9 analysts have shared their evaluations of ChargePoint Hldgs CHPT during the recent three months, expressing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 4 | 0 | 0 |

| 3M Ago | 1 | 2 | 0 | 0 | 0 |

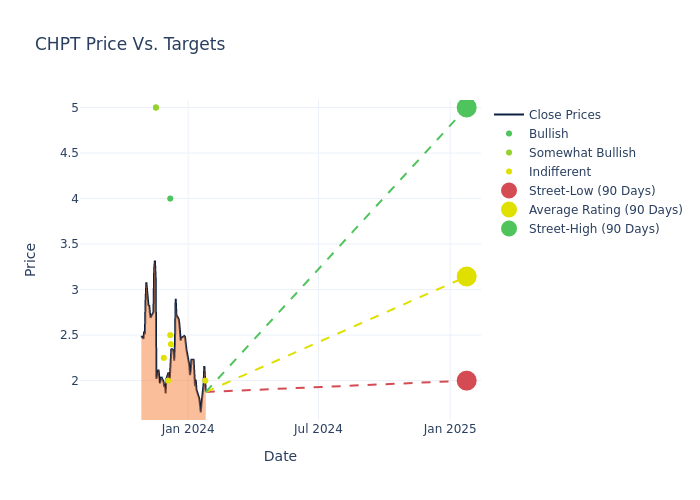

In the assessment of 12-month price targets, analysts unveil insights for ChargePoint Hldgs, presenting an average target of $3.24, a high estimate of $5.00, and a low estimate of $2.00. Experiencing a 56.57% decline, the current average is now lower than the previous average price target of $7.46.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of ChargePoint Hldgs among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mark Delaney | Goldman Sachs | Lowers | Neutral | $2.00 | $2.50 |

| Itay Michaeli | Citigroup | Lowers | Neutral | $2.40 | $8.25 |

| Christopher Souther | B. Riley Securities | Announces | Neutral | $2.50 | - |

| Chris Pierce | Needham | Maintains | Buy | $4.00 | - |

| Wesley Brooks | HSBC | Announces | Hold | $2.00 | - |

| Robert Jamieson | UBS | Lowers | Neutral | $2.25 | $9.00 |

| Chris Dendrinos | RBC Capital | Lowers | Outperform | $5.00 | $9.00 |

| Bill Peterson | JP Morgan | Lowers | Overweight | $5.00 | $8.00 |

| Chris Pierce | Needham | Lowers | Buy | $4.00 | $8.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to ChargePoint Hldgs. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of ChargePoint Hldgs compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of ChargePoint Hldgs's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of ChargePoint Hldgs's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on ChargePoint Hldgs analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering ChargePoint Hldgs: A Closer Look

ChargePoint designs, develops, and markets networked electric vehicle charging system infrastructure and cloud-based services that enable consumers to locate, reserve, and authenticate EV charging. The company's hardware product lineup includes solutions across home, commercial, and fast-charging applications. ChargePoint derives the majority of its revenue from the United States.

Financial Insights: ChargePoint Hldgs

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Negative Revenue Trend: Examining ChargePoint Hldgs's financials over 3 months reveals challenges. As of 31 October, 2023, the company experienced a decline of approximately -12.01% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: ChargePoint Hldgs's net margin is impressive, surpassing industry averages. With a net margin of -143.47%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): ChargePoint Hldgs's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -47.39%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): ChargePoint Hldgs's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -14.03%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.77, caution is advised due to increased financial risk.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.