Ratings for BankUnited BKU were provided by 4 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 2 | 0 | 2 |

| Last 30D | 0 | 0 | 2 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 1 |

| 2M Ago | 0 | 0 | 0 | 0 | 1 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

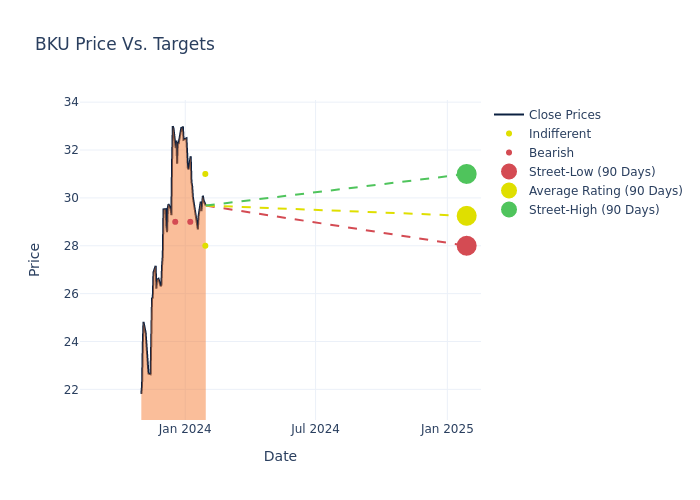

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $29.25, a high estimate of $31.00, and a low estimate of $28.00. Marking an increase of 2.02%, the current average surpasses the previous average price target of $28.67.

Breaking Down Analyst Ratings: A Detailed Examination

The analysis of recent analyst actions sheds light on the perception of BankUnited by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| David Chiaverini | Wedbush | Lowers | Neutral | $31.00 | $34.00 |

| Steven Shaw | Wells Fargo | Raises | Equal-Weight | $28.00 | $26.00 |

| Brody Preston | UBS | Announces | Sell | $29.00 | - |

| Ryan Nash | Goldman Sachs | Raises | Sell | $29.00 | $26.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to BankUnited. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of BankUnited compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for BankUnited's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into BankUnited's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on BankUnited analyst ratings.

All You Need to Know About BankUnited

BankUnited Inc is a bank holding company with one wholly owned subsidiary, BankUnited. The bank provides a full range of banking services through banking centers located primarily throughout Florida, as well as New York City. BankUnited is a commercially focused regional bank focusing on small and middle-market businesses, but also provides certain commercial lending and deposit products on a national platform. It has historically grown through organic growth. BankUnited was established by a group of investors who acquired the assets and most of the liabilities of its predecessor from the Federal Deposit Insurance Corporation. The group recapitalized BankUnited with an investment of over $900 million. most of its revenue comprises net interest income derived mostly from loans.

Unraveling the Financial Story of BankUnited

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: BankUnited's revenue growth over a period of 3 months has faced challenges. As of 30 September, 2023, the company experienced a revenue decline of approximately -6.31%. This indicates a decrease in the company's top-line earnings. When compared to others in the Financials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: BankUnited's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 19.08%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): BankUnited's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 1.83%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): BankUnited's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.13%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: BankUnited's debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.33, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.