Stryker SYK has been analyzed by 8 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 4 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 2 | 0 | 0 |

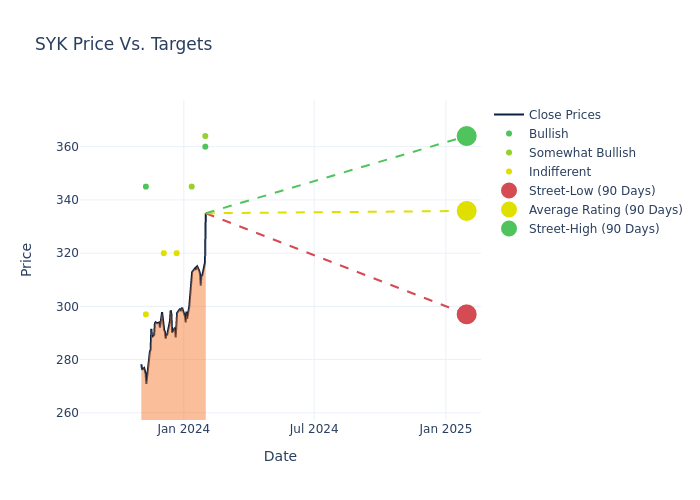

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $331.38, along with a high estimate of $364.00 and a low estimate of $297.00. Witnessing a positive shift, the current average has risen by 9.85% from the previous average price target of $301.67.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Stryker among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kyle Rose | Canaccord Genuity | Announces | Buy | $360.00 | - |

| Larry Biegelsen | Wells Fargo | Raises | Overweight | $364.00 | $336.00 |

| Shagun Singh | RBC Capital | Raises | Outperform | $345.00 | $315.00 |

| Richard Newitter | Truist Securities | Raises | Hold | $320.00 | $300.00 |

| Drew Ranieri | Morgan Stanley | Raises | Equal-Weight | $320.00 | $300.00 |

| Jason Wittes | Roth MKM | Maintains | Buy | $345.00 | - |

| Danielle Antalffy | UBS | Raises | Neutral | $297.00 | $289.00 |

| Richard Newitter | Truist Securities | Raises | Hold | $300.00 | $270.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Stryker. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Stryker compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Stryker's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Stryker's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Stryker analyst ratings.

All You Need to Know About Stryker

Stryker designs, manufactures, and markets an array of medical equipment, instruments, consumable supplies, and implantable devices. The product portfolio includes hip and knee replacements, endoscopy systems, operating room equipment, embolic coils, hospital beds and gurneys, and spinal devices. Stryker remains one of the three largest competitors in reconstructive orthopedic implants and holds the leadership position in operating room equipment. Just over one fourth of Stryker's total revenue currently comes from outside the United States.

Unraveling the Financial Story of Stryker

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Stryker's remarkable performance in 3 months is evident. As of 30 September, 2023, the company achieved an impressive revenue growth rate of 9.6%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Stryker's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 14.1%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Stryker's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 3.92%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Stryker's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.83% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Stryker's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.71.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.