Throughout the last three months, 4 analysts have evaluated Coty COTY, offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 2 | 0 | 0 |

| Last 30D | 1 | 1 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

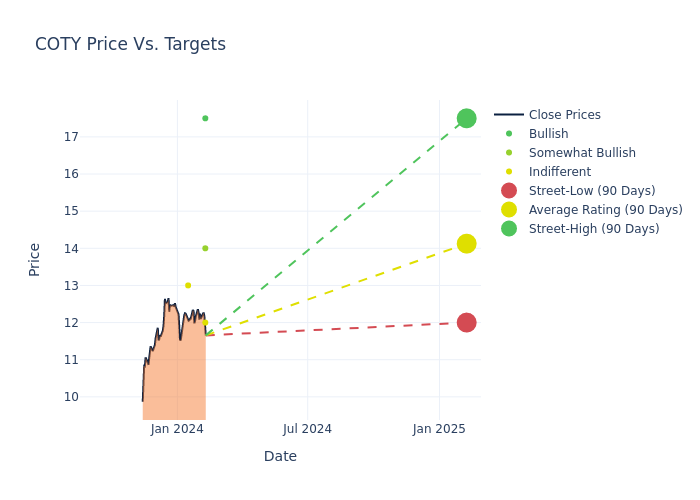

Analysts have set 12-month price targets for Coty, revealing an average target of $14.12, a high estimate of $17.50, and a low estimate of $12.00. Observing a 8.62% increase, the current average has risen from the previous average price target of $13.00.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Coty. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Nik Modi | RBC Capital | Maintains | Outperform | $14.00 | - |

| Chris Carey | Wells Fargo | Raises | Equal-Weight | $12.00 | $11.00 |

| Linda Bolton Weiser | DA Davidson | Raises | Buy | $17.50 | $17.00 |

| Lauren Lieberman | Barclays | Raises | Equal-Weight | $13.00 | $11.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Coty. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Coty compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Coty's stock. This analysis reveals shifts in analysts' expectations over time.

Capture valuable insights into Coty's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Coty analyst ratings.

Delving into Coty's Background

Coty is a global beauty maker that focuses on fragrance (59% of sales) and color cosmetics (28%), with limited exposure to skincare (5%) and body care (8%). For its fragrance business, Coty licenses luxury and high-end brands including Gucci, Burberry, Hugo Boss, Davidoff, and Calvin Klein, while its consumer cosmetics business focuses on acquired mass brands such as CoverGirl, Max Factor, Rimmel, Sally Hansen, and Bourjois. It also collaborates with social media celebrities Kim Kardashian and Kylie Jenner to launch makeup products bearing their names. By region, Coty generates close to 45% of sales from Europe, 30% from North America, 10% from Asia, and 8% from Latin America, with the rest from travel retail. German investment firm JAB is a controlling shareholder, with a 53% stake.

Financial Insights: Coty

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Coty's remarkable performance in 3 months is evident. As of 31 December, 2023, the company achieved an impressive revenue growth rate of 5.25%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Staples sector.

Net Margin: Coty's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.28% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.36%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Coty's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.39%, the company showcases efficient use of assets and strong financial health.

Debt Management: Coty's debt-to-equity ratio is below the industry average. With a ratio of 0.89, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.