Zinger Key Points

- Alphabet shares plunge over 6%, erasing $120 billion in market value and dropping its valuation below the $2 trillion mark.

- Forced Chrome divestiture would threaten Alphabet’s ad revenue, with "Search & Other" contributing $175 billion — 56% of 2023 total revenue.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

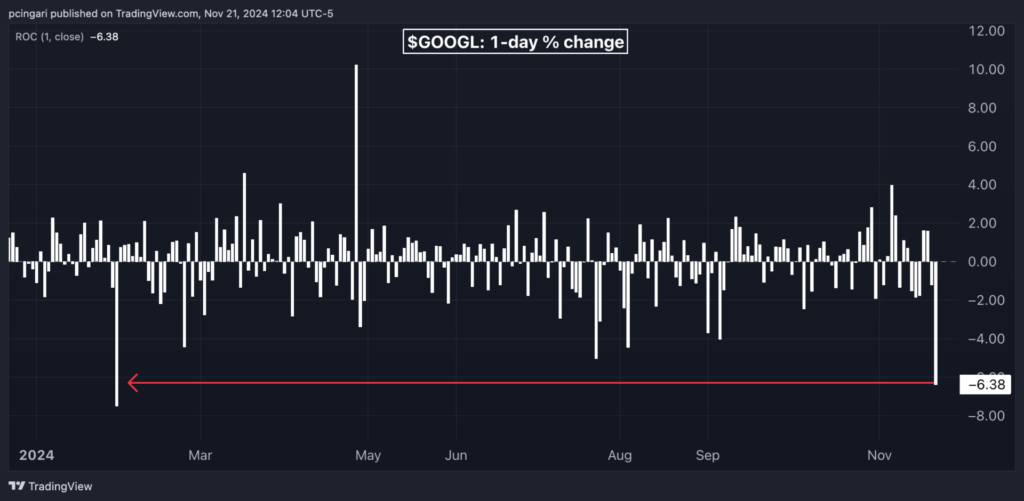

Shares of Alphabet Inc. GOOGL GOOG plunged more than 6% during Thursday morning trading in New York, marking their steepest decline since January 2024.

The drop has wiped out over $120 billion in market capitalization, dragging Alphabet's valuation below the critical $2 trillion threshold.

Chart: Alphabet Suffers Worst Day Since Late January 2023

Why The Selloff?

The sharp decline follows the U.S. Department of Justice's (DOJ) announcement of sweeping remedies in its high-profile antitrust lawsuit against Google.

On Wednesday, the DOJ proposed measures aimed at curbing Google's dominance in search and digital advertising, potentially reshaping Alphabet’s core business operations.

The most aggressive recommendation is a requirement for Alphabet to divest Google Chrome, the internet's leading browser with over 60% market share globally.

Regulators view Chrome as a cornerstone of Alphabet's ability to consolidate its dominance in both search and ad tech markets. This divestiture would mark an unprecedented government intervention into one of the tech giant’s most integrated and profitable ecosystems.

Other proposals include forcing Google to share search data with competitors, thus leveling the playing field for rival search engines, and to end default search agreements, which make Google the automatic search engine on devices and web browsers like Apple's Safari.

"Google's unlawful behavior has deprived rivals not only of critical distribution channels but also distribution partners who could otherwise enable entry into these markets by competitors in new and innovative ways," the DOJ said in a statement.

What’s At Stake?

Alphabet’s business model relies heavily on the synergies between its services. In the third quarter of 2024, Alphabet’s “Search & Other” segment generated $49.4 billion, accounting for 56% of the company's total revenue for the quarter.

For the full fiscal year 2023, Alphabet reported $307.4 billion in total revenue. The revenue breakdown highlights the scale of Alphabet’s reliance on search and ad-driven income:

- Google Search & Other: $175.0 billion

- YouTube Ads: $31.5 billion

- Google Network: $31.3 billion

- Google Cloud: $33.1 billion

- Other Revenues: $34.7 billion

- Other Bets: $1.5 billion

These numbers underline the DOJ's focus on Alphabet's most lucrative business segments. A forced breakup of Chrome, combined with mandated data-sharing and restrictions on default agreements may threaten to erode Alphabet’s competitive edge and profitability.

Expert Take: Google's Strategic Challenges

Ahead of the DOJ announcement, RBC Capital Markets shared insights from a conversation with Brian O’Kelley, CEO & co-founder of Scope3 and a seasoned expert in ad tech. O’Kelley raised critical points about Alphabet’s future in light of the antitrust case:

- Open Internet vs. AI: O’Kelley sees the value of open internet a declining asset since consumers shift toward AI-powered experiences. According to him, “the DOJ is litigating against the last decade, as opposed to current day looking forward.”

- Chrome's Role: He indicates that Google’s network business “isn’t depending on owning the legacy ad tech assets.” Even without Chrome, users will continue going to Google.com for search, suggesting that Chrome’s value may be less critical than it seems.

- Regulatory Differences: O’Kelley highlights stark contrasts in regulatory approaches between Europe and the U.S. While Europe is moving swiftly to ban cookies and enforce stricter privacy rules, U.S. regulation may take longer to materialize, giving Alphabet more time to adapt.

Read Next:

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.