Analysts' ratings for Patterson-UTI Energy PTEN over the last quarter vary from bullish to bearish, as provided by 4 analysts.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

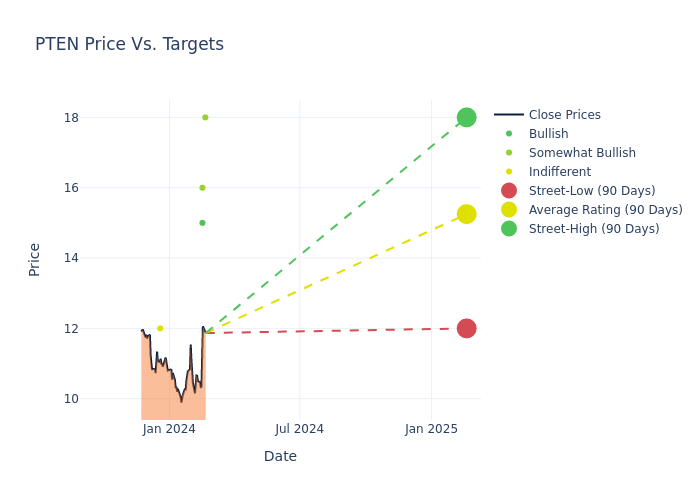

Insights from analysts' 12-month price targets are revealed, presenting an average target of $15.25, a high estimate of $18.00, and a low estimate of $12.00. Highlighting a 12.0% decrease, the current average has fallen from the previous average price target of $17.33.

Analyzing Analyst Ratings: A Detailed Breakdown

The perception of Patterson-UTI Energy by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jason Bandel | Evercore ISI Group | Lowers | Outperform | $18.00 | $19.00 |

| Keith Mackey | RBC Capital | Lowers | Outperform | $16.00 | $17.00 |

| James Rollyson | Raymond James | Lowers | Strong Buy | $15.00 | $16.00 |

| Ati Modak | Goldman Sachs | Announces | Neutral | $12.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Patterson-UTI Energy. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Patterson-UTI Energy compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Patterson-UTI Energy's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

For valuable insights into Patterson-UTI Energy's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Patterson-UTI Energy analyst ratings.

About Patterson-UTI Energy

Patterson-UTI Energy is one of the largest land rig drilling contractors in the United States and maintains moderately sized pressure pumping operations primarily in Texas and the Appalachian region, plus some modest operations in Colombia. It also provides directional drilling services and tool rental services in most U.S. onshore oil and gas basins.

Financial Milestones: Patterson-UTI Energy's Journey

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Patterson-UTI Energy's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2023, the company achieved a revenue growth rate of approximately 39.03%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Energy sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 0.0%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Patterson-UTI Energy's ROE stands out, surpassing industry averages. With an impressive ROE of 0.0%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Patterson-UTI Energy's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.0% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 0.28, Patterson-UTI Energy adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.