Across the recent three months, 8 analysts have shared their insights on Arista Networks ANET, expressing a variety of opinions spanning from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 4 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 2 | 0 | 1 | 0 | 0 |

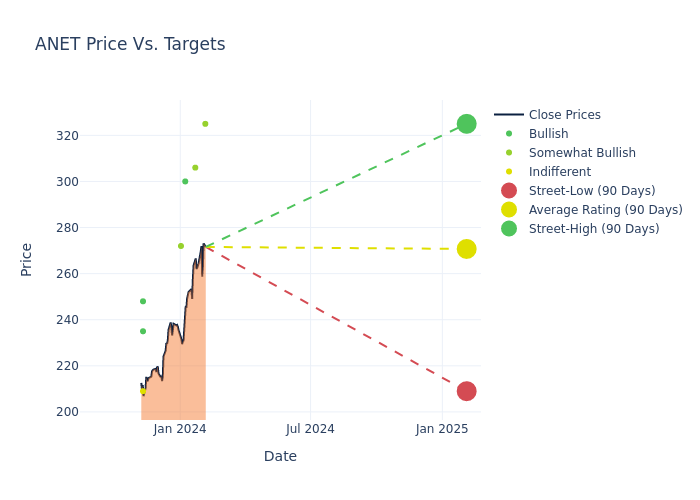

Insights from analysts' 12-month price targets are revealed, presenting an average target of $272.75, a high estimate of $325.00, and a low estimate of $209.00. Surpassing the previous average price target of $227.43, the current average has increased by 19.93%.

Breaking Down Analyst Ratings: A Detailed Examination

An in-depth analysis of recent analyst actions unveils how financial experts perceive Arista Networks. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Erik Suppiger | JMP Securities | Raises | Market Outperform | $325.00 | $215.00 |

| Thomas Blakey | Keybanc | Raises | Overweight | $306.00 | $287.00 |

| Thomas Blakey | Keybanc | Raises | Overweight | $287.00 | $232.00 |

| Ben Reitzes | Melius Research | Announces | Buy | $300.00 | - |

| Meta Marshall | Morgan Stanley | Raises | Overweight | $272.00 | $230.00 |

| James Fish | Piper Sandler | Raises | Neutral | $209.00 | $190.00 |

| Mike Burton | Goldman Sachs | Raises | Buy | $248.00 | $223.00 |

| Alex Henderson | Needham | Raises | Buy | $235.00 | $215.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Arista Networks. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Arista Networks compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Arista Networks's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Arista Networks's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Arista Networks analyst ratings.

Unveiling the Story Behind Arista Networks

Arista Networks is a networking equipment provider that primarily sells Ethernet switches and software to data centers. Its marquee product is its extensible operating system, or EOS, that runs a single image across every single one of its devices. The firm operates as one reportable segment. It has steadily gained market share since its founding in 2004, with a focus on high-speed applications. Arista counts Microsoft and Meta Platforms as its largest customers and derives roughly three quarters of its sales from North America.

A Deep Dive into Arista Networks's Financials

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Positive Revenue Trend: Examining Arista Networks's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 28.27% as of 30 September, 2023, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Arista Networks's net margin excels beyond industry benchmarks, reaching 36.13%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Arista Networks's ROE stands out, surpassing industry averages. With an impressive ROE of 8.82%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 6.32%, the company showcases effective utilization of assets.

Debt Management: Arista Networks's debt-to-equity ratio is below the industry average at 0.01, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.