Across the recent three months, 5 analysts have shared their insights on Janus Henderson Group JHG, expressing a variety of opinions spanning from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 3 | 0 | 2 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 2 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

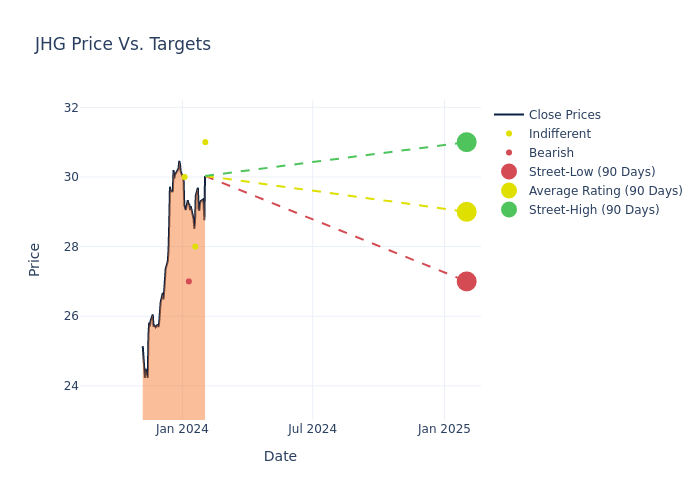

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $28.2, a high estimate of $31.00, and a low estimate of $25.00. Surpassing the previous average price target of $26.67, the current average has increased by 5.74%.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of Janus Henderson Group's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ken Worthington | JP Morgan | Raises | Neutral | $31.00 | $28.00 |

| Andrei Stadnik | Morgan Stanley | Raises | Equal-Weight | $28.00 | $27.00 |

| Brennan Hawken | UBS | Raises | Sell | $27.00 | $25.00 |

| Adam Beatty | UBS | Announces | Sell | $25.00 | - |

| Bill Katz | TD Cowen | Announces | Market Perform | $30.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Janus Henderson Group. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Janus Henderson Group compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Janus Henderson Group's stock. This examination reveals shifts in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Janus Henderson Group's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Janus Henderson Group analyst ratings.

Unveiling the Story Behind Janus Henderson Group

Janus Henderson Group provides investment management services to retail intermediary (54% of managed assets), self-directed (23%) and institutional (23%) clients. At the end of September, active equities (61%), fixed-income (21%), multi-asset (15%) and alternative (3%) investment platforms constituted the company's USD 308.3 billion in assets under management. Janus Henderson sources 59% of its managed assets from clients in North America, with customers from Europe, the Middle East, Africa, and Latin America (31%) and the Asia-Pacific region (10%) accounting for the remainder. Headquartered in London, JHG is dual-listed on the New York Stock Exchange and the Australian Securities Exchange.

Janus Henderson Group: Financial Performance Dissected

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Over the 3 months period, Janus Henderson Group showcased positive performance, achieving a revenue growth rate of 1.58% as of 30 September, 2023. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: Janus Henderson Group's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 17.41%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Janus Henderson Group's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.03%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.43%, the company showcases effective utilization of assets.

Debt Management: Janus Henderson Group's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.07.

The Basics of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.