In the last three months, 5 analysts have published ratings on Pactiv Evergreen PTVE, offering a diverse range of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 1 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

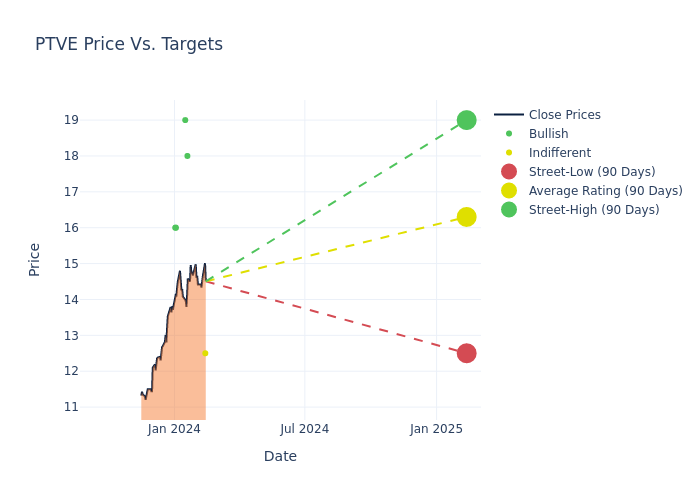

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $16.3, a high estimate of $19.00, and a low estimate of $12.50. This current average reflects an increase of 39.67% from the previous average price target of $11.67.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Pactiv Evergreen among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Adam Samuelson | Goldman Sachs | Raises | Neutral | $12.50 | $11.00 |

| Philip Ng | Jefferies | Announces | Buy | $18.00 | - |

| Curt Woodworth | UBS | Announces | Buy | $19.00 | - |

| Anthony Pettinari | Citigroup | Raises | Buy | $16.00 | $10.00 |

| George Staphos | B of A Securities | Raises | Buy | $16.00 | $14.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Pactiv Evergreen. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Pactiv Evergreen compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Pactiv Evergreen's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Pactiv Evergreen's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Pactiv Evergreen analyst ratings.

About Pactiv Evergreen

Pactiv Evergreen Inc is engaged in the business of manufacturing and distributing fresh foodservice and food merchandising products and fresh beverage cartons. It operates in three segments: Foodservice, Food Merchandising, and Beverage Merchandising. These segments manufacture a broad range of products such as food containers, drinkware, tableware, service ware, ready-to-eat food containers, clear rigid-display containers, trays for meat and poultry, molded fiber egg cartons, printed cartons, spouts & filling machines, and other products. The company's geographical segments are the United States, the Rest of North America, and Others, of which the vast majority of its revenue comes from the United States.

Pactiv Evergreen: A Financial Overview

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Challenges: Pactiv Evergreen's revenue growth over 3 months faced difficulties. As of 30 September, 2023, the company experienced a decline of approximately -14.29%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Materials sector.

Net Margin: Pactiv Evergreen's net margin excels beyond industry benchmarks, reaching 2.1%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Pactiv Evergreen's ROE stands out, surpassing industry averages. With an impressive ROE of 2.25%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.44%, the company showcases effective utilization of assets.

Debt Management: Pactiv Evergreen's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 3.0.

Understanding the Relevance of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.