Analysts' ratings for Paylocity Holding PCTY over the last quarter vary from bullish to bearish, as provided by 7 analysts.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 2 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

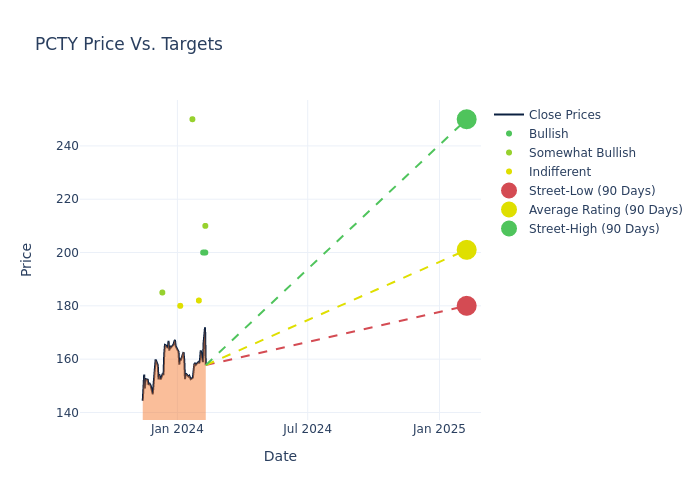

Analysts have recently evaluated Paylocity Holding and provided 12-month price targets. The average target is $201.0, accompanied by a high estimate of $250.00 and a low estimate of $180.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 2.19%.

Analyzing Analyst Ratings: A Detailed Breakdown

The perception of Paylocity Holding by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scott Berg | Needham | Maintains | Buy | $200.00 | - |

| Arvind Ramnani | Piper Sandler | Raises | Overweight | $210.00 | $207.00 |

| Matt VanVliet | BTIG | Announces | Buy | $200.00 | - |

| Steven Enders | Citigroup | Raises | Neutral | $182.00 | $180.00 |

| Patrick Walravens | JMP Securities | Maintains | Market Outperform | $250.00 | - |

| Samad Samana | Jefferies | Lowers | Hold | $180.00 | $240.00 |

| Bryan Bergin | TD Cowen | Lowers | Outperform | $185.00 | $195.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Paylocity Holding. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Paylocity Holding compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Paylocity Holding's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Paylocity Holding's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Paylocity Holding analyst ratings.

Unveiling the Story Behind Paylocity Holding

Paylocity is a provider of payroll and human capital management, or HCM, solutions servicing small- to midsize clients in the United States. The company was founded in 1997 and targets businesses with 10 to 5,000 employees and services about 36,000 clients as of fiscal 2023. Alongside core payroll services, Paylocity offers HCM solutions such as time and attendance and recruiting software, as well workplace collaboration and communication tools.

Understanding the Numbers: Paylocity Holding's Finances

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Over the 3 months period, Paylocity Holding showcased positive performance, achieving a revenue growth rate of 25.39% as of 30 September, 2023. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Paylocity Holding's net margin excels beyond industry benchmarks, reaching 10.87%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Paylocity Holding's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 3.98%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Paylocity Holding's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.94%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Paylocity Holding's debt-to-equity ratio is below the industry average at 0.08, reflecting a lower dependency on debt financing and a more conservative financial approach.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.