over 57%.

Price Action: CHWY stock is down 2.34% at $29.27 at last check Monday.

Also Read:

Photo via Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.