During the last three months, 4 analysts shared their evaluations of JELD-WEN Holding JELD, revealing diverse outlooks from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

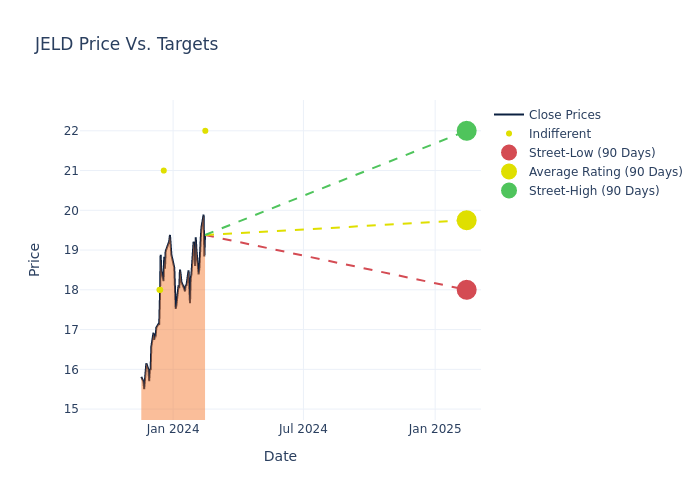

Insights from analysts' 12-month price targets are revealed, presenting an average target of $19.75, a high estimate of $22.00, and a low estimate of $18.00. Witnessing a positive shift, the current average has risen by 18.48% from the previous average price target of $16.67.

Investigating Analyst Ratings: An Elaborate Study

The perception of JELD-WEN Holding by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jeffrey Stevenson | Loop Capital | Announces | Hold | $22.00 | - |

| Stanley Elliott | Stifel | Raises | Hold | $21.00 | $18.00 |

| Susan Maklari | Goldman Sachs | Raises | Neutral | $18.00 | $16.00 |

| Matthew Bouley | Barclays | Raises | Equal-Weight | $18.00 | $16.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to JELD-WEN Holding. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of JELD-WEN Holding compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for JELD-WEN Holding's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of JELD-WEN Holding's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on JELD-WEN Holding analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into JELD-WEN Holding's Background

JELD-WEN Holding Inc is engaged in door and window manufacturing. The company design, produce and distribute interior and exterior building product, offering a selection of doors, windows, walls, and related products. The products are used in the new construction of residential single and multi-family homes and non-residential buildings. The firm's operating segments are North America, Europe, and Australasia. It generates a majority of its revenue from North America.

JELD-WEN Holding: Delving into Financials

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Negative Revenue Trend: Examining JELD-WEN Holding's financials over 3 months reveals challenges. As of 30 September, 2023, the company experienced a decline of approximately -5.53% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: JELD-WEN Holding's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.07% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): JELD-WEN Holding's ROE excels beyond industry benchmarks, reaching 5.41%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): JELD-WEN Holding's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 1.34%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: JELD-WEN Holding's debt-to-equity ratio stands notably higher than the industry average, reaching 1.63. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.