During the last three months, 4 analysts shared their evaluations of Liberty Energy LBRT, revealing diverse outlooks from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

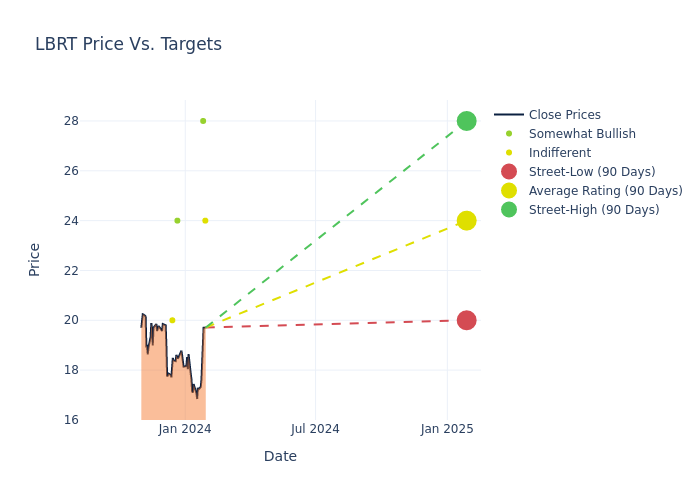

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $24.0, with a high estimate of $28.00 and a low estimate of $20.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 1.03%.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of Liberty Energy's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Connor Lynagh | Morgan Stanley | Raises | Equal-Weight | $24.00 | $23.00 |

| Luke Lemoine | Piper Sandler | Raises | Overweight | $28.00 | $27.00 |

| Roger Read | Wells Fargo | Lowers | Overweight | $24.00 | $25.00 |

| Scott Gruber | Citigroup | Lowers | Neutral | $20.00 | $22.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Liberty Energy. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Liberty Energy compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Liberty Energy's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Liberty Energy analyst ratings.

Get to Know Liberty Energy Better

Liberty Energy is an oilfield services company that provides hydraulic fracturing services—mainly pressure pumping—in major basins throughout North America. Its 2020 acquisition of Schlumberger's OneStim business segment made Liberty one of the largest pressure pumpers in North America. It also added wireline operations, two Permian frac sand mines, and an expanded technological portfolio.

Breaking Down Liberty Energy's Financial Performance

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3 months period, Liberty Energy faced challenges, resulting in a decline of approximately -11.59% in revenue growth as of 31 December, 2023. This signifies a reduction in the company's top-line earnings. When compared to others in the Energy sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Liberty Energy's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 8.59%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Liberty Energy's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 5.09%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Liberty Energy's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.02% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Liberty Energy's debt-to-equity ratio is below the industry average at 0.22, reflecting a lower dependency on debt financing and a more conservative financial approach.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.