Across the recent three months, 4 analysts have shared their insights on PACCAR PCAR, expressing a variety of opinions spanning from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 2 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

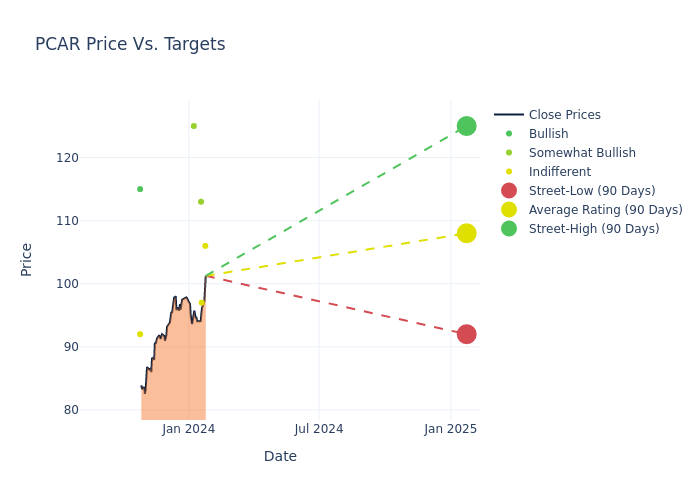

In the assessment of 12-month price targets, analysts unveil insights for PACCAR, presenting an average target of $110.25, a high estimate of $125.00, and a low estimate of $97.00. Marking an increase of 16.46%, the current average surpasses the previous average price target of $94.67.

Exploring Analyst Ratings: An In-Depth Overview

A comprehensive examination of how financial experts perceive PACCAR is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jerry Revich | Goldman Sachs | Raises | Neutral | $106.00 | $93.00 |

| Ross Gilardi | B of A Securities | Raises | Neutral | $97.00 | $84.00 |

| Tami Zakaria | JP Morgan | Raises | Overweight | $113.00 | $107.00 |

| Angel Castillo | Morgan Stanley | Announces | Overweight | $125.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to PACCAR. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of PACCAR compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of PACCAR's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into PACCAR's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on PACCAR analyst ratings.

Delving into PACCAR's Background

Paccar is a leading manufacturer of medium- and heavy-duty trucks under the premium brands Kenworth and Peterbilt, which are primarily sold in the NAFTA region and Australia, and DAF trucks, which are sold in Europe and South America. The company's trucks are sold through over 2,300 independent dealers globally. Paccar Financial Services provides retail and wholesale financing for customers and dealers, respectively. The company commands approximately 30% of the Class 8 market share in North America and 17% of the heavy-duty market share in Europe.

Financial Insights: PACCAR

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: PACCAR displayed positive results in 3 months. As of 30 September, 2023, the company achieved a solid revenue growth rate of approximately 23.2%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: PACCAR's net margin is impressive, surpassing industry averages. With a net margin of 14.13%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): PACCAR's ROE excels beyond industry benchmarks, reaching 7.9%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): PACCAR's ROA excels beyond industry benchmarks, reaching 3.28%. This signifies efficient management of assets and strong financial health.

Debt Management: PACCAR's debt-to-equity ratio is below the industry average at 0.81, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.