Zinger Key Points

- Potential changes in the 2024 Farm Bill threaten the booming delta-8 THC market, sparking concerns from hemp advocates.

- Internal industry conflict heats up as hemp businesses clash with cannabis giants over market dominance and regulatory control.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

The hemp industry is at a crossroads as proposed changes in the 2024 Farm Bill threaten to reshape its regulatory landscape. Lawmakers are considering amendments that could ban products like delta-8 THC, a hemp-derived compound that has surged in popularity, especially in states where marijuana remains illegal.

Proposed Hemp Redefinition Could Threaten Hemp’s Growth

According to a recent report by the American Bar Association (ABA), the House Agriculture Committee’s draft of the 2024 Farm Bill includes language aimed at closing loopholes that allow the production and sale of intoxicating hemp-derived cannabinoids. If enacted, these changes would redefine hemp, excluding products containing cannabinoids not naturally produced by the cannabis plant or synthesized outside of it. This move could significantly impact hemp businesses that rely on the burgeoning market for delta-8 THC products.

Psychoactive hemp-derived products such as delta-8 THC have surged in the market. According to Cannabis Business Times figures cited by the ABA, delta-8 THC products generated $1.2 billion in sales in 2023. The compound has found a niche market due to its similar effects to delta-9 THC but with less potency. Companies like Curaleaf Holdings Inc. CURLF have entered the delta-8 THC market, capitalizing on consumer demand for these alternative cannabinoids.

However, the potential ban has raised concerns among hemp industry advocates who fear it could “destroy the hemp cannabinoid market,” as the ABA briefing noted. Many are calling for regulatory oversight rather than an outright ban. States like California, South Dakota, Louisiana, Iowa and Nebraska have already implemented bans on hemp THC products, adding pressure to the national debate.

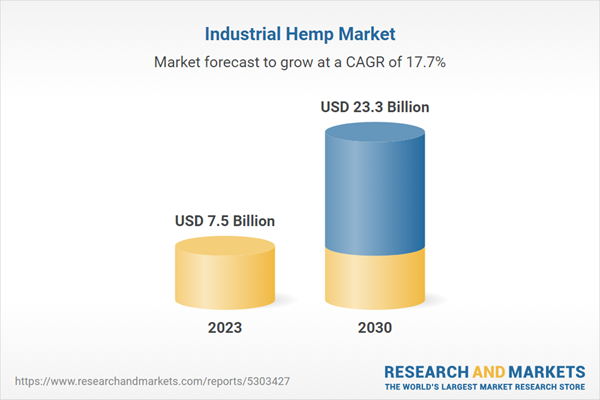

Global Hemp Market Growth Projections Soar

While regulatory pressures mount, the global industrial hemp market is experiencing significant growth. A report by Research and Markets projects the market to reach $23.3 billion by 2030, growing at a compound annual growth rate (CAGR) of 17.7% from 2023. Factors driving this expansion include increasing demand for sustainable and biodegradable materials, favorable regulatory changes and the rising popularity of hemp-derived products.

Legal Ambiguities Fuel Cannabis Industry Divide

Nevertheless, despite the market’s positive trajectory, internal tensions within the industry are intensifying. Conflicts between hemp companies and large marijuana operators have come to the forefront, particularly within the U.S. Cannabis Council (USCC). Hemp businesses, benefiting from legal ambiguities to sell often unregulated psychoactive products, are clashing with multi-state operators (MSOs) over market influence and regulatory approaches.

Read Also: Hempcrete Project Gets $6.2M EPA Grant To Develop Eco-Friendly Construction Materials

Robert Hoban, a prominent figure in the cannabis sector, recently described the situation as an industry “civil war.” He questioned whether the market will be “controlled by a small group of publicly-traded, multi-billion-dollar vertically integrated marijuana companies… or produced and distributed by farmers and small businesses.”

Hemp THC Products Challenge Marijuana Markets

Meanwhile, these internal disputes are further complicated by recent events in states like Florida, where voters there rejected Amendment 3, a measure to legalize recreational cannabis. Hemp businesses contributed over $500,000 to Gov. DeSantis’ bid to defeat the amendment, fearing legalization would harm businesses involved in hemp cultivation and sales. Conversely, major cannabis company Trulieve Cannabis Corp. TCNNF supported the initiative, which underscores the ongoing tensions within the industry. It should be noted that the Florida cannabis initiative garnered 56% of the vote but to be adopted as a constitutional amendment, it needed 60%.

The rejection of cannabis legalization in Florida and the Dakotas underscores the complex dynamics at play. Hemp-derived THC products continue to challenge traditional cannabis markets, especially in regions where adult-use cannabis remains illegal.

As the hemp sector grapples with potential regulatory changes and internal conflicts, its future remains uncertain. The industry needs to find a balance between growth, safety and fair market practices.

Read Next:

Photo by Nicky via Pixabay.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.