Across the recent three months, 9 analysts have shared their insights on AvalonBay Communities AVB, expressing a variety of opinions spanning from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 2 | 2 | 1 | 0 | 0 |

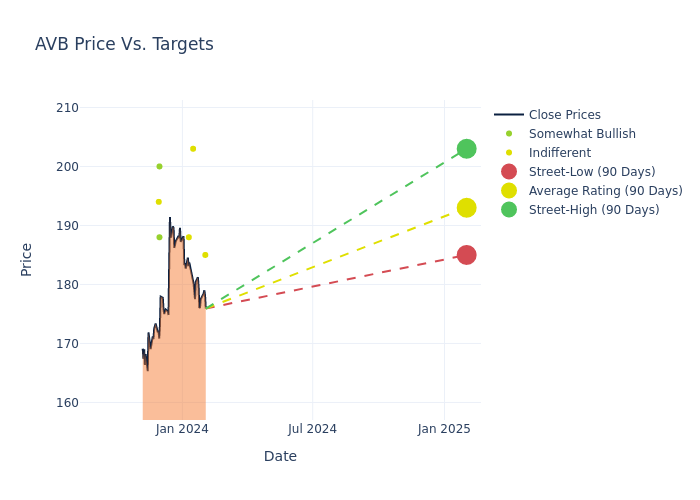

The 12-month price targets, analyzed by analysts, offer insights with an average target of $193.11, a high estimate of $203.00, and a low estimate of $176.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 1.12%.

Understanding Analyst Ratings: A Comprehensive Breakdown

A comprehensive examination of how financial experts perceive AvalonBay Communities is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Carroll | RBC Capital | Maintains | Sector Perform | $185.00 | - |

| Michael Lewis | Truist Securities | Raises | Hold | $203.00 | $202.00 |

| Vikram Malhotra | Mizuho | Raises | Neutral | $188.00 | $176.00 |

| Haendel St. Juste | Mizuho | Lowers | Neutral | $176.00 | $186.00 |

| Steve Sakwa | Evercore ISI Group | Raises | Outperform | $188.00 | $183.00 |

| Michael Lewis | Truist Securities | Maintains | Buy | $202.00 | - |

| Austin Wurschmidt | Keybanc | Lowers | Overweight | $200.00 | $205.00 |

| Anthony Paolone | JP Morgan | Lowers | Neutral | $194.00 | $201.00 |

| Michael Lewis | Truist Securities | Lowers | Buy | $202.00 | $214.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to AvalonBay Communities. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of AvalonBay Communities compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of AvalonBay Communities's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of AvalonBay Communities's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on AvalonBay Communities analyst ratings.

Get to Know AvalonBay Communities Better

AvalonBay Communities owns a portfolio of 276 apartment communities with over 82,000 units and is developing 18 additional properties with over 5,700 units. The company focuses on owning large, high-quality properties in major metropolitan areas of New England, New York/New Jersey, Washington D.C., California, and the Pacific Northwest.

Financial Milestones: AvalonBay Communities's Journey

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Positive Revenue Trend: Examining AvalonBay Communities's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 4.86% as of 30 September, 2023, showcasing a substantial increase in top-line earnings. When compared to others in the Real Estate sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: AvalonBay Communities's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 24.66%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): AvalonBay Communities's ROE excels beyond industry benchmarks, reaching 1.46%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.83%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: AvalonBay Communities's debt-to-equity ratio is below the industry average at 0.69, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.