In the latest quarter, 5 analysts provided ratings for W.W. Grainger GWW, showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 2 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

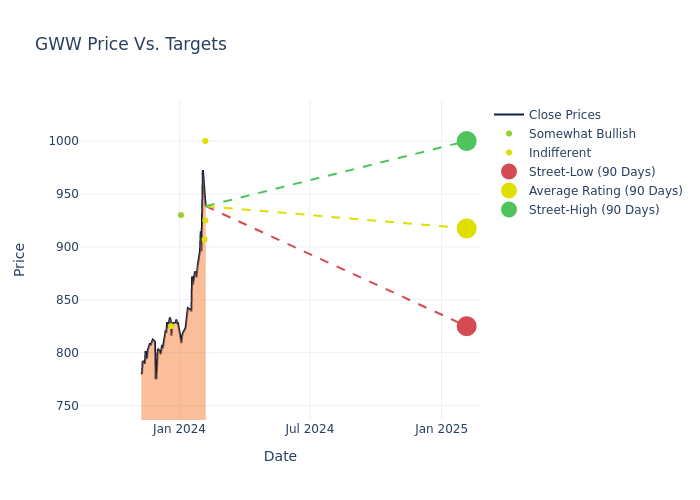

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $917.4, with a high estimate of $1000.00 and a low estimate of $825.00. This upward trend is apparent, with the current average reflecting a 15.25% increase from the previous average price target of $796.00.

Deciphering Analyst Ratings: An In-Depth Analysis

The analysis of recent analyst actions sheds light on the perception of W.W. Grainger by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Patrick Baumann | JP Morgan | Raises | Neutral | $925.00 | $800.00 |

| Tommy Moll | Stephens & Co. | Raises | Equal-Weight | $1000.00 | $775.00 |

| Deane Dray | RBC Capital | Raises | Sector Perform | $907.00 | $809.00 |

| Christopher Glynn | Oppenheimer | Raises | Outperform | $930.00 | $800.00 |

| Hamzah Mazari | Jefferies | Announces | Hold | $825.00 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to W.W. Grainger. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of W.W. Grainger compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for W.W. Grainger's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of W.W. Grainger's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on W.W. Grainger analyst ratings.

Unveiling the Story Behind W.W. Grainger

W.W. Grainger distributes approximately 1.5 million maintenance, repair, and operating products that are sourced from over 4,500 suppliers. The company serves roughly 5 million customers through its online and electronic purchasing platforms, vending machines, catalog distribution, and network of over 300 global branches. In recent years, Grainger has invested in its e-commerce capabilities and is the 11th-largest e-retailer in North America.

W.W. Grainger: A Financial Overview

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Decline in Revenue: Over the 3 months period, W.W. Grainger faced challenges, resulting in a decline of approximately -5.01% in revenue growth as of 31 December, 2023. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: W.W. Grainger's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 9.88% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): W.W. Grainger's ROE excels beyond industry benchmarks, reaching 12.1%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): W.W. Grainger's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 4.85%, the company showcases efficient use of assets and strong financial health.

Debt Management: W.W. Grainger's debt-to-equity ratio is below the industry average. With a ratio of 0.8, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.